Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Understanding the Difference: Harmonised System Code vs Harmonised Tariff Schedule

-

Freya Jane

- Director of Customer's Success

International trade thrives in the linked world of today, enabling the trading of goods and services worth about $28.7 trillion USD yearly. To facilitate the seamless movement of this enormous quantity of goods across international boundaries, a uniform method for product classification is needed. This is where the harmonised system and harmonised tariff schedule step in.

The harmonised system of coding used to classify internationally traded goods plays a crucial role in streamlining cross-border transactions. However, things can become complicated when terminology like HTS code and HS code are used interchangeably, creating confusion among importers and exporters. Fear not, this blog will serve as your guide, clarifying the differences between HS and HTS codes and outlining their functions in the context of global trade.

What are HS codes?

A harmonised system code (HS code) is a standardised numerical system for classifying internationally traded goods. These codes are managed by the World Customs Organisation (WCO) and are currently in its 6th edition, i.e., 2022.

Structure and purpose

Heading and subheading: The HS system contains more than 5,000 headings and subheadings.

Classification: Each item is issued a unique six-digit code based on its type, composition, and intended purpose.

Breakdown of the code

Chapter: Initial 2 digits

Function: Broadly provide information about the goods.

Examples

Chapter 84: Machines and mechanical appliances

Chapter 85: Electrical machinery and equipment

Heading and subheading: Last 4 digits

Function: These digits provide detailed information about the material, function, and manufacturing procedure of the goods.

Example:

HS code 8414.90 means “air or vacuum pumps, air or other gas compressors, and fans; ventilating or recycling hoods incorporating a fan, whether or not fitted with filters.”

Curious to learn more about HS codes?

Read our guide: HS Code: A Comprehensive Guide for Importers and Exporters

What are HTS codes?

The Harmonised Tariff Schedule Code (HTS) is a further extension of the HS code that is specific to each country. It consists of a 6-digits HS code and an additional four digits that provide more detailed information about taxes and duties applied to each product. The additional digits may vary from country to country; for instance, the EU uses an 8-digit HTS code, while the US uses a 10-digit code.

Purpose

HTS code helps customs officials calculate the accurate amount of taxes and duties for every shipment. It is also used to determine any specific regulations or restrictions that apply to certain goods; for instance, to import some products, you need to obtain a permit or licence.

How is the HTS code different from the Schedule B code?

Although the Schedule B codes are a subset of the HTS codes, they are different from each other. Harmonised Tariff Schedule codes are used to classify goods for imports, while Schedule B codes classify exports.

