Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

How Harmonised System Codes Facilitate Global Trade

-

Freya Jane

- Director of Customer's Success

The dynamic nature of the global commerce environment is supported by the smooth flow of goods across international borders. However, facilitating this flow demands a strong system of clear and constant communication. Considering the wide range of goods that pass through customs stations on a daily basis, it may seem logistically difficult to achieve such efficiency. The simple but critical solution is in the Harmonised System code.

Did you know that HS codes are used in more than 98% of global merchandise trade?

That is a startling statistic that emphasises how important these apparently simple six-digit identifiers are in facilitating global trade.

This blog post will walk you through the world of HS codes, highlighting their significance and benefits in international trade.

Understanding Harmonised System Code

A harmonised system code is a 6-digit code used to classify internationally traded goods. Developed and maintained by the World Customs Organisation (WCO), it acts as a uniform language for categorising goods. This harmonised system allows all the countries to be on the same page when classifying goods prior to importing and exporting. Based on who is responsible for the shipment and where it is going, there are multiple ways to refer to harmonised codes. For instance, they may be called HC, HTS, commodity code, or tariff.

Click here to learn the difference between HS & HTS codes. Read out!

Why is it important to get the right HS code?

Getting the right HS code is essential for smooth global trade. It ensures you pay the right taxes and duties, preventing customs delays and fines. Precise HS codes guarantee that your products are appropriately categorised and avoid delays in the verification process. Additionally, they provide trustworthy trade data and help customs officials control risk. In short, utilising the correct HS code ensures that your items move smoothly and compliantly across borders.

What does each part of a commodity code mean?

The HS code classifies commodities using a hierarchical system. Consider a file system where categories become increasingly specific. The top level is Chapters (2 numbers), followed by Headings (4 digits) that further categorise inside the Chapter. Finally, Subheadings (6 digits) offer the most precise classification of a particular commodity.

For example, the following is the breakdown of the commodity code for fresh apples (080810):

Chapter (08): The first two digits represent “fruit and nuts, citrus fruit or melons’ peels.”

Heading (0808): After two more digits, it becomes “apples, pears and quinces, fresh.”

Subheading (080810): The last two digits identify the specific commodity, “fresh apples.”

In this case, apples (080810), pears (080830), and quinces (080840) all share the first four digits (Chapter and Heading) since they all fall under the same broad category of fresh fruit. The last two digits distinguish them within that category.

HS general rules for interpretation

There are six main rules for interpreting HS codes:

1. Emphasise Headings and Notes: Section, Chapter, and Sub-Chapter titles are provided solely for reference purposes. The classification is based on the specific terms used in the headings, Section/Chapter Notes, and the rules listed below.

2. Incomplete, Unfinished, and Disassembled Goods: It refers to the classification of the incomplete, unfinished, or disassembled articles.

3. Mixtures and Combinations: This covers the classification of materials or substances, including mixtures or combinations. Goods made partially or entirely of a specific material are classified under that heading. Mixed goods are classified according to the most essential material.

4. Classification Under Multiple Headings: The most detailed description is preferred if a product can be categorised under two or more headings. If multiple headings are equally specific, consider the essential nature of the goods. If you are still undecided, choose the numerically last heading.

5. Packing Materials and Containers: Packing materials and containers are classified alongside goods if they are commonly used for that purpose. However, this does not apply to reusable containers or containers that define the essential characteristics of the goods.

6. Subheading Classification: Subheading classification applies the same principles as heading classification, taking into account subheading terms, notes, and general rules.

Let iCustoms AI-driven iClassification tool simplify the HS classification for you. Start Now!

How does the HS code facilitate global trade?

HS code facilitates global trade in the following ways:

