Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Importing Goods into the UK: An Essential Guide

-

Freya Jane

- Director of Customer's Success

Is importing goods to the UK has been a hassle to you?

You are not alone; it is common for traders to get stuck in import documentation, regulations, and expected expenses. Everything from selecting the shipping methods to clearing customs and calculating taxes needs meticulous attention and expertise, leaving traders with confusion and frustration.

As per the World Options study,

“The United Kingdom is the world’s 4th largest importing country, and it approximately has $823 billion import value yearly, including items like fuel, manufactured goods, foodstuff, machinery, etc. “

Similar to any other country, the United Kingdom has an appropriate method you must go through when importing goods. Fear not; we have come up with a detailed guide covering all you need to know about importing goods into the UK. Keep reading to equip yourself with the best strategies for importing to the UK and ensuring success.

Comprehending the basics of importing goods into the UK

Importing goods into the UK involves the movement of products from other countries to the United Kingdom. To accomplish this successfully, people need to follow a series of steps and must have a thorough understanding of the procedures involved, such as:

- Certifications and import licences

- Commodity codes

- Import regulations

- UK customs

- Taxes and duties

- Customs documentation

- International market

Documents required for importing to the UK

A lot of documents are needed while importing goods to the UK. The common ones are listed below:

Must-have documents:

- Commercial invoice

- Bill of lading

- EORI number

- Packing list

Documents you may need:

- Certificate of origin

- CE certificate

- Certification for port health

- Test certificates

- Import licences

- MSDS

- Certificate of authorisation

Automate documentation with AI-powered IDP, reducing errors and saving you 70% of your time!

