Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

5 top CDS import softwares for Retailers & Manufacturers

-

Freya Jane

- Director of Customer's Success

The role of CDS import software in contemporary trade cannot be overstated since it is essential to expediting and enhancing the import procedure. This software makes it easier to communicate with customs officials, helps you comply with constantly changing regulations, and makes the complicated paperwork needed for imports easier to understand.

The CDS import software becomes an indispensable tool for businesses navigating the complex world of international trade. It improves the speed and accuracy of customs declarations while also boosting operational efficiency and regulatory compliance.

In this blog, we examine the different aspects of the top 5 CDS import software, including its features, advantages, and revolutionary influence on modern import declarations.

What is CDS Import Software?

CDS-refers to the Customs Declaration Software, it is a digital platform used to file import declarations electronically. Gone are the days of mountains of paper forms; CDS streamlines the process, allowing importers to:

- Submit declarations remotely, saving time and resources.

- Enter detailed information about shipments, including goods descriptions, origin, value, and tariff codes.

- Attach supporting documents electronically.

- Calculate duties and taxes due.

- Track the status of declarations and shipments.

CDS: A Bridge Between Trade and Security:

Ultimately, CDS import software represents a powerful tool for enhancing both trade efficiency and border security. By embracing its capabilities and staying informed about its evolution, customs officers can streamline cargo clearance, ensure compliance, and contribute to a thriving global trade environment.

Top Five Software

In the world of international trade, the efficient and accurate processing of import declarations stands as a cornerstone for both commercial facilitation and border security. This role is increasingly fulfilled by Customs Declaration Service (CDS) software, digital platforms enabling the electronic submission of such declarations. Recognising the importance of navigating this complex landscape, we present a comparative analysis of five prominent CDS custom platforms globally:

1. iCustoms

1.1. Automated Customs Declarations

- Effortless Form Generation: Say goodbye to tedious data entry! iCustoms pre-populates essential fields based on your product information and trade agreements. You only need to confirm or adjust details, significantly reducing the risk of errors and omissions.

- Direct HMRC Integration: Ditch the paper mountains and manual uploads. iCustoms seamlessly integrates with the UK’s HMRC CDS system, sending your declarations electronically for faster processing and real-time status updates.

- Multiple Declaration Types: Whether you’re dealing with standard imports, simplified procedures, or special regimes, iCustoms offers flexible templates to ensure compliance with specific regulations.

1.2. Duty & VAT Calculation

- Accuracy Guaranteed: Eliminate guesswork and potential fines. iCustoms uses the latest duty rates, exchange rates, and trade agreements to calculate your landed costs with pinpoint accuracy, including duties, VAT, and any additional fees.

- Detailed Breakdown: Gain clarity beyond just the final numbers. iCustoms provides a comprehensive breakdown of each cost component, empowering you to optimise your pricing and trade strategies.

- Proactive Risk Management: Identify potential duty challenges upfront. iCustoms flags potential tariff classifications and duty exemptions, allowing you to make informed decisions and explore cost-saving alternatives before submitting your declaration.

1.3. Automated Customs Declarations3. Compliance & Validation

- Built-in Rule Engine: Rest assured knowing you’re playing by the rules. iCustoms’ extensive rule engine automatically checks your declarations against thousands of UK customs regulations and trade agreements, highlighting any potential compliance issues before submission.

- Data Error Prevention: Minimise the risk of delays and rejections. iCustoms automatically validates your data format and identifies inconsistent or missing information, ensuring your declarations are complete and error-free.

- Pre-Clearance Confidence: Achieve peace of mind before your goods even reach the border. iCustoms’ compliance checks significantly reduce the chance of post-clearance audits and penalties, allowing you to focus on your business.

1.4. Trade Documentation Management

- Paperless Perfection: A digital workflow will replace filing cabinets, so say goodbye to them. iCustoms eliminates the need for human data entry by automatically capturing data from your packing lists, invoices, and certificates of origin. This will save you time and valuable resources.

- Automated Document Routing: No more headaches obtaining approvals and signatures. iCustoms improves document workflows by automatically routing papers for internal review and authorisation in accordance with pre-established norms. This guarantees a smooth and effective procedure without the requirement for further follow-ups.

