Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Product Classification Made Easy: A Fast and Accurate Guide

- Freya Jane

- Director of Customer's Success

Within product classification in customs management, determining the precise tariff code for any item being imported or exported is one of the most crucial steps. As a universal identifier, this code assists in classifying goods according to their features and facilitates the calculation of duties and taxes that apply to transactions involving international trade.

The categorisation process is based on a standardised approach known as the Harmonised System (HS) classification code.

According to the World Customs Organisation, “The Harmonised System is used by more than 200 countries and about 98% of traders in international commerce.”

The extensively used worldwide HS code organises goods according to their components, purposes, and intended uses, providing a structured approach to categorising them. Customs administrations widely use this method to guarantee uniformity and precision in assessing tariffs and duties.

Streamline Product Classification with iCustoms

iCustoms comes with an AI-powered product, i.e., iClassification, that can make the process of product classification easier by providing different leveraging features, including

Database Access for Tariff Codes

iClassification makes it easy for users to access a database of tariff codes and other relevant information. With the help of this method, users may quickly and reliably discover the relevant tariff code for a product, ensuring the application of the correct charges and taxes.

This software may have tools that allow users to search for tariff codes based on the product description or other relevant criteria. It may also permit users to input the product’s details and receive a suggested tariff code, which can help reduce the risk of errors.

Real-Time Compliance Monitoring

iCustoms continuously checks and assures compliance with regulations, standards, and particular specifications relating to product classification and customs declarations, lowering the chance of errors.

Automated AI-Based Classification

With the automated and AI-based product classification tool, companies can improve the accuracy of Commodity Code determination and minimise time spent in sorting out goods.

Overall, iClassification streamlines the business product categorisation process and ensures that accurate tariff codes are applied to imported and exported items. iCustoms helps firms accurately identify items, allowing for appropriate payment of Customs Duty and Import VAT.

Want to learn more about Product Classification & HS Codes? Read out!

How are Products Classified?

The products are classified according to the Harmonised System, a standard numerical way to sort traded goods, which aids in figuring out where the items belong. The World Customs Organization has established specific guidelines that traders must follow for all traded products.

Product Classification Rules

There are six rules defined by the World Customs Organisation:

Rule 1: There are defined chapters, sub-chapters, sections, and titles for the products for ease of reference. These titles aid in finding the category or sections of the products. Thus, it is imperative to use the exact terms in the tiles.

Rule 2: If a heading specifies an item, it must be considered even if it isn’t done but still appears to be the finished product. It refers to the product being complete but disassembled.

Rule 3: When something falls under more than one heading:

(a) Select the category with more details.

(b) If it’s still tricky, sort it according to its fundamental or most essential components.

(c) If none of the preceding options work, choose the last category from equally fitting ones.

Rule 4: If a product doesn’t fit any of the above-discussed criteria, it should be grouped with other items that are comparable to it in type or nature.

Rule 5: A few specific guidelines for particular items:

- Cases built for certain items, such as cameras, instruments, or guns that are intended to be used on a long-term basis, are specifically classified with a specific set of articles.

Rule 6: When classifying objects into subcategories, adhere to the terms and notes particular to that subcategories. Apply the same criteria as previously, but only compare subcategories at the same level.

Automated & AI-driven product classification solution

Addresses Concerns of Users:

iCustoms software is intended to recognise and address the concerns of users, including:

Error mitigation

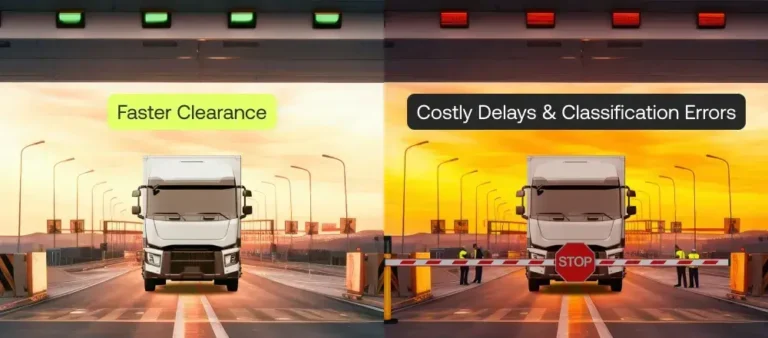

Product classification errors can lead to costly fines and delayed shipments. iClassification reduces these risks by identifying the most accurate HS codes for your products using advanced AI and machine learning algorithms.