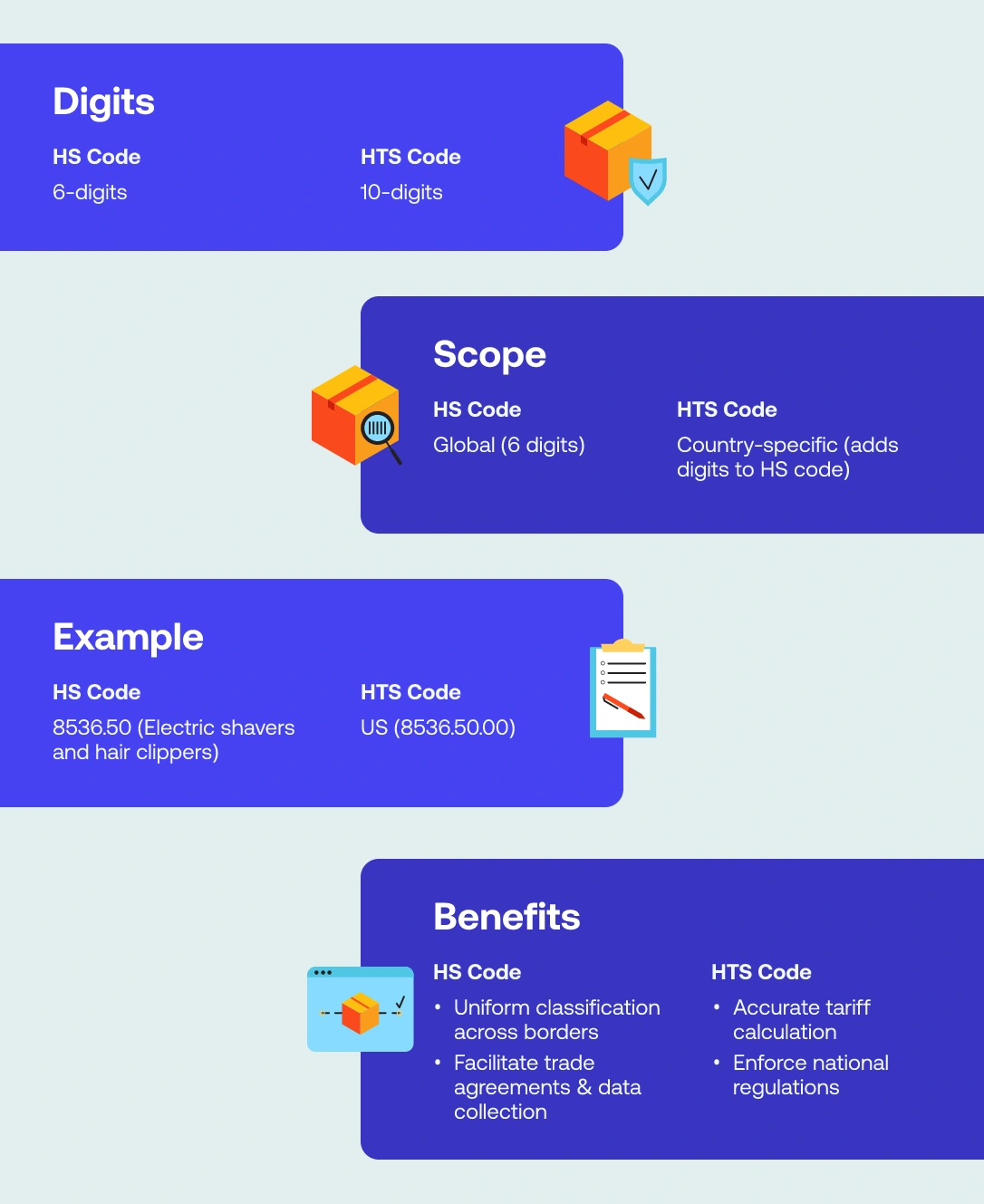

Harmonised system code vs. harmonised tariff schedule

In the international trading system, HS (Harmonised System) and HTS (Harmonised Tariff Schedule) codes are essential components. They assist in the classification of commodities, guarantee adherence to global regulations, and establish the tariffs and charges that are relevant to imported items. Despite their similarities, HS and HTS codes differ greatly from one another.

1. Global vs. country-specific systems

HS code

Global standard: The HS code system is a globally recognised system maintained by the World Customs Organisation (WCO). By describing goods in a standardised language, it promotes international trade.

Uniform classification: More than 200 economies and countries utilise HS codes, which facilitate international communication about goods in trade agreements, trade data, and customs paperwork.

HTS Code

Country-specific: An expansion of the HS code that is specific to a given country is the HTS code. It has more digits than the first six that the HS code provides, enabling a more precise and in-depth classification that is necessary for national objectives.

Unique schedules: Every country creates a different tariff schedule on the basis of the HS code by adding extra digits to meet specific national requirements. Tariffs and levies on imported items are set using these schedules.

2. Structure & digits

HS code

6-digit system: This system is used to categorise commodities according to their intended application, composition, and type. This regulated system aids in the uniform classification of goods by customs agencies worldwide.

Division of the Digits:

The first two digits represent the chapter, which classifies products generally according to their nature (e.g., machinery, textiles).

The next two numerals, which represent the heading, provide more specific information about the item falling under that category.

The last two digits are called subheading, which provides even more specific information about the product.

HTS Code

Extended digits: The HTS code adds additional, nation-specific digits to the six-digit HS code. These enhancements make it possible to classify more precisely in order to comply with national tariff and regulation requirements.

Examples of extensions:

The HTS code is ten digits long in the United States. The 7th and 8th digits indicate additional subheadings that further define the products, while the ninth and tenth digits offer more national-level detail.

The seventh and eighth digits of the eight-digit code used by the European Union provide specificity within the context of the unified customs tariff.

3. Purpose and application

HS code

- Product identification: In international trade, the HS code acts as a common language for product identification. This customs tariff classification guarantees that goods are consistently categorised across borders, promoting efficient trade operations.

- Trade data collection: In order to gather and analyse trade data, HS codes are necessary. They support governments and international organisations in keeping an eye on cross-border goods movements, economic trends, and trade patterns.

- Customs declarations: In order to guarantee correct categorisation and adherence to customs laws, businesses importing or exporting products must provide the relevant HS code on customs declarations and shipping documents.

HTS Code

Tax calculation: The HTS code is primarily used to ascertain the tariffs and duties that apply to imported products in a particular country. The extended digits in the HTS code provide the information necessary to apply the appropriate tariff rates.

Country-specific tariffs: The HS code and additional national digits are used by each country to determine its own tariff rates. This enables nations to regulate the flow of commodities, safeguard their own industries, and make money via import taxes.

Experience hassle-free HS code identification and reduce the risk of penalties with iClassification. Try Now!

4. Compliance with rules and regulations

Regulatory compliance

Both HS and HTS codes are essential to guarantee adherence to various rules. These rules may cover intellectual property rights, environmental legislation, and health and safety restrictions.

Accurate product classification using HS and HTS codes helps customs authorities monitor and enforce compliance with these regulations and make sure that imported goods fit national and international standards.

Accurate classification

Correct application of HS and HTS codes guarantees accurate product classification, reducing the possibility of misclassification and enabling quick customs processing.

Accurate product classification is crucial for customs officials to apply the appropriate tariff rates and for businesses to avoid expensive mistakes and penalties.

Risk mitigation

By using the correct HS and HTS codes, importers and exporters can reduce the risk that comes with non-compliance.

Proper classification allows firms to precisely predict the taxes and charges they will incur, helping them manage their costs and pricing strategies.

The bottom line

Harmonised system code (HS) and harmonised tariff schedules both play crucial roles in international trade. While both have the same purpose of categorising goods, they cater to different needs. A harmonised system code is a globally recognised six-digit code, while a harmonised tariff schedule is a 10-digit, more country-specific code used for goods classification. Understanding the difference between the two helps importers and exporters steer the international trade process more smoothly and efficiently.

Ready to streamline HTS and HS code classification for your goods? Look no further than iCustoms! Our advanced AI-driven iClassification tool can ensure a seamless customs clearance process by quickly determining the relevant HS code for your product with a few clicks. To find out more, visit our website right now!

Facing slow and error-prone HTS code classification?

Let iClassification save you time and reduce the risks of errors!

You may also like

Reduced Compliance Risks

Ensure accurate HTS classification and minimise the risk of delays, fines, and penalties associated with non-compliance.

Subscribe to our Newsletter

About iCustoms

Reduced Compliance Risks

Ensure accurate HTS classification and minimise the risk of delays, fines, and penalties associated with non-compliance.