- Centralised Document Repository: Access all your trade documents in one convenient location. iCustoms provides a secure and organised cloud repository for all your import-related documents, simplifying retrieval and record-keeping.

2. Deloitte

The following are the key features of declaration software:

- Compliance with EU customs code: CDS adheres to the new EU customs requirements outlined in the Union Customs Code.

- Free access to declaration data: Businesses can access their submitted CDS declarations for free, unlike CHIEF which charged for downloading data.

- Cost reduction: Eliminates the download fees associated with accessing declaration data on CHIEF, potentially reducing costs for businesses.

- Early access and practice: Businesses can practice using CDS and familiarise themselves with the platform through HMRC’s Trader Dress Rehearsal service before the full transition.

3. Descartes

- Solution with ABI approval: With ABI approval, Descartes’ solution meets U.S. Customs and Border Protection’s criteria for electronic data interchange.

- Streamlined customs entry process: It helps to simplify and automate the procedure of entering customs, which also lowers the risk of errors and saves your time.

- Improved accuracy and productivity: Customs brokers and self-filing importers benefit from more accurate customs declarations.

- Automated data checks: By automatically verifying data for mistakes and discrepancies, it lessens the possibility of costly delays and fines.

4. Customs4trade

Key features of CAS Declarations, as summarised from the provided website:

- Automated filing: CAS Declarations automate the submission of customs declarations for imports, exports, and transit, potentially leading to time savings and decreased errors compared to manual filing.

- Multi-country support: It caters to diverse declaration types across numerous countries, making it well-suited for businesses engaged in international operations.

- Faster clearance: Automating processes can result in decreased shipment lead times, potentially enhancing overall efficiency and responsiveness.

- Enhanced accuracy and compliance: Reduced shipment lead times from automated operations may improve overall responsiveness and efficiency.

5. Hurricane

The following are the key features of CDS:

- Data Enhancement: Hurricanes act as a “data highway” for postal operators and others involved in cross-border shipping. They enhance shipping data by incorporating details such as address verification, commodity classification, and identification of prohibited/restricted goods.

- Duty and Tax Calculations: Hurricane’s solutions deliver instantaneous calculations of duties and taxes for cross-border shipments, guaranteeing precise estimations and seamless customs clearance.

- Prohibited & Restricted Goods Screening: They provide automated screening of shipments against country-specific lists of prohibited or restricted goods, averting potential violations and delays.

- Denied Parties Screening: In order to ensure compliance and reduce risks, it accesses global denied party lists to identify individuals or organisations with which transactions are forbidden.

Benefits for manufacturers and retailers

Moving to CDS import software offers manufacturers and merchants a contemporary platform as well as numerous benefits that can enhance productivity, maximise expenses, and disclose untapped growth prospects. Let’s delve deeper into the advantages for each category:

For Manufacturers:

1.1. Streamlined Workflow and Reduced Errors

CDS’s intuitive interface minimises the complexity of customs declarations, leading to:

- Automated processes and pre-populated fields drastically cut down on form-filling time.

- Preventing human error by decreasing the quantity of manual inputs speeds up the clearance procedure.

- Eliminating or drastically reducing the need for human intervention streamlines the clearance process and makes human mistakes less likely to occur.

1.2. Faster Clearance and Lower Inventory Costs

The expedited customs process with CDS translates to:

- Goods reach production lines faster, reducing inventory waiting times and associated carrying costs.

- Predictable clearance times enable better scheduling and resource allocation.

- Quick turnaround times allow manufacturers to adapt to market demands more efficiently.

1.3. Enhanced Transparency and Control

Real-time tracking of shipments through CDS provides unparalleled visibility, including

- Early identification of possible obstacles minimises delays by enabling quicker corrective action.

- Manufacturers may make strategic decisions about logistics and inventory management with the use of real-time data.

- Transparency and improved communication promote stronger cooperation with foreign partners.

1.4. Cost Savings and Competitive Edge

CDS offers several cost-cutting advantages:

- Elimination of paper forms saves on printing, postage, and storage costs.

