Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Landed Cost Calculator | Ease Your CDS with iCalculator

-

Freya Jane

- Director of Customer's Success

Have you ever considered the importance of a landed cost calculator when determining how much it costs to send a package to its right owner? Putting a shipping sticker on a box or having stock on hand isn’t enough. This cost is more complicated than just the cost of products and storage.

In fact, there is a complex web of possible fees and charges that come into play as your goods move from your sellers to your customers’ homes. We call the total amount of money you spend on your supply chain the “landing cost.” A landing cost calculator is one of the best tools you can use to get a full picture of this financial situation.

This blog outshines the methodology of how the landed cost calculator works and helps in the CDS (Customs Declaration Service). To illustrate its processing, we further investigate the iCalculator’s core purposes, advantages, and a working length scenario-based example.

What is the landed cost?

Landed cost refers to the overall expenses involved in shipping a product from its production site to its final destination. This comprehensive sum includes handling fees, taxes, customs duties, shipping and freight charges, and insurance premiums.

For a precise calculation of this overall cost, a landed cost calculator is quite helpful. This application quickly processes information and generates accurate cost estimates by allowing users to input data on various taxes, levies, and associated charges. For UK retailers, it’s a quick and dependable solution that provides real-time information about all of the expenses related to the transportation of their goods.

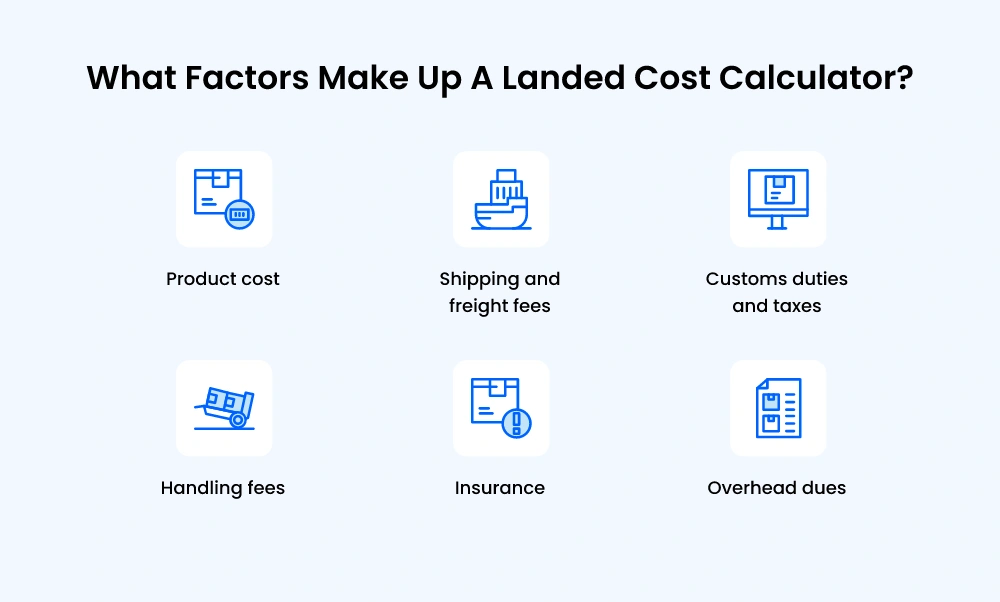

What factors make up a landed cost calculator?

The elements of the overall landed cost calculator are derived directly from the landed cost components. This calculator delivers comprehensive outcomes by factoring in the following key elements:

- Product cost: The original price of the product

- Shipping and freight fees: The transportation costs of the goods by air, land, or water.

- Customs duties and taxes: It includes all the taxes and VAT amounts associated with products.

- Handling fees: The price for warehousing or storing the products

- Insurance: The amount that is taken to protect your product or that secures the quality of the product.

- Overhead dues: Include other additional charges like bank charges or currency conversion amounts.

iCustoms Landed Cost Calculator

iCustoms is a leading customs management software fully integrated with AI technology. It provides advanced customs declaration services with many features, such as product classification, document management, an iCalculator and intelligent document automation.

