Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

5 Important Elements Of Customs Software Solution

-

Freya Jane

- Director of Customer's Success

Generally, businesses overspend (by 41%) on software that contains features they never use. This issue can be addressed with customs software solution, which can provide bespoke solutions to fix this waste.

A customs software solution is a specially designed computer program or system intended to automate and expedite a variety of processes associated with customs declaration. These cover everything from processing customs declarations to precisely calculating taxes and duties to efficiently overseeing the complex network of trade compliance. This advanced technology is beneficial not only for customs agencies but also for other enterprises and organizations involved in the intricate world of global trade.

What Does Customs Software Solution Provide?

Customs Software solutions offer a wide range of features and functionalities, including the ability to handle a variety of goods and commodities, assistance with a wide range of export and import documentation, tools for thorough trade analysis and management of data, and smooth connection with a range of systems and platforms.

For organisations, putting these solutions into practice has several advantages. They increase the effectiveness of operations, reduce the possibility of mistakes and delays, and guarantee strict compliance with the laws and rules administering trade, imports, and exports.

By automating several customs procedure activities, the use of a customs software solution greatly speeds up business procedures and solves customs issues. Additionally, it is essential to ensure complete compliance with strict customs laws while saving time and money.

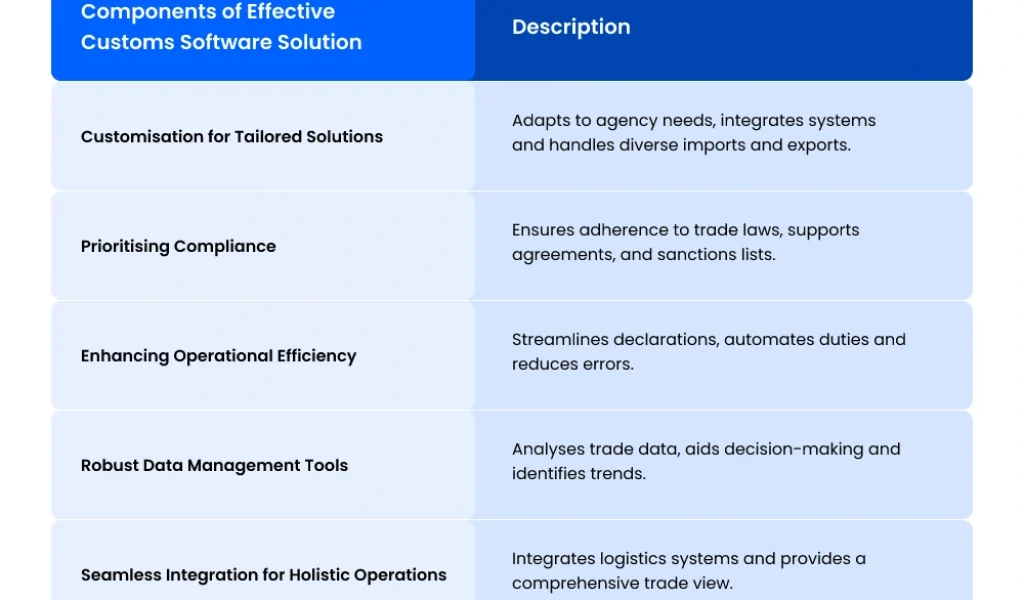

5 Important Elements Of Customs Software Solution

1. Customs Software Solution Allows for Customisation

Customs software solutions are essential for fulfilling the distinct requirements and demands of every customs agency or business, thanks to their tremendous degree of customisation. This customisation entails integrating with pre-existing systems and providing comprehensive support for an extensive range of export and import procedures and documentation. It offers a strong solution that is adaptable enough to deal with a variety of products and commodities, guaranteeing a smooth and customised experience.

2. Prioritising Compliance

Ensuring compliance with the complex regulations and legislation that regulate exports, imports, and trade activities is a fundamental aspect of any effective customs declaration service. Therefore, features that support trade agreements, sanctions lists, and other important compliance-related criteria are required. A good solution should be able to negotiate the intricacies of regulatory systems easily.

