Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

iClassification Workflow: AI-Powered HS Code Classification

Have you ever experienced delays, penalties, or unexpected duties when shipping products across borders? One of the major causes of these problems is the misclassification of HS codes.

The Harmonised System (HS) code is a worldwide recognised classification system that governs customs charges, VAT, and import/export restrictions for goods. Choosing the right HS code is crucial as it can affect taxes, fines, and shipment seizures.

Different countries have different rules for product classifications, and misclassification can lead to legal issues. But, with thousands of HS codes and intricate rules, how can you be sure you’re selecting the correct one?

This is where iClassification (iCustoms’ AI-driven HS code finder) comes in.

Understanding the HS Code structure

Before we go into the workflow, let’s quickly grasp how HS codes are structured:

- First 2 digits (Chapter): Identifies the broad category of goods

- Next 2 digits (Heading): Narrows down the classification

- Next 2 digits (Subheading): Defines the product in more detail

- Additional digits (if applicable): Country-specific extensions for tariffs and taxes

For instance, the HS number 6403.91 refers to leather footwear.

- 64: Footwear

- 03: Leather material

- 91: Type of sole and usage

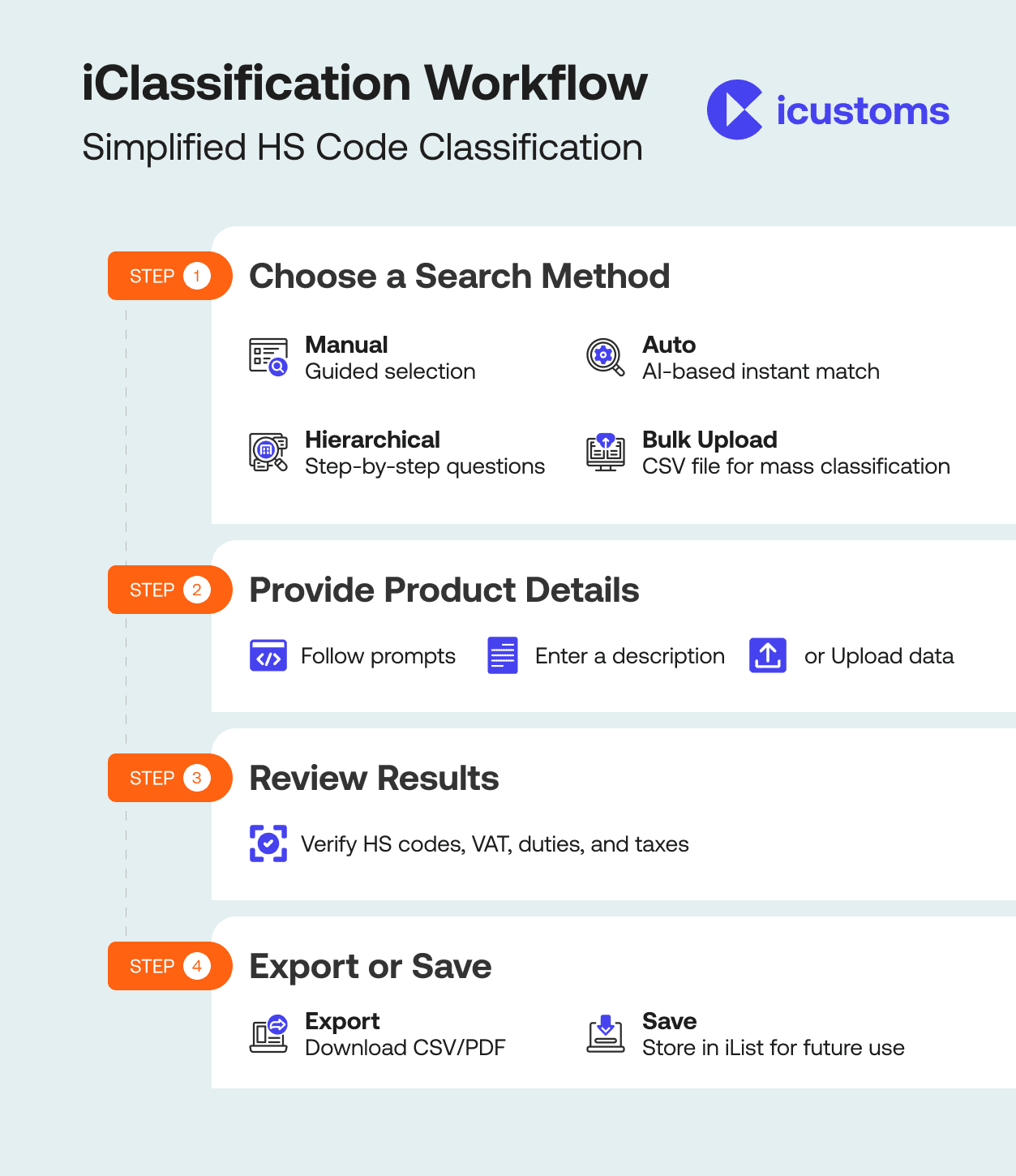

iClassification Workflow: Find out HS codes in simple steps

Step 1: Gather the required information

To get started, ask yourself, “What is the simplest way for me to describe my products?” Depending on your response, choose one of these four intuitive methods:

1. Manual search

This option is ideal if you like a methodical, guided approach. Our system will help you refine the classification by guiding you through a sequence of prompts and categories.

For example, you may begin by selecting the product type (e.g., “apparel”), then define features such as material (e.g., “leather”) and purpose (e.g., “footwear”). This method ensures accuracy and is suitable for those who are new to HS codes or wish to gain practical experience.

2. Auto search

In this option, simply enter a description of your products (e.g., men’s leather shoes) for quick and easy results. Our powerful AI engine will analyse your input and immediately recommend the most appropriate HS code. This strategy is quick, simple, and ideal for clients who require immediate answers without having to go through many steps.

3. Hierarchical search

Consider this procedure to be a chat with an expert who asks specific questions to help you find the correct HS code.