The system minimises human error while ensuring accuracy and consistency by checking data with a global database.

Compliance updates

Maintaining compliance with constantly evolving international trade laws is a difficult undertaking. By offering real-time updates to its HS code database and tariff information,

iClassification removes this difficulty. This guarantees that your classifications are always in line with the most recent regulatory changes, assisting your company in avoiding fines and maintaining its competitive edge in global trade.

Categorise Products with the Power of AI:

In comparison to manually searching through the codes and regulations, iCustoms software provides sophisticated machine-learning tools, making the customs tariff classification of new products up to 100% faster and much simpler.

Global HS code search and analysis:

- To ensure the success of global supply chains, iCustoms maintains an up-to-date and comprehensive database of over 20+ million products, providing access to the most recent information.

- Enhance accuracy with reduced expenditure on duty

Importers and exporters can optimise overall duty spending by using the advanced global tariff code lookup, HS, and HTS code searches.

HS Codes Lookup

The HS Codes lookup tool allows you to enter the six-digit HS code number for one country and find the equivalent HS number for the other.

- Locate the necessary item quickly

- Minimal time is spent

- Organise your research and eliminate the manual classification

HS Codes Mapping

A partial commodity code, words or phrases that describe your product, or the entire tree of commodity codes, which enables you to drill down to the precise numbers, are your three search options.

- Greater transparency and quicker decision-making

- Improved management of the research process

- Access all the data in a structured way.

- Identify shortcomings

Validation

iCustoms precisely approves the HS code and descriptions and provides a status code that identifies the issue. The API’s capabilities and speed are optimised for this.

- It provides pertinent clearance information, including a legitimate description, a possible HS code, and 8 and 10-digit export and import codes.

- Make sure classified data is accurate.

- Decrease risk and increase reliability

Bulk Upload

In order to guarantee that products always have accurate classification data and can cross borders without delay, businesses can upload and process their files in real-time at a nominal expense.

- Save money and time.

- Supports importing files in multiple formats

- Automated process

- Sort more items at once.

- Easily manage large volumes

Look how iCustoms’ AI-driven iClassification tool streamlines Product Classification. Start Now!

Importance of Product Classification

Duty and Tax Determination: Classification establishes the correct duty and taxes for imported or exported items.

Trade Regulations: Depending on the nature and origin of the goods, it guarantees adherence to trade regulations.

Customs Control: Assists in the identification of prohibited goods by customs authorities for security and safety.

Trade Facilitation: Precise classification of products makes cross-border trade run more smoothly.

The Bottom Line

In summary, AI-driven tools in modern customs declaration software facilitate the simplification of product classification. This accelerates the procedure and guarantees precise classification, which is essential for setting tariffs, adhering to rules, and promoting seamless international trade.

Ready to streamline your import and export process? Embrace the days of error-free classification with our cutting-edge AI-powered software! Discover a smooth and precise product category classification that guarantees error-free handling and simple customs processing.

People Also Ask

What are custom product classification codes?

Customs classification codes are numerical identifiers that are used for categorising goods for international trade. By standardising the process of identifying and controlling goods, they facilitate the processing of customs filings.

How can I obtain an HS code for a product?

One way to obtain the Harmonised System code for a product is to verify with the customs officials or use iCustom’s online databases, which help you find the required code.

What is the difference between CN and HTS?

Both the Combined Nomenclature and the Harmonised Tariff System are used to classify commodities in international trade. The HTS system is utilised virtually almost everywhere in the world, while the CN is particularly used in the European Union.

What is the function of customs classification?

Customs classification helps to facilitate international product classification by categorising products for appropriate identification and duty application.

What happens if the incorrect classification code is applied to imported goods?

Incorrect classification codes can cause fines, delays in customs, and even the seizure of goods.

Do classification codes change with time?

Yes, classification codes can be changed over time, but you can keep yourself updated with iCustoms, as we incorporate any alteration as soon as they are announced.