Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Using CDS Software: 5 Easy Steps for Customs Declarations

-

Freya Jane

- Director of Customer's Success

Navigating the complexities of customs declarations can be difficult, but it doesn’t have to be with the correct tools. Customs Declaration Software is one such application that has made this process easier. In this blog post, we’ll walk you through five easy steps to help you use CDS software for flawless customs declarations. These procedures will help simplify the process and give you the confidence to handle customs declarations, regardless of experience level, easily.

According to a report by FSB, “9% of participants reported that they previously engaged in the activity of importing or exporting but have ceased doing so in the last five years.”

The main cause of stopping is:

- The amount of paperwork (56%)

- Supply chain or logistical problems (29%)

- Total costs (49%)

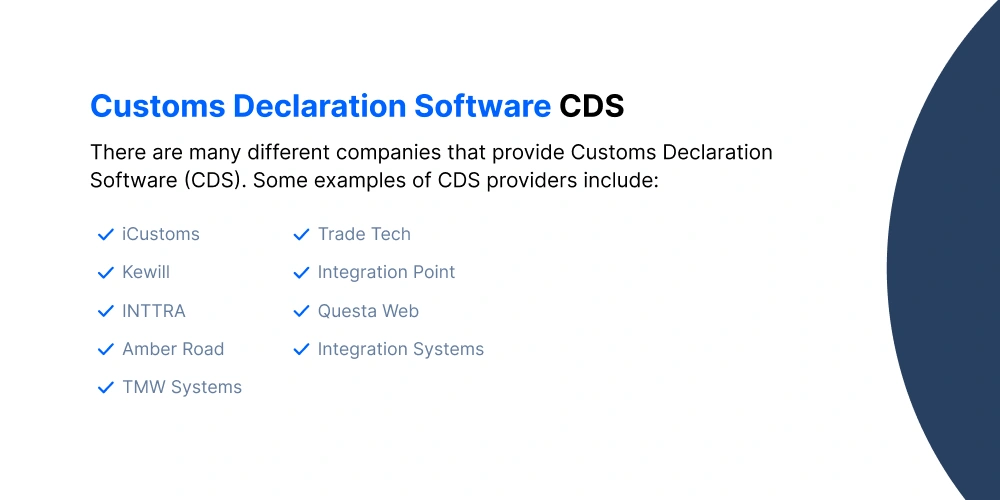

Choosing the Right CDS Software Provider

For a smooth customs clearance process UK, choosing the correct Customs Declarations Software (CDS) vendor is essential. Here’s a guide to assist you in making a wise decision:

1. Determine What Your Company Needs

Determine the Needs: As you assess your unique demands for a customs declaration, take into account variables such as the number of operations, the complexity of the items, and the necessity for compliance.

Scalability: Make sure that the software will grow with your company and meet your changing requirements.

2. Look at Possible Providers

Market Standing: Seek out customs clearance brokers to take you to service providers who have a solid track record and good industry reviews.

Features and Functionality: Evaluate each provider’s features, including customer support, automation capabilities, integration with current systems, and user interface.

3. Security and Compliance

Adherence to Regulations: Make sure the system complies with the laws governing customs in your business areas.

Data Security: To safeguard sensitive data, make sure strong security measures are in place.

4. Usability and Integration

Adaptability: Select a custom clearance software supplier that minimises interruptions by seamlessly integrating with your current systems.

User-Friendly Interface: Select software that is easy to use and streamlines the declaration process.

5. Assistance and Training

Customer Service: Consider the availability, responsiveness, and level of experience of the provider’s customer service representatives.

Training: Find out if the supplier provides materials or training sessions to assist users in making the most of their software usage.

6. Expense Factors

Cost Structure: Recognise the pricing structure, whether it is transactional, subscription, or customised. Make sure it fits both your projected consumption and budget.

7. Demo or Trial Period

Ask for a Demo: Take advantage of a demo or trial to evaluate the software’s usability, functionality, and suitability for your business’s requirements.

8. Feedback and References

Look for References: To learn more about present users’ experiences and satisfaction levels with the supplier, ask for references.

9. Roadmap and Updates for Future Support

Updates and Roadmaps: Ask the supplier about their future update plans to make sure the software is updated to reflect any changes to the law.

10. Making a Decision

Evaluate and Select: Compare suppliers using the specified criteria after doing an in-depth assessment, then select the one providing such customs declaration services that most closely match your needs and company objectives.

Try iCustoms, a premium software provider for all your declaration needs. Start Now!

Prepping Your CDS Software: Essential Steps

To get your CDS software ready to go, do the following:

Find Out the Ideal CDS Solution: Start by evaluating several CDS systems to determine which best suits your company’s needs. Making a well-informed decision requires careful consideration of all of the possibilities and comparison research.

Installation Procedure: Set up the CDS software on your device. Usually, this entails downloading the program and following the manufacturer’s or developer’s installation guidelines.

Configuration & Setup: Fill out the CDS system with the details unique to your company to start the setup process. This contains vital information that is required for proper declarations, such as your tax identification number, contact details, and other relevant data.