- No more download fees for declaration data further decreases operating expenses.

- Streamlined processes and accurate data minimise the risk of fines and penalties.

- Faster clearance and lower costs lead to competitive pricing and improved market position.

1.5. Duty Drawback and Traceability Advantages

CDS simplifies specific processes:

- Free import tariffs on materials used in exported finished items are easily refundable to manufacturers.

- Improved import material tracking makes traceability laws easier to follow.

For Retailers

1.1. Smoother Supply Chain and Reduced Delays

Faster customs clearance through CDS leads to the following:

- Quicker availability of goods on shelves minimises lost sales and customer frustration.

- Customers are happier and more likely to return when there are shorter wait periods for requested products.

- Ability to launch new items fast in response to changes in consumer demand.

1.2. Global Sourcing Opportunities and Cost Optimisation

CDS simplify international sourcing:

- Access to a larger pool of international suppliers offering potentially lower prices or unique products.

- Easier supplier change in response to shifting demands and market dynamics.

- Possibility of reduced costs in sourcing because of heightened competition and availability of new markets.

1.3. Risk Mitigation and Business Continuity

CDS’s data accuracy and transparency contribute to:

- Imported items are better tracked, which makes it easier to spot possible safety concerns quickly.

- Automated procedures and accurate data reduce the possibility of non-compliance fines.

- Consistent adherence to regulations builds trust and loyalty with customers.

1.4. Scalability and Future-Proofing

CDS is designed to grow with your business:

- The platform can handle larger import volumes as your business expands.

- CDS seamlessly integrates with existing WMS and ERP systems, ensuring smooth data flow.

- Constant upgrades and updates ensure compliance with evolving regulations and industry standards.

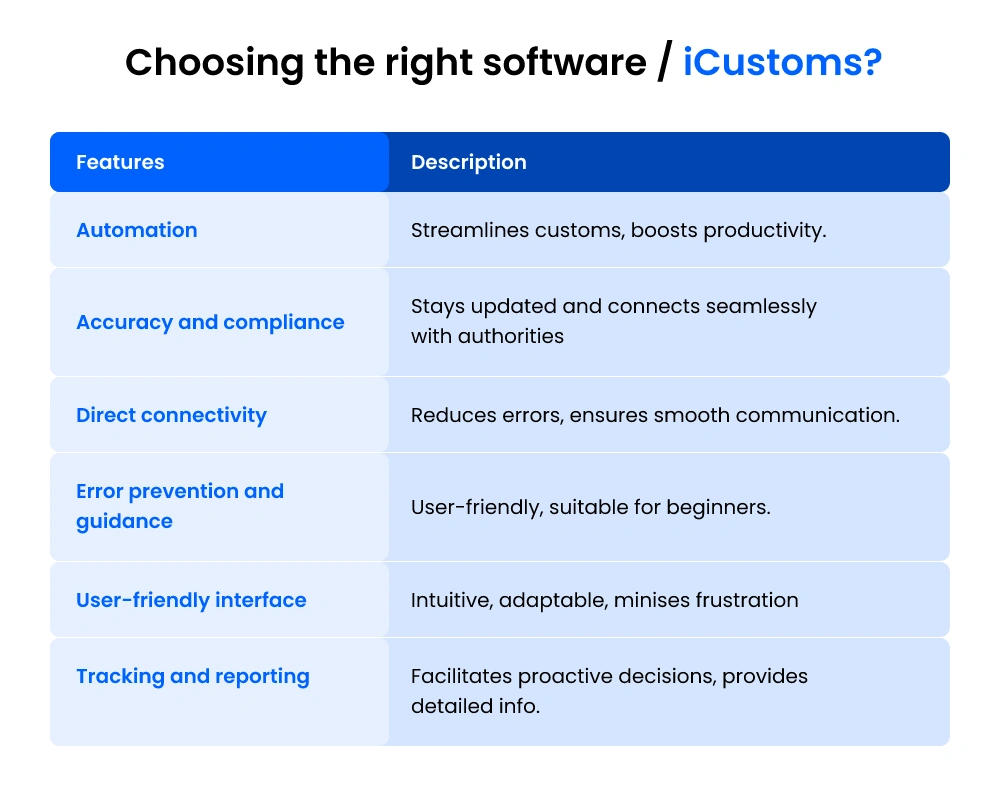

Choosing the right software/ iCustoms?