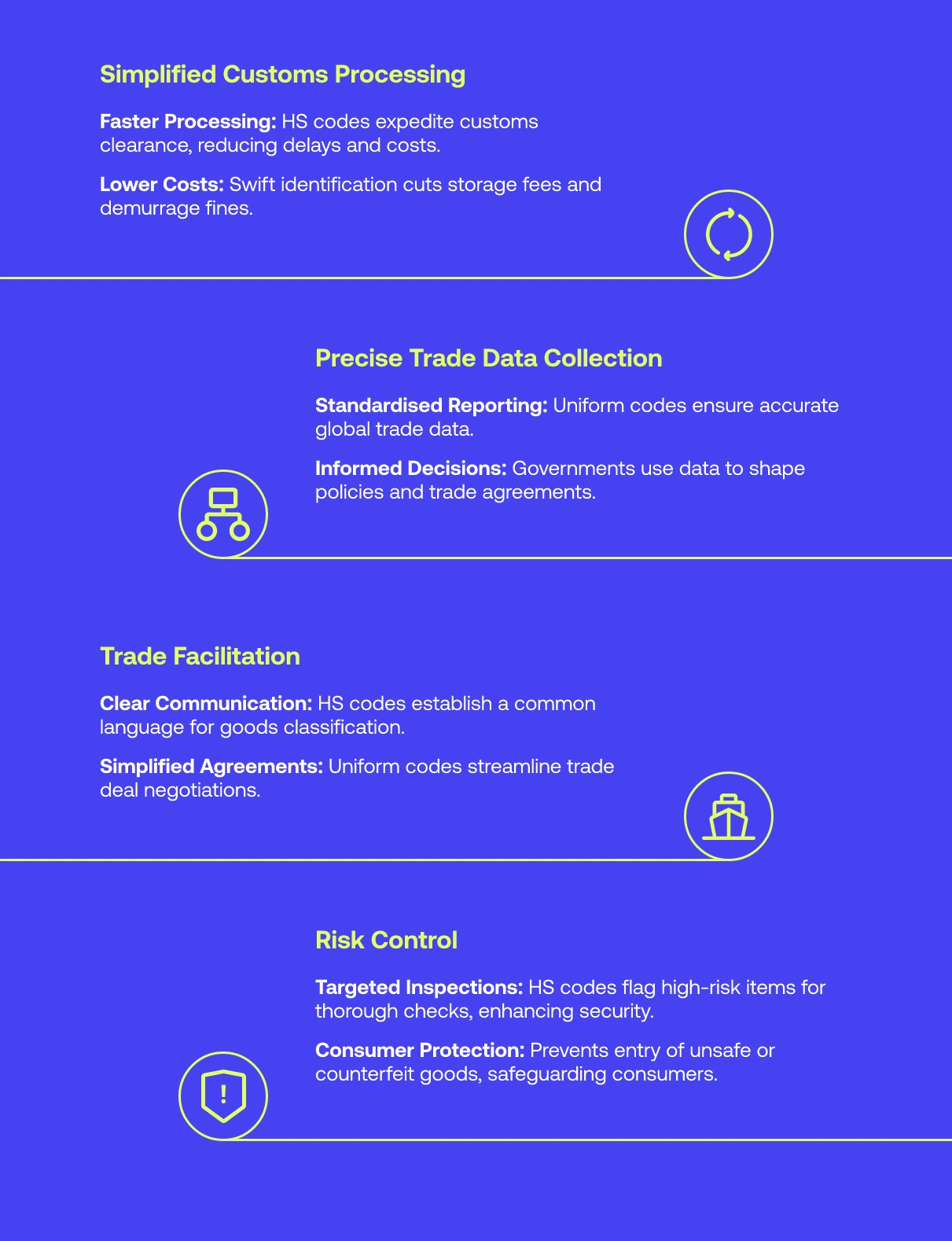

Simplified customs processing

Faster processing: Customs officers all throughout the world use HS codes as a common language. Consider a shipment of laptops (HS code: 8471.30.00) arriving in the UK. The product’s HS code provides customs with rapid product identification, removing the need for prolonged descriptions or complicated term interpretations. As a result, items will be identified, classified, and processed more quickly, resulting in quicker customs clearance and shorter shipment wait times.

Lower costs: Your shipment will spend less time delayed in customs thanks to HS codes, which speed up processing. This results in decreased storage fees and possible demurrage fines (penalties for exceeding the allotted time to empty a container).

Precise trade data collection

Standardised reporting: HS codes provide uniform import and export data reporting among all nations. This eliminates the confusion and discrepancies that can come when utilising several classification systems. Imagine each country having its own distinct code for “coffee.” HS codes ensure that everyone uses the same code (for example, 0901.11.00 for green coffee beans), allowing for accurate data collection for worldwide commerce statistics.

Making well-informed decisions: For a variety of objectives, governments and international organisations depend on this precise trade data. They are able to assess trade patterns, spot potential markets, and decide on trade agreements and policies with knowledge. For example, a nation seeing an increase in imports of coffee (HS code: 0901) may look into trade agreements with significant coffee-producing countries.

Trade facilitation

Clear communication: HS codes offer a standard language for discussing and categorising items. This removes misunderstanding and makes it easier for countries negotiating trade agreements to communicate with one another. Consider negotiating a decrease in tariffs for “electronics.” HS codes allow both importers and exporters to precisely designate which electronic items (e.g., HS code range: 84.6 and 85) are included by the agreement, minimising ambiguity and potential disagreements.

Simplified agreements: Trade agreements can be made more quickly and effectively thanks to HS codes. A uniform classification scheme can help countries come to agreements that are simpler to implement.

Risk control

Targeted inspections: Customs officials can designate high-risk items for additional examination by using HS codes. For example, products that fall under particular HS codes (such as chemicals or hazardous materials) may be marked for required inspections. This contributes to the safety and security of international trade by directing resources towards potentially dangerous goods.

Consumer protection: Another function of HS codes is to shield customers from goods that might be dangerous. Customs can prohibit the entry of counterfeit items, toxic materials, or products that do not satisfy safety regulations by identifying high-risk goods.

Benefits of harmonised system code for international trade

There are many benefits that HS codes provide to businesses that trade internationally. Here’s a breakdown of the key benefits:

Cost savings: Faster customs clearance due to HS codes results in lower storage fees and demurrage charges connected with delays. Furthermore, appropriate classification helps to prevent penalties for incorrect duty calculations.

Enhanced productivity: HS codes simplify the whole trading procedure. Businesses benefit from faster delivery times and increased overall efficiency when there is expedited customs clearance and unambiguous product identification.

Precise trade information: HS codes guarantee that businesses can obtain accurate information about their international trade. This makes it possible to make well-informed decisions about future export plans, marketing, and production, maximising earnings and allocating resources as efficiently as possible.

Regulation compliance: Using the appropriate HS codes shows that you are committed to abiding by local customs laws in various countries. This avoids needless delays, possible fines, and reputational harm from non-compliance.

Takeaway

A harmonised system code is an essential tool to ensure effective international trade. It guarantees accurate trade data, expedites the customs clearance process, and lowers expenses. By knowing and utilising HS codes appropriately, businesses can handle international trade more compliantly and confidently.

People Also Ask

How do I find my Harmonised system code?

You can find accurate HS code using iCustoms' advanced AI-driven iClassification tool.

What is the difference between the HS code and the tariff code?

Tariff codes and HS codes are essentially the same. Consider the six-digit HS code to be the universal language. Different countries may add additional digits for their own tariff systems.

What happens if I use the wrong HS code?

Incorrect HS codes can lead to non-compliance, shipment delays, fines or penalties and even seizure of goods.