System Testing and Validation: Carry out comprehensive tests to confirm that your CDS is functioning as intended. To verify smooth operation, enter test data and submit a trial customs declaration. It is crucial to confirm that every element is functioning as planned prior to initiating the declaration procedures.

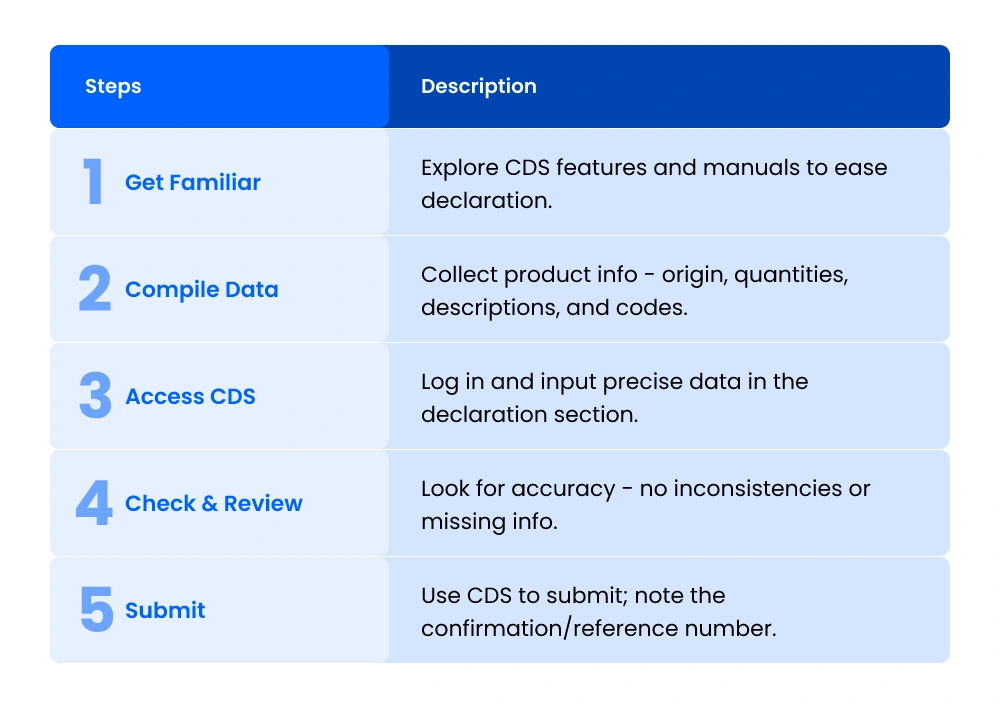

5 Steps for Custom Declaration Using CDS Software

Customs Declarations Software has completely transformed the process of declaring items for import or export. It simplifies the intricate and complex custom process, increasing its effectiveness for both individuals and enterprises.

To use CDS software to navigate the custom clearance process UK, follow these five crucial steps:

Step 1: Get familiar with CDS Software

Spend some time exploring the CDS software before beginning the declaration process. Examine its features, user manuals, and interface, which are supplied by customs authorities. The declaration process will go more smoothly if you are familiar with the layout and features of the software.

Step 2: Compile the Necessary Data

Gather all the information you’ll need regarding the products you plan to declare. This contains information such as the country of origin, item quantities, descriptions, values, and any appropriate codes (such as HS codes, which you can get from the iClassification feature of our CDS software). For customs clearance to go smoothly and without delays, accuracy is essential.

Want to learn more about HS codes for different industries? Read here!

Step 3: Access the CDS application

Utilising your login information, log into the CDS platform. Go to the section where customs declarations are kept. Enter the collected data precisely in the appropriate fields. Depending on the type of commodities and regions involved in the trade, the software may ask you for specific information.

Step 4: Check and Examine

Examine all entered information carefully before submitting the declaration. Look for any inconsistencies, inaccurate information, or missing data. When it comes to customs declarations, accuracy is critical because incorrect information can lead to legal problems, fines, and delays.

Step 5: Submit the Declaration

After you have confirmed the details, use the CDS software to submit the declaration. A confirmation or reference number will be generated by the application upon submission, showing that customs authorities have received your declaration. Remember this number so you can trace it easily.

The Bottom Line

Remember that using CDS customs software may require you to register with your company’s customs authority and obtain any licences or permits. Check with your local customs office to ensure that all applicable laws and regulations are being followed. Frequent updates ensure accuracy, supporting the timely submission of customs declarations.

Take off on this expedited journey now! To witness the strength and effectiveness of our CDS software in action, schedule a demo. It’s time to streamline your company’s customs declaration procedures and advance more seamless international trade operations.

FAQ's

What is CDS Software?

Customs Declaration Software is a digital tool developed to make customs declarations for both exports and imports more efficient and straightforward. This technology enables customers to submit the information and paperwork that customs authorities need electronically.

What is a CDS System?

The framework or platform on which CDS software runs to make customs declaration processing, submission, and clearance easier is known as the CDS system.

Do I Need Software to Access CDS?

Generally, in order to access CDS, one needs to connect to the system with specialised software.

How Do I Get Access to CDS?

You can obtain access to the Customs Declaration System (CDS) by completing the registration process with the customs authorities of your country and acquiring the necessary software for electronic submission.