How to import goods to the UK: All the steps involved

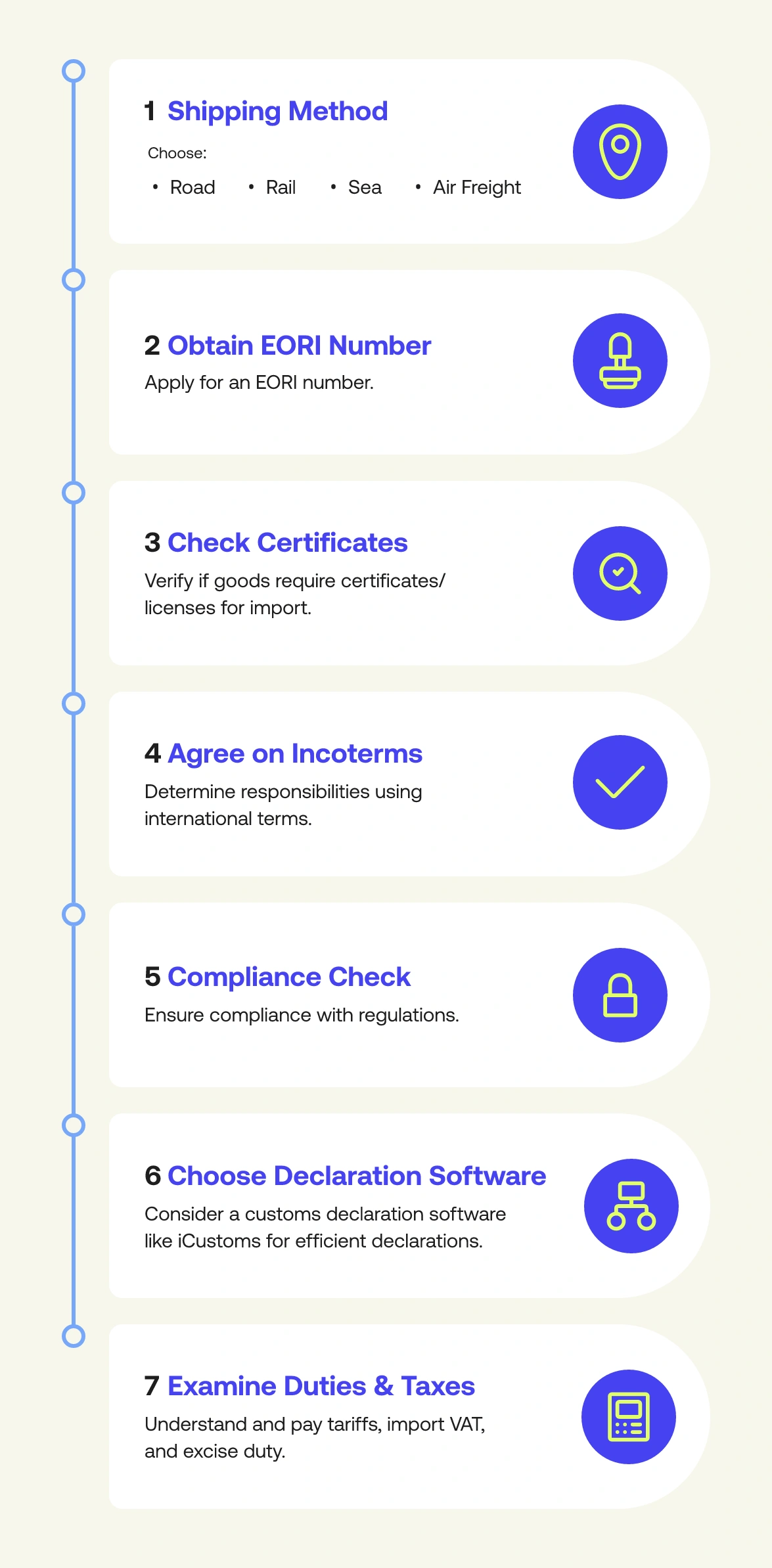

Follow these steps to import goods into the UK seamlessly:

Step 1: Select your shipping method

The shipping method for the transportation of goods from their original country to the UK has a significant impact on the overall expenses.

The following are the various shipping options you can consider:

Road freight: Can be costly and slow due to added fuel and toll expenses.

Rail freight: Considered effective for RU, but there are very limited rail routes.

Sea freight: Very cost-effective but can be slower than other methods.

Air freight: Very costly but faster than all of the listed ones.

Finding the most cost-effective and simple shipping method can be a daunting process for anyone new to global trade. To accomplish this task, you can get help from any freight forwarder company, which can help you choose the right method, negotiate the rates and track your shipment in real time.

Step 2: Get an EORI number

Economic Operators Registration and Identification (EORI) is a 12-digit code starting with a GB and is required when importing products into the UK. However, the EORI number may not be required when you are moving goods between Ireland and Northern Ireland or if you are running a service-based business. In case of the absence of an EORI number, you might face increased expenses and delayed shipments.

To get an EORI number, you can apply on the govt. website, and it should be assigned to you within a week.

Step 3: Ensure that the company sending goods can export to the UK

The company sending the goods into the UK must need to:

- Have certificates or licenses to export goods to the UK

- Make an export declaration

Checking what documents are required to enable your goods to reach the UK will help avoid unnecessary delays.

Step 4: Check whether you need any certificate or license

Importing specific goods requires certificates or licenses to pass the borders, such as:

Plants and plant products

Animals and animal products

Chemicals

Drugs

Medicine

High-risk goods

Products having fluorinated gas

Nuclear material

Besides this, if you are importing manufacturing goods, food items, or plant seeds, you must ensure that the goods follow accurate marketing, labelling, and marking standards.

Discover the top 5 CDS import software for Manufacturers & Retailers. Read more!

Step 5: Agree on incoterms with the supplier

In international trade, both the importer and the supplier must agree to a set of terms and conditions that establish their responsibilities, i.e., incoterms. Their significance in customs procedures cannot be overstated, as they determine who is liable for a specific customs obligation.

For instance, if you are a non-UK-based business exporting goods under DDP incoterms from a European Union country, you are in charge of both the import into the UK and the export in the country of departure. On the other hand, you will not be responsible for either the import into the UK or the export in the country of dispatch if you are selling under EXW incoterms.

Step 6: Check compliance with the importing rules

The United Kingdom has a strict set of measures to promote fair trading and protect the environment, resulting in avoiding delays and legal penalties.

These include:

Product safety regulations: Traders must confirm that the products they are importing are properly labelled with the safety certifications and comply with the particular safety standards.

Trade-specific regulations: Some products may have specific regulations that you must comply with; for instance, pharmaceutical products require approval from the Medicines and Healthcare Products Regulatory Agency, while food items must comply with specific labelling standards.

Environmental regulations: The companies importing goods must be compliant with the rules and restrictions on packaging materials, waste management, and hazardous substances.

Step 7: Choose the right software provider for import declaration

Import declaration is the most important and critical step, as it holds many chances for mistakes. Although it can be performed on your own, it is suggested to hire a customs agent or use AI-driven customs declaration software.

iCustoms - Premium customs declaration software provider

To ensure accurate customs declarations, choose iCustoms’ AI-driven CDS and automate complex declaration procedures.

You can get the following benefits from iCustoms’ CDS:

Regulations enforcement: It ensures your shipments are rigorously compliant with the governing importing and exporting rules, saving you from fines and penalties.

Processing taxes and fees: By calculating tariffs and duties related to trade, iCustoms CDS spares you the trouble of manual computation.

Logistics management: iCustoms ensures a smooth flow of goods by efficiently integrating with the logistics system and thoroughly tracking the goods.

Improved efficiency: By automating everything involved in customs procedures, iCustoms reduces errors and shipment delays, improving overall efficiency.

Increased transparency: iCustoms makes the process more transparent overall by offering insightful real-time data and analytics.

