Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Customs Duty Calculator | All You Need to Know

-

Freya Jane

- Director of Customer's Success

Have you ever witnessed the effect of customs charges on trade business? Countries determine prices for imported and exported commodities, which increases GDP and benefits merchants. The Customs Duty Calculator is a helpful tool for determining the exact tax amount or percentage based on the destination country.

The recovery of global trade and the significance of precise duty calculations

The landscape of international trade is undergoing a revival. There are many studies regarding this; one such is by the World Trade Organisation (WTO).

“The volume of goods trade will rise by 2.6% in 2024 after declining in 2023, and by an even greater 3.3% in 2025.”

This positive outlook represents a renewed focus on efficient trade processes for businesses of all sizes. In this scenario, precise customs duty calculations hold immense significance. As the volume of imports and exports increases, businesses need a dependable method to estimate their landing costs and guarantee seamless international trade.

Learning about the concepts of customs duty, tax, VAT and landed cost

The trader must know about customs duty, excise duty, tax, VAT, and landed costs to understand the custom calculator thoroughly. All these words have different meanings and usage. Upcoming sections identify the separate bases of each term.

Customs duty

Customs duty, frequently abbreviated to “duty,” is a fee that a country’s government imposes on imports of goods made abroad. This tax has many purposes and is based on the imported goods’ value, volume, or weight.

Increasing the cost of imported products relative to domestic alternatives protects domestic production. In practice, this involves the imposition of tariffs and taxes and the tariffs calculation on products as they traverse borders, entering or leaving a particular country.

Customs taxes

Customs tax is the value of a general tax applied to all products. Its duties are sometimes called import taxes or import fees. These are taxes a country’s government levies on imports. These taxes are paid upon entry and depend on commodities’ value, quantity, and categorisation.

Value-added Tax

To calculate duty, one additional concept is needed, and it is a value-added tax. VAT is a tax that the end consumer pays for the products he purchases. It has no link to the importer or exporter.

It is also known as G.S.T. (General sales tax), and only VAT-registered businesses can charge this tax. A specific value is added to the goods and services at each stage.

Excise Duty

Excise duty is a tax paid on products such as alcohol, tobacco, and medication. Making those products expensive requires funding outside of the end user. It is to reduce its usage and waste to protect people’s health.

Landed cost

Landed cost is a product’s complete cost from origin to destination. The price includes shipping, handling, customs duties, taxes, VAT, currency conversion, and logistics. In essence, landing cost shows the whole cost a firm incurs to transport a product, including all financial costs.

Imports and exports benefit from landed cost calculator tax estimates. They can make educated pricing, profitability, and trade strategy choices. Including these factors helps businesses estimate import and export costs.

Example:

Here, we’ve taken a general scenario to understand the landed cost concept in more detail. The general formula of landed cost is:

Landed cost = Total amount + shipping cost +customs duty + risk + overhead

Suppose you buy 800 units of an item from a source for £25 each. The 3% customs charge is £0.75 per item (£25 x 0.03). Shipping costs £1,500, or £1.875 per item (£1500 / 800 units). Insurance costs £250 plus £5 per order, or £5.31. The payment processing cost is £2 per unit.

The total landing cost per item is £34.935: £25 (product), £1.875 (freight), £0.75 (customs tax), £5.31 (insurance), and £2 (processing charge).

Tired of confusing customs duty calculations?

Eliminate manual calculations, save time, and make informed decisions with iCustoms Duty Calculator!

What is a customs duty calculator?

Cutting Down on Import Charges

A customs duty UK calculator is an advanced tool that streamlines the intricate process of calculating import duties, taxes, and associated expenses. For companies involved in global trade, it’s revolutionary since it provides importers, exporters, and customs officers with simplified computations.

Calculating the Cost of Imports

An import duty calculator is useful when it comes to precisely estimating the costs associated with bringing items into the country. This customs tax calculator UK calculates the cost of importing items quickly by taking into account variables, including the product’s value, country of origin, and category. It also includes customs, taxes, VAT, and other fees.

Accuracy in Real Time

These calculators take into account tax rates, trade agreements, and tariffs dynamically; they are not only static number crunchers. They guarantee that a company’s taxable income is computed accurately and in accordance with the most recent regulations and tariff revisions by offering real-time updates. The UK import taxes calculator provides dependable guidance assistance in the dynamic world of global trade.

