Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

10 Top Benefits of Customs Management System With iCustoms

-

Freya Jane

- Director of Customer's Success

Do you become overwhelmed by the paperwork involved in international trade? Customs declarations are an essential but frequently time-consuming process that can seriously impede your international business operations. But do not worry! You might save your own life with innovative solutions like a customs management system. It is an AI tool for the advanced management of international trade. The software can manage the flow of goods across national borders and handle customs declarations.

HMRC is the customs administrative authority of the UK, which has a working mechanism of CHIEF (Customs Handling of Import and Export Freight). CHIEF is going to be replaced by CDS (Customs Declaration Software) in 2023. So businesses are required to make customs declarations via customs management platforms like iCustoms.

What is the Customs Management System?

The term “customs management system” refers to a software solution that includes: all

- Necessary components for import/export customs clearance

- Rapid document submission

- Advanced AI and cutting-edge machine learning

- Accurate data transfers

- Regulatory compliance.

It enables you to resolve and register large amounts of data quickly.

It makes the procedure for clearing customs as easy as pie! We’re in the era of technology now, where software solutions have advanced and improved our lives. One such convenience that makes trading across borders easier, the web of documentation simpler, and services accurately authentic is customs software. Its reliability & speed are its best features.

iCustoms is a customs software solution that best meets the needs of your trade! Whether you are importing or exporting, let iCustoms do the declarations!

Why iCustoms?

iCustoms is one of the handy technology companies to serve 200 million customs transactions following Brexit. The team is succeeding by cutting the customs declaration time to 3 minutes from an average of 30 minutes while improving submission accuracy to 99% from the current 37%. iCustoms has the green flag from HMRC to process the Customs Declaration in the United Kingdom.

This software is commonly employed to monitor and oversee customs declarations, handle payments and fees, and enforce regulations associated with the import and export of goods. It is often seamlessly integrated with various systems, including databases and logistics management systems, to offer a comprehensive overview of the movement of goods across international borders.

iCustoms tailored solutions for your particular industry

The complexity of customs differs by industry. iCustoms provides customised solutions for:

- Manufacturing: Use automated valuation and bill of materials management to streamline the import of raw materials, component tracking, and export of finished goods.

- Retail/e-commerce: Use bulk processing and e-commerce platform integration to expedite large-volume transactions and returns.

- Technology: Use a large product library and AI-powered categorisation to guarantee precise classification for evolving products.

- Pharmaceuticals: Oversee complicated paperwork and strict guidelines for delicate products with special features.

- Other Industries: We also provide services for the food and beverage, textile, and automotive industries.

For a customised consultation suited to the requirements of your industry, get in touch with us.