Ready to experience the power of iCustoms’ AI-powered CDS? Start Now!

Step 8: Examine the customs duties and taxes to be paid

You will have to pay VAT and duties for each import. Taxes and duties can be classified into two categories based on the country of origin of the imported goods. The two classes are:

Preferential

Non-preferential

A preferential tariff is applied to products that are imported from a country that is a part of the United Kingdom’s scheme of preferences and has trade agreements with the UK.

A non-preferential tariff is applied to goods that are imported from a country that doesn’t have a trade agreement with the UK, and it necessitates ensuring compliance with the rules set up by the World Trade Organisation.

If you are a fully taxable business, you won’t have to pay import VAT. In case your business involves importing biofuels, tobacco, or alcohol, you must also pay excise duty.

You can find excise duty rates here.

Common mistakes to avoid when importing goods into the UK

There are several procedures involved in importing products into the UK, and even small mistakes can result in delays, unforeseen expenses, or even fines.

Here are the common mistakes importers should be careful about:

1. Not getting the required certifications or licenses

Some products, such as chemicals, food items, and medicines, may require special licenses and certifications, which importers usually ignore. Importing such goods without the required paperwork may lead to shipment delays, rejections, or even seizure.

How to steer clear of this error:

- Consult the UK government’s import regulations to find out if your goods need an import license or certification.

- Apply for the required license in advance to avoid last-minute delays.

- Make sure your supplier has all the necessary compliance paperwork before shipping.

2. Using incorrect HS codes to misclassify goods

The Harmonised System (HS) code is a widely accepted classification scheme for figuring out import laws and customs charges. Incorrect tariff payments, delays in customs clearance, and potential fines might result from entering the incorrect code.

How to steer clear of this error:

- Use an accurate HS code lookup tool such as the one iCustoms offers, i.e., iClassification.

- If in doubt, seek the advice of a freight forwarder or customs specialist to confirm the accurate classification.

3. Underestimating VAT and customs duties

Many importers fail to accurately calculate the total cost of their imports, leading to unexpected charges. The final cost must include import charges, VAT (usually 20%), and excise duties (for items like alcohol and tobacco).

How to steer clear of this error:

- Investigate and determine the entire landed cost, which comprises:

- Product cost

- Insurance and shipping charges

- Customs charges

- VAT

- Find out if your products are eligible for a preferential tariff under a trade agreement with the UK.

To obtain precise duty calculations, consider using automated customs declaration software such as iCustoms.

4. Inaccurate or incomplete documentation

Inaccurate or missing paperwork may result in extra costs, delays at customs, or even your goods being denied entrance. The following are the most frequently needed documents:

- Commercial invoice: Offers information about the items, such as their origin and value.

- Bill of lading (or airway bill): Acts as proof of shipment.

- Packing list: Lists the contents of the shipment.

- EORI number: Required for businesses importing into the UK.

How to steer clear of this error:

- Confirm the accuracy of the documentation before delivery.

- Make sure that information about suppliers, stated values, and product descriptions is consistent throughout all documents.

- Reduce human error by automating and verifying import paperwork using AI-powered intelligent document processing solutions.

Last Words

A comprehensive understanding of the procedure and adherence to regulatory standards are essential for successfully importing goods into the UK. Adhering to product safety regulations, getting relevant licences, and precisely calculating import tariffs and VAT on UK imports are vital for a thriving experience.

Using iCustoms as your customs declaration partner will greatly expedite your import procedure. Our cutting-edge AI-driven software, streamlined customs declaration, and trustworthy duty and tax calculation let you concentrate on your business while leaving the intricacies of import to our knowledgeable staff.

By working with iCustoms as your reliable partner, you can fully recognise your company’s potential in the competitive UK market. Contact us right now!

Tired of spending hours on manual customs procedures?

Let iCDS automate it for you, ensuring faster processing!

FAQ's

Do I need a licence to import goods into the UK?

Generally, an import license is not required for importing most industrial goods into the UK, while a few might need it. The Import Licencing Branch (ILB) necessitates having import license for the following goods:

- Torture equipment

- Anti-personnel mines

- Firearms

How does the UK charge import duties?

UK customs impose duties on imported goods that are worth more than £135. The import charges generally consist of:

- 20% VAT

- Freight and duty

- Insurance

- Cost

Do I have to pay duty on items shipped to the UK?

Anything sent from one country to another, either via postal or courier, undergoes customs to make sure it is not restricted or banned, which applies appropriate tax or duties on it.

You may also like:

Ready to streamline your Customs Declaration Process?

Boost efficiency, reduce errors, and ensure accuracy with iCDS

Subscribe to our Newsletter

About iCustoms

Ready to streamline your Customs Declaration Process?

Boost efficiency, reduce errors, and ensure accuracy with iCDS