Want to learn how you can ensure customs compliance? Read more!

3. Improving the Efficiency of Operations

The foundation of a well-designed customs software solution is efficiency. These solutions greatly improve operational efficiency through the simplification and automation of numerous operations, such as customs declarations and duty/tax calculations. This automation ensures a smoother and more effective workflow by minimising the potential risks of mistakes and delays in addition to speeding up procedures.

4. Robust Data Management Tools

One of the most essential features of custom declaration software is how well it manages data. These technologies are essential for managing and evaluating trade-related data, which ranges from detailed partner insight to export and import statistics and trade flows. Organisations are able to recognise patterns and trends and make well-informed decisions about their trade activities thanks to this efficient data-driven strategy.

5. Holistic Integration

For CDS software solutions to function properly, integration capabilities are essential. It is essential to have the capacity to easily interact with various third party platforms and supply chain management systems, ranging from transportation management systems to logistics systems. This integration makes it possible to see the trading process from every angle, guaranteeing efficient and well-coordinated activities in all areas.

Who Are the Intended Customers for Customs Software Solutions?

Customs Agencies

Government customs agencies that monitor and control international trade specifically use custom declaration software. This tool lets these organisations handle export and import declarations, guarantee adherence to customs regulations, and enable seamless cross-border operations.

Discover the Potential of Seamless Trade Operations Right Now

Customs software solutions are very beneficial to enterprises, importers, exporters, and other entities participating in international trade. By streamlining the intricate documentation procedure needed for cross-border goods delivery, these solutions guarantee compliance with customs laws and cut down on delays.

Logistics and Freight Forwarding Businesses

By making the administration of customs procedures simpler, customs software solutions serve the needs of E-commerce logistics and freight forwarding businesses. These solutions support the management of shipments, the coordination of customs clearance procedures, and the optimisation of freight movements.

Cross-Border Operations Stakeholders

Customs software solutions are very helpful to different parties involved in cross-border business, including transporters, brokers, and warehouses (simplifies the warehouse management tasks). These tools guarantee easier operations and save administrative burdens by facilitating effective compliance, documentation, and communication.

Importers and Exporters

Customs software solutions are essential for companies involved in international trade. They enable efficient and economical import and export procedures by streamlining the documentation process. This automates duties associated with customs declarations and guarantees compliance with constantly changing trade legislation.

Advantages for Various Industries

A vast range of industries are served by custom software solutions, from retail to manufacturing and beyond. They support businesses involved in international trade operations by helping to manage the complex complexities of transactions, cutting costs, minimising delays, and guaranteeing flawless compliance.

Explore how iCustoms is helpful for various industries. Start Now!

Discover the Potential of Seamless Trade Operations Right Now

With the help of iCustoms’ AI-powered solution, which is designed to simplify customs declarations, you can enter a world of accuracy and convenience. Our cutting-edge software guarantees speed, accuracy, and compliance, enabling your company to prosper in the international marketplace.

So get your journey started and book a demo.

FAQ's

What are the main benefits of utilising customs software solutions?

Custom software solutions come with numerous advantages, such as expedited customs clearing procedures, precise duty computations, increased operational effectiveness, improved regulatory compliance, and better data management.

How does customs software protect and comply with data?

The custom software solution has strong security features like encryption techniques, safe data storage, user identification, and adherence to data protection laws, which ensures data compliance and protection.

Are custom software solutions compatible with current business systems?

Yes, many custom software solutions are made to work easily with other company systems already in place. This integration improves overall operating efficiency and allows for seamless data flow.

Can custom software solutions be tailored to meet certain company requirements?

Certainly, customs software solutions can be adjusted to meet the particular needs of different types of enterprises. These systems can be customised to manage particular customs procedures, adjust to changing legal frameworks, and meet the various requirements of various trade industries and situations.