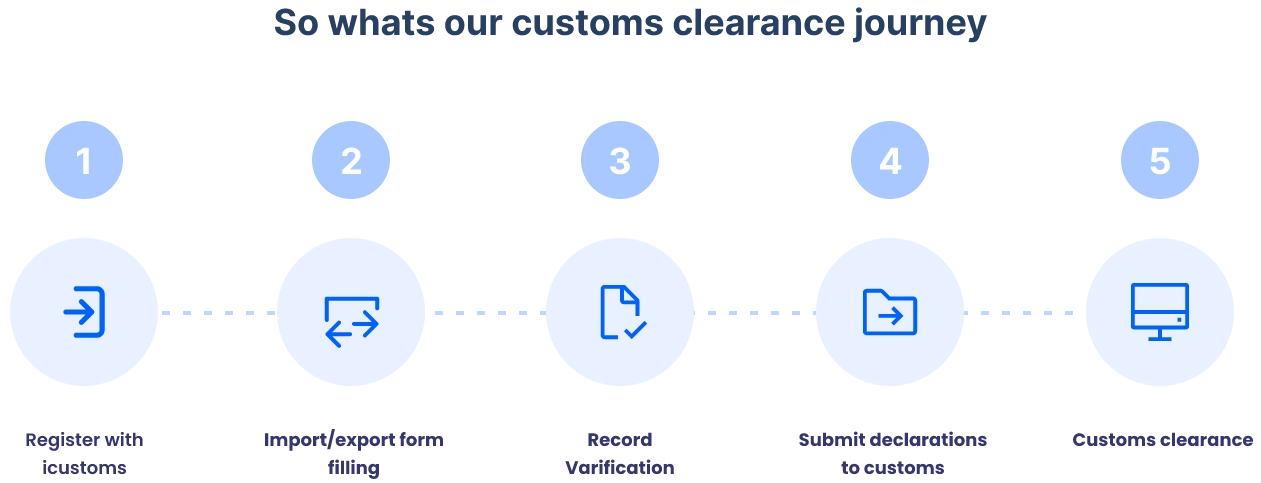

What’s our customs management system journey?

Step 1:

Register with iCustoms

Step 2:

Fill the forms, whether you are exporting or importing

Step 3:

Verification of records will take place

Step 4:

Submit declarations to customs

Step 5:

Last step is where you’ll get your goods cleared (Customs clearance)

How can our services help you?

Improve your customer’s journey

Reduce costly errors and mistakes associated with import/export filling. Instead of entering the same information repeatedly, you can enter your information in one place.

Save your time

Save time by automating the process of filling out your export and import declarations. You can instantly finish more than a dozen customs forms with the help of our fast-filling solution.

Cut additional costs

Reduce costly mistakes associated with product classification. Our solutions categorise items accurately and quickly, saving you additional costs and avoiding penalties.

Avoid delays

Full visibility into your declaration status and real-time HMRC feedback allows you to respond to requests to keep goods moving quickly.

Tired of complex customs procedures and lengthy delays? iCustoms can help!

What products do we have for you?

- All-in-one customs management solution for UK Imports.

- All-in-one customs management solution for UK Exports

- Classify your goods more accurately with the power of AI-based technology (comprehensive library of 20M+ products)

- End-to-end machine-learning solution to process trade documents, minimise manual work and boost productivity.

- Review all the practical requirements, processes, and procedures businesses should have in place to comply with HMRC requirements.

- Calculate the landed cost of your imported products.

- Screen all your orders automatically against restricted or denied parties.