Here, we are specifically talking about iCustom’s duty and VAT calculators. It is a powerful tool for UK supply chain businesses. Because it speeds up the tax evaluation process, makes it more accurate, and gives sellers and brokers more confidence in trading.

Product features of landed cost calculator

iCustoms landed cost definition is similar to the standard meaning of landed price. But iCalculator calculates all levies, duties, and charges for a trader’s consignment to avoid any sudden additional costs. It helps to improve transparency, reliability, and cost efficiency by providing accurate and precise evaluations.

iCustoms duty and VAT calculator has the following characteristics:

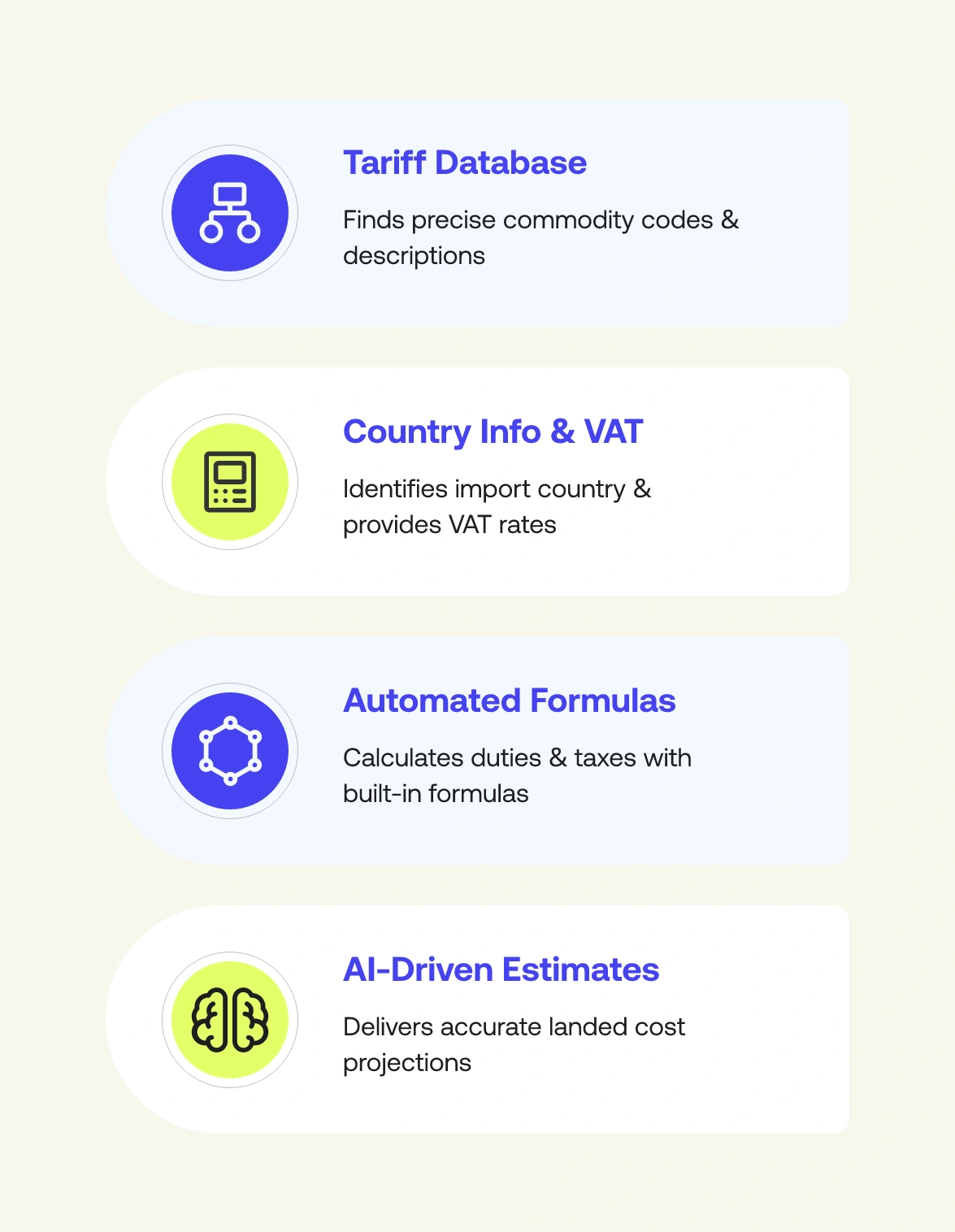

1. Finding commodities from the tariff database:

iCalculator is a complete package and covers all aspects of estimating the correct tax values. The process starts with getting the exact commodity code and description with respect to products.

iCustoms product classification tool is integrated with HMRC and provides an accurate harmonised code when the goods are described. It fetches the correct code with complete details in a matter of seconds.

2. Gathering Import/Export Country Information:

After getting the commodity code, finding the country where the goods are imported is important. However, the trader also needs the exact duty rate for the country. The iCustoms tariff database gives merchants and customs brokers country-specific VAT percentages to estimate landed costs.

3. Integrated formulas and algorithms:

In order to calculate the duties, iCustoms uses its built-in formulas from HMRC to calculate the duties and other relevant taxes. It uses predefined mathematical formulas or algorithms in systems. This formula calculates customs duty or tax for an imported or exported item.

4. Duty calculation:

Finally, the iCalculator provides the landing estimates for imported cargo with complete details. It differs from other cost calculators because its fundamental structure is subject to the HMRC Tariff API. Hence, the iCustoms’ landing cost calculator is an AI-driven calculator that improves cost transparency.

This clarity helps you budget and prevent surprises. It also reduces product returns by reducing errors and inconsistencies, ensuring consumers receive predictable shipments. This improves client happiness, loyalty, and brand value.

