Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

UK Secures Landmark Free Trade Deals with Australia and New Zealand, Boosting Economy and Innovation

-

Freya Jane

- Director of Customer's Success

On May 31, the UK’s free trade agreements with Australia and New Zealand will come into effect. These agreements, the first that the UK has negotiated from scratch since leaving the European Union, are expected to bring benefits to businesses and consumers across all three countries.

The deals will facilitate the removal of tariffs on all UK goods exports, open up unprecedented access for services, and ease the burden of digital trade.

They will also make it easier for UK professionals to live and work in Australia and New Zealand. The agreements will increase bilateral trade with Australia by 53% and with New Zealand by 59% in the long term.

They will remove UK import tariffs on the majority of goods from Australia and New Zealand, reducing prices for UK consumers on favorites such as wine and manuka honey and lowering costs on machinery parts for UK manufacturers.

They will also establish progressive rules on digital trade and free flow of data, cutting red tape for SMEs and easing trade while protecting intellectual property, brands, and innovations.

Both countries, Australia and New Zealand, are key members of the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), a huge trade bloc in the Indo-Pacific. The UK recently concluded negotiations to join the CPTPP, putting it at the heart of a trading powerhouse worth £9 trillion. Learn more about CPTPP here

The agreements are the result of the UK’s status as an independent trading nation and its ability to tailor agreements to its country’s economic strengths.

They represent a bold new future for the UK as it moves forward with the world’s most dynamic and fast-growing economies. They will create new opportunities for business & boost wages.

Free trade agreements are governed by various rules, regulations, and trade agreements, and compliance with these requirements is crucial for businesses engaged in global trade.

However, FTAs also come with specific compliance requirements that businesses must adhere to realise the benefits fully.

Let’s take a closer look at how FTAs impact trade compliance for UK businesses.

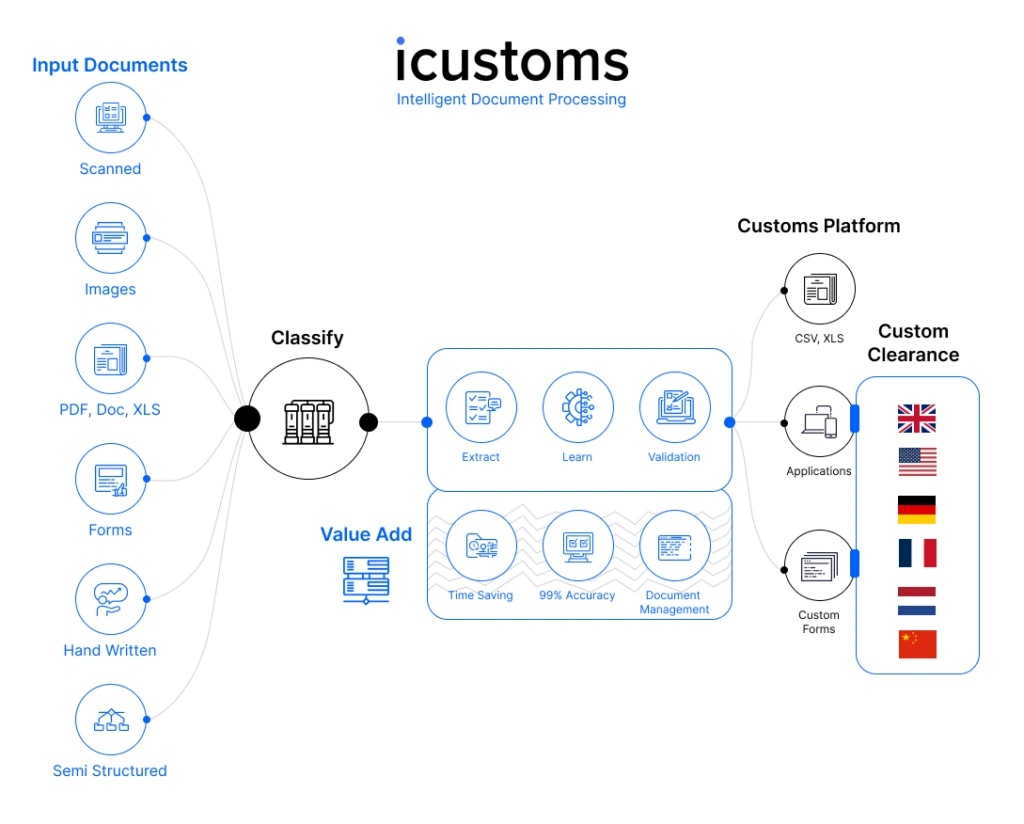

iCustoms.ai, a leading trade compliance technology provider, offers innovative solutions that can support UK businesses in complying with free trade agreements (FTAs).

- Automated rules of origin management: iCustoms’ advanced algorithms and machine learning rules engine automate the complex process of managing rules of origin. The platform can accurately collect, verify, and manage the necessary data to determine the eligibility of products for preferential treatment under FTAs, ensuring compliance with rules of origin requirements.

- Customs management: iCustoms customs management software can streamline customs processes, automating data entry, generating accurate customs documentation, and performing real-time checks to ensure compliance with customs laws and regulations. The platform also offers features such as duty optimisation, tariff classification, and valuation management to ensure compliance with FTA requirements.

- Data analytics: Its business intelligence reporting enables businesses to analyse trade data, identifying patterns and trends. The platform uses AI and machine learning to provide actionable insights, helping businesses proactively manage risks and ensure compliance with FTA requirements.

- Digital documentation: iCustoms.ai’s digital document management capabilities streamline the management of documents.

Reach out to the iCustoms team at info@icustoms.ai to learn more about how it helps with trade compliance.

So get your journey started and book a demo.