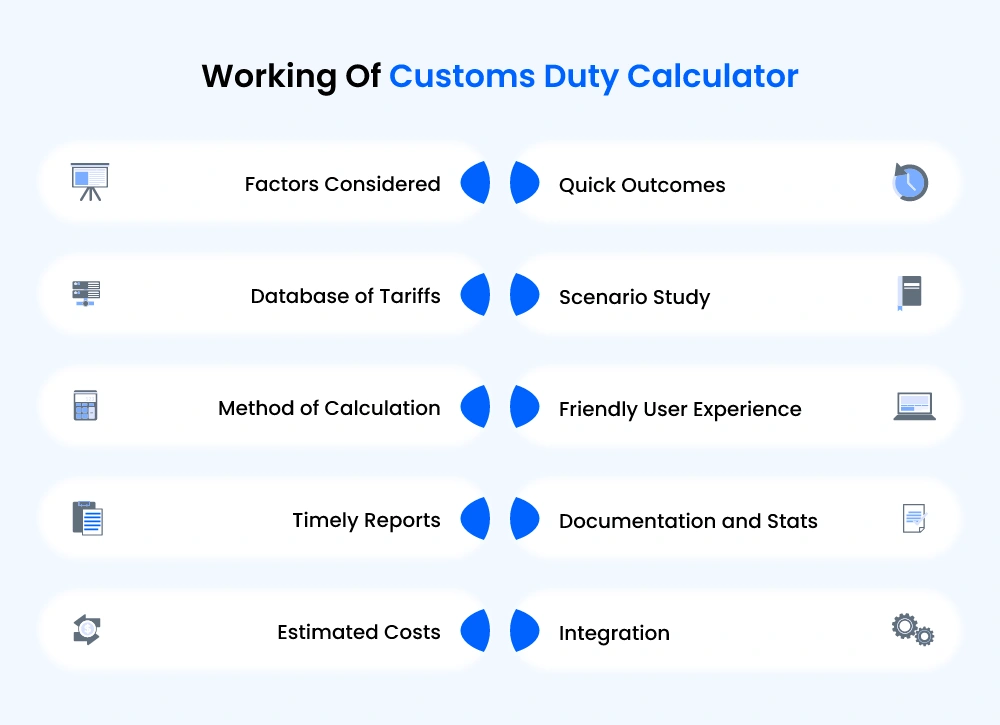

How does the customs duty calculator work?

The import fee calculator works like a regular calculator but includes customs tax percentages for a specific country. A customs duty calculator automates and simplifies the calculation of import taxes, duties, and other fees. Its functionality revolves around precision, efficiency, and real-time updates.

Factors Considered

The process of calculating starts when the user enters the information, like country of origin, product commodity code, and product classification. All this information is about imported goods.

Database of Tariffs

The destination country’s tariffs, taxes, and rules are all pulled into the calculator from a comprehensive tariff database. This information must be updated regularly to stay accurate and in line with the latest trade rules.

Method of Calculation

The customs charge calculator can figure out complicated customs duties, taxes, VAT, and other fees by using the data and rate database that is given. It considers things like the product’s features, worth, place of origin, trade deals, and any possible exclusions.

Timely Reports

The customs tax calculator is built to reflect real-time changes to regulations, tariffs, and free trade agreements. Because of this, you can be certain that the results they offer are always precise and up-to-date.

Estimated Costs

Once the maths is done, the tool makes a thorough list of all the costs that come with buying the particular product. This list could have import charges, taxes, VAT, and other possible fees.

Quick Outcomes

Users get results immediately, which gives them a clear picture of how much it will cost to import the goods. This lets them make intelligent choices about trade deals, price plans, and general control of the supply chain.

Scenario Study

Playing around with various situations on several customs duty calculators is possible. Users may play around with factors like product value and country of origin to see how such changes affect prices. Decisions of a strategic nature may benefit from this.

Friendly User Experience

The input method for customs duty calculators is often straightforward because of the intuitive design of these tools. This ease of use makes the product suitable for companies of all sizes and expertise.

Documentation and Stats

Reports summarising the calculations performed by the calculator are often generated. The information in these reports may be used for audits, record-keeping, and strategic budgeting.

Integration

Some customs tax calculators may be integrated with a company’s existing software or system, streamlining data sharing across all stages of the trading process.

Eliminate manual calculations, save time, and make informed decisions with iCustoms Duty Calculator!

Let iCustoms ensure you 99% of accuracy, avoiding financial losses.

Benefits of customs charges calculator

- For goods customs declaration services, the UK import calculator is best for customs charges.

- It saves traders time and effort, so they can focus on making smart choices instead of crunching numbers.

- The duty calculator gives traders confidence to make decisions based on estimated results rather than assumptions.

- Customs calculators provide easy-to-understand terms and are easy to operate.

- Many import duty UK calculators also provide comprehensive reports that may be used for future reference, budgeting, and even audits.

How does the customs duty calculator simplify the supply chain business?

Supply chain management is all about accuracy, precision, and time management. A faster and more efficient supply chain is within reach with the help of the Customs Duty Calculator. Because of its speed, accuracy, and ability to ensure compliance, it eliminates the need for guessing.

Using this digital tool, your supply chain company will quickly become an efficient machine ready to face modern business challenges. This system is fully automated and uses facts and figures to calculate the values of the tax amounts to be paid.

The chain management system plays a vital role as a great business opportunity for traders. As well as for the country to improve its relationship with other countries. The import duties calculator lets UK exporters manage trade compliance and make smart decisions based on the calculations.

Conclusion

The Customs Duty Calculator is a cutting-edge tool that streamlines import-export calculations. This automatic program gives real-time, precise information on import duties, taxes, and charges, outperforming manual computations in terms of speed and accuracy. It anticipates costs quickly based on tariffs, product categorisation, origin, and trade agreements, assisting traders with pricing strategies and decision-making.

Searching for a simple method to handle calculations related to import-export? iCustoms provides you with the solution with our cutting-edge Customs Duty iCalculator! Say goodbye to tedious calculations and hello to real-time, precise information on import tariffs, taxes, and charges. Improve your trading decisions and pricing tactics with ease. Experience more seamless international trade by utilising our service right now!

Get Your Free Demo Today!

Discover the power of iCustoms’ iClassification tool and simplify your trading journey.

FAQs

How is customs duty calculated?

Customs duty is determined using variables such as the product's value, origin, and category. The amount of duty is determined by specific goods' tariff rates.

Can you avoid paying customs duty?

Legally avoiding customs duty is difficult. However, in some situations or in accordance with trade agreements, exemptions or lower tariffs may be applicable.

How do you calculate VAT and customs?

VAT is calculated on the item's total value, including customs duties. Usually, the value of the product plus any relevant VAT and customs costs make up the total cost.

Do you pay both VAT and customs duty?

Yes, both are typically payable. VAT is a consumption tax that is levied on goods and services, whereas customs duty is paid when items are imported.

You may also like:

Slash Import Costs with AI!

Identify potential savings and ensure compliance with iCustoms AI

Subscribe to our Newsletter

About iCustoms

Slash Import Costs with AI!

Identify potential savings and ensure compliance with iCustoms AI