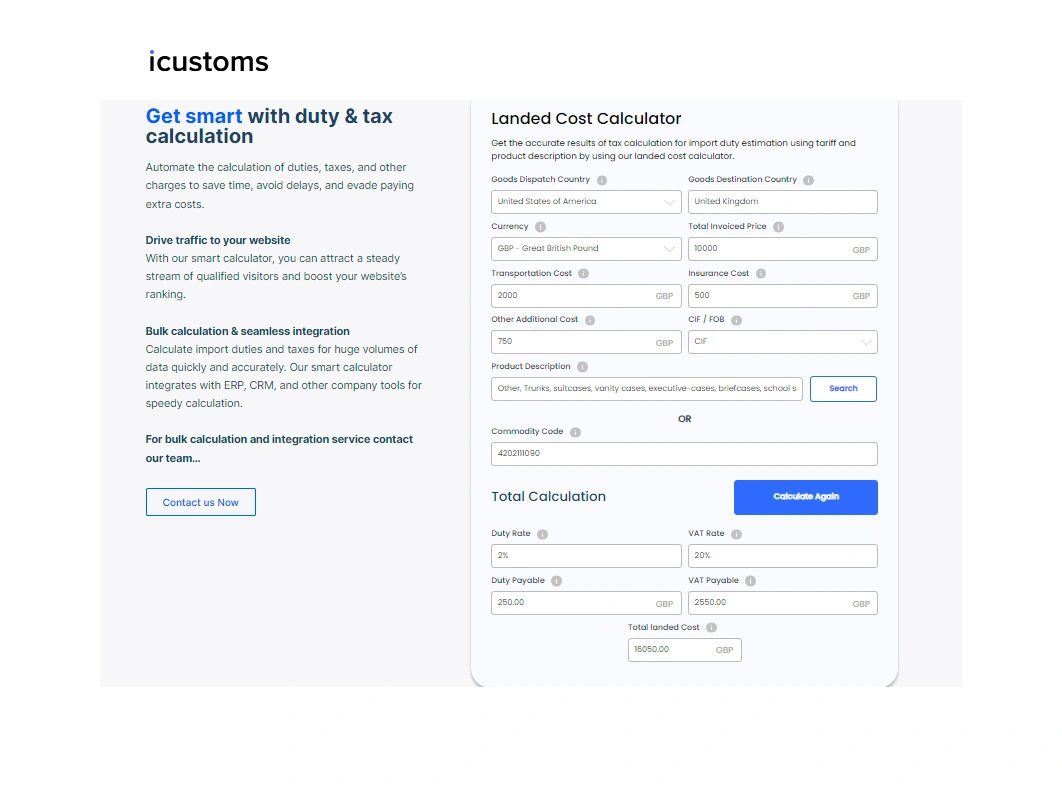

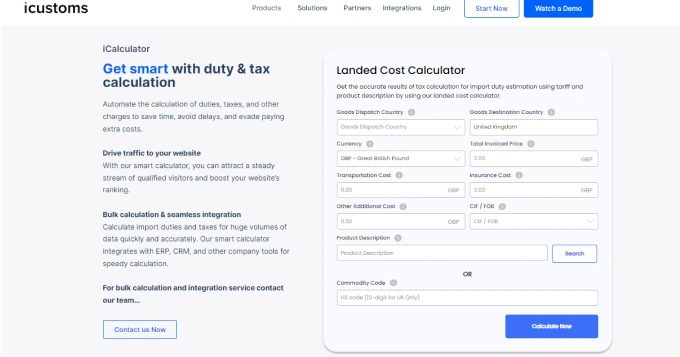

Working Interface Example of iCustoms Landed Cost Calculator

This is the user interface of the iCalculator for calculating the landing fee after filling out the following details in the relevant sections. Before demonstration, let’s understand the things that are part of this calculator;

Example:

Suppose a UK merchant wants to import vanity, trunk, and other types of bags from the USA. He wants to calculate the total landed cost of the products. Here is the list of prices he paid in USD:

Total invoice Price = £10,000

Transport cost = £2000

Insurance cost = £500

Other additional costs = £750

Currency exchange

Solution:

In order to calculate the total landed cost through iCalculator, here is the output of the results obtained in the image below:

Duty = 2%

VAT rate = 20%

Duty payable = £250

VAT payable = £2550

Total landed cost = £16,050

rate (USD to GBP) = 0.79 (1USD = £0.79)

Benefits of iCalculator

The iCustoms Landed Cost Calculator provides a number of benefits that can help you improve the efficiency of your import and export processes. This technology simplifies complex computations, resulting in a more transparent and cost-effective supply chain. Here are some of the primary advantages it offers:

- Ease of Use: iCalculator has a user-friendly interface that makes it simple to use even for complex computations.

- Convenient Design: Its design prioritises convenience by assuring accessibility and simplicity of navigation for quick usage.

- Customs Compliance: By using iCalculator, organisations may ensure compliance by aligning with customs laws.

- Instant Import Processing: The solution enables quick import processing, which reduces delays and allows for speedier transactions.

- Extensive Inventory: With over 20 million item records available, iCalculator provides a vast database that improves accuracy and information availability.

- Efficient User Experience: The tool prioritises an efficient user experience with the goal of streamlining operations and decision-making processes for more fluid workflows.

Ending statement

It is clear that UK customs trade is becoming more complicated for importers and exporters. Therefore, they must go ahead, and the iCustoms Landed Cost Calculator is a perfect solution that transforms your customs management experience. The AI-powered iCustoms Landed Cost Calculator simplifies tax assessment.

This technology improves accuracy, transparency, dependability, and cost-effectiveness by effortlessly linking with HMRC and providing real-time harmonised code data. Reduces mistakes and surprise costs, improving customer happiness with accurate results.

FAQ's

What is the landed cost?

Landed cost refers to the total expenses in getting a product to its destination."

What is the difference between standard cost and landed cost?

The difference between standard cost and landed cost lies in additional expenses like shipping, customs, etc.

What is the other name for landed cost?

Another term for landed cost is 'total landed expenses'.