This feature will ask you a series of questions about your product. Each question adds to the preceding one, gradually improving the classification. This strategy is best suited for complex or speciality items that demand precision.

4. Bulk upload

Managing several products? Save time by uploading a CSV file with product names, descriptions, quantities, and other important information.

Our system will process all of your items at once and assign the appropriate HS codes in bulk. This strategy is particularly valuable for organisations with vast catalogues or regular shipments, as it ensures inventory efficiency and uniformity.

Step 2: Provide the product details

Once you’ve chosen your method, provide the following information:

- For manual search: Begin by selecting options based on prompts such as product type, material, purpose, etc. The system refines the search as you progress.

- For auto search: Enter a precise and brief description of your goods. The more exact the description is, the more accurate the match!

- For bulk upload: Create a CSV file with columns such as product name and description. Then simply upload the file and sit back while we handle the rest.

- For hierarchy search: Answer each question carefully. Each response gets you closer to the correct HS code.

Step 3: Review the results

After you provide your information, our system will provide the accurate HS codes, as well as the applicable VAT, duties, and taxes. Take a moment of your time to review the given HS codes.

Step 4: Export or save your data.

Now that you have your HS codes and related information, here’s how you can proceed:

Export: Download the results as a CSV or PDF file for easy documentation or sharing with stakeholders.

Save: Keep the data in your iCustoms account for future use or updates.

To save the data, you can use our iList product. It saves your goods, their descriptions, and any other relevant information, which can later be exported from iList with just one click.

Furthermore, iCustoms’ iClassification tool extends beyond just finding standard HS codes; it also gives HS codes for controlled and regulated items. With iClassification, you can confidently categorise any sort of product, including those subject to stringent regulatory controls.

You may also like:

Simplify Customs with our Powerful Customs Management Software

Automate declarations, track shipments, & ensure compliance.

About iCustoms

Simplify Customs with our Powerful Customs Management Software

Automate declarations, track shipments, & ensure compliance.