Automation for Efficiency

- From creating declarations to tracking shipments and handling duty payments, iCustoms streamlines the whole customs clearance procedure. This streamlines operations, gets rid of paperwork, and minimises manual data entry.

- By automating repetitive tasks, your team can focus on more strategic initiatives, boosting productivity and overall efficiency.

- The automation lowers the possibility of human error, guaranteeing more precise assertions and adherence to rules.

Accuracy and Compliance

- iCustoms stays updated with the latest rules and guidelines, guiding you through complex tariff codes, commodity classifications, and origin requirements. It minimises the risk of delays, penalties, and potential legal issues.

- iCustoms seamlessly connects with the UK’s Customs Declaration Service, facilitating accurate and efficient communication with customs authorities.

Direct Connectivity

- By integrating with other systems, iCustoms streamlines data entry, which in turn reduces human error and improves communication with customs officials. That way, declarations can be sent in without a hitch, status updates can be received promptly, and questions may be answered quickly.

- Information flows seamlessly between your systems and CDS, keeping you informed of any changes or requirements, fostering proactive decision-making and timely responses.

Error Prevention and Guidance

- Even people with little experience with customs can confidently manage the process with the help of iCustoms’ straightforward instructions written in simple language.

- Getting access to customer support guarantees helps with technological problems or updates related to regulations, offering continuous direction and assurance.

User-Friendly Interface

- The iCustoms interface features intuitive menus, sensible workflows, and useful hints to make it easy to use. This minimises team member irritation, speeds up user acceptance, and cuts down on training time.

- The software is adaptable to user preferences and particular company requirements, guaranteeing a customised experience and effective workflows.

Comprehensive Tracking and Reporting

- Follow the progress of shipments from the point of departure through customs clearance and ultimate delivery. It facilitates proactive decision-making, prompt intervention in the event of delays, and enhanced visibility throughout the supply chain.

- Gain access to extensive information on declarations, duty payments, and any interactions with regulations. This information will help you make well-informed decisions, optimise your operations, and pinpoint areas that need development.

Conclusion

In conclusion, Customs Declaration Software (CDS) is indispensable for manufacturers and retailers navigating global trade complexities. Among the top options—iCustoms, streamlines workflows, ensures compliance, and provides benefits like faster clearance, cost savings, and duty drawback advantages.

Manufacturers benefit from simpler processes, quicker clearance, lower costs, and improved traceability thanks to CDS. Retailers benefit from streamlined supply chains, fewer delays, chances for international sourcing, and risk reduction. Both benefit from scalability and future-proofing.

Ready to transform your CDS import process? Book your demo today!

FAQ's

What is a CDS import software?

A solution designed specifically for importing and managing data for Customs Data Systems is called CDS import software. It facilitates the efficient administration of declarations for regulatory compliance and customs procedures by streamlining the process of importing and organising customs-related data from various sources.

What is the difference between CDS and Chief?

CDS (Customs Data System) is the modernised UK customs declaration system that replaced the previous CHIEF (Customs Handling of Import and Export Freight) system. CDS is intended for complete customs management, whereas CHIEF is primarily used to process customs declarations for imports and exports.

Do importers need to register for CDS?

Yes, importers in the United Kingdom need to register for CDS (Customs Data System) to submit customs declarations and comply with customs regulations. CDS is the modernised customs declaration system, and registration is necessary for efficient import and export processes.

What is a CDS import platform?

A CDS import platform is software that helps manage and process customs-related data for imports, ensuring compliance with regulations in Customs Data Systems (CDS).

You may also like:

Master Imports with iCustoms CDS

Seamlessly Conquer Import Control System Release 2

Subscribe to our Newsletter

About iCustoms

Master Imports with iCustoms CDS

Seamlessly Conquer Import Control System Release 2