- Claim duty and tax online on returned goods

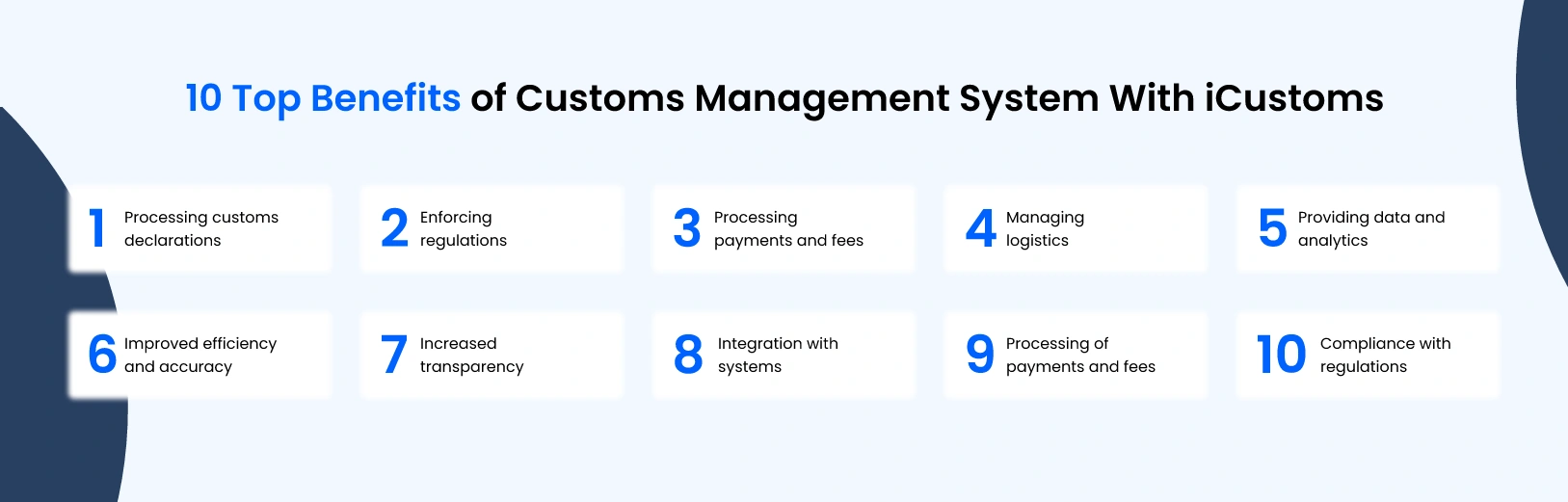

10 Benefits of Using Customs Management System with iCustoms

1. Processing customs declarations

iCustoms manages and tracks the information submitted on customs declarations, including the type and value of imported or exported goods, the country of origin, and the applicable tariff codes.

2. Enforcing regulations

Customs clearance software of iCustoms can be used to enforce regulations related to importing and exporting goods. It can also help customs agencies identify and prevent the illegal trade of goods, such as drugs or weapons.

Want to learn more about Customs Clearance Software? Read here!

3. Processing payments and fees

The Customs management system is used to process payments and fees associated with the import and export of goods, such as:

- Tariffs

- Duties

- Taxes

4. Managing logistics

iCustoms seamlessly integrates with logistics management systems, ensuring a smooth flow of goods across international borders. This involves meticulous tracking to guarantee the goods navigate through the designated customs checkpoints.

5. Providing data and analytics

iCustoms offers valuable data and analytics, enhancing customs operations, recognising trends, and aiding decision-making. This data supports research and policy development in the realm of international trade.

6. Improved efficiency and accuracy

Our customs management system enhances efficiency by automating various processes to manage the movement of goods across borders. This results in a reduction of errors and an improvement in the precision of customs declarations, payments, and other essential information.

7. Increased transparency

Our Customs management software can provide valuable data and analytics that can be used to improve the transparency of international trade. This can help support research and policy development related to trade and help stakeholders better understand the flow of goods across national borders.

8. Integration with systems

Customs declaration systems are often integrated with logistics management systems, which can help improve the efficiency and accuracy of the movement of goods across national borders. This can help reduce delays and improve the overall flow of international trade.

9. Processing of payments and fees

iCustoms can help process payments and fees associated with importing and exporting goods, such as tariffs, duties, and taxes.

10. Compliance with regulations

iCustoms can help customs brokerage challenges and help them comply with all relevant regulations and requirements for importing and exporting goods. This can include enforcing quotas, sanctions, and embargoes and identifying and preventing the illegal trade of goods.

The bottom line

By choosing iCustoms, businesses can more efficiently and effectively organise their global trade operations. Moreover, using iCustoms declaration software can help manage the complexity of the import and export processes after Brexit.

See how iCustoms can help you achieve faster customs clearance and ensure compliance with confidence.

FAQ's

What does CMS mean in customs?

The term CMS refers to the Customs Management System. It is a digital platform designed to streamline customs procedures.

What are the three pillars of customs management?

The three main components of customs management are:

- Origin

- Classification

- Valuation rules

What are the core functions of customs?

Customs' primary responsibilities include collecting tariffs, facilitating commerce, and enforcing laws to restrict the flow of commodities across international boundaries.

You may also like:

Ready to streamline your Customs Declaration Process?

Boost efficiency, reduce errors, and ensure accuracy with iCDS

Subscribe to our Newsletter

About iCustoms

Ready to streamline your Customs Declaration Process?

Boost efficiency, reduce errors, and ensure accuracy with iCDS