AI-Driven Trade Compliance in 2025: The Transformation You Can't Ignore

Adnan Zaheer

Adnan Zaheer, CEO of iCustoms, pioneers AI-driven trade compliance solutions. Follow him for insights on automation and global trade innovation.

In today’s fast-paced, interconnected world of global trade, one thing is clear: Artificial Intelligence (AI) is no longer a futuristic idea or just a tool for a select few.

It’s a powerful force transforming trade compliance, helping businesses work more efficiently, accurately, and make smarter decisions. As trade regulations become more complex and cross-border transactions grow, AI is giving businesses the tools they need to meet compliance standards and succeed in a competitive market.

The Current Landscape: Challenges and Complexities in Trade Compliance

Trade compliance has always been a high-stakes, complex field. Each cross-border transaction involves multiple actors, ranging from customs brokers to government authorities, and a significant exchange of documents.

The World Trade Organization’s (WTO) Standards Toolkit reports that an average of 36 documents are exchanged and 240 copies shared per transaction, making the cost of errors—both financial and operational—potentially staggering.

The trade compliance industry has long faced a perfect storm of challenges:

- Data Overload: Managing vast amounts of information from invoices to shipping manifests is time-consuming and error-prone.

- Penalty Risks: Misclassified HS codes or documentation errors can lead to shipment delays, fines, or penalties that impact profitability.

- Complex Regulations: Rules differ across borders, creating a complex web of compliance requirements.

- Manual Processes: Paperwork, data entry, and reconciliation tasks are tedious, costly, and prone to human error.

- Low Innovation: Historically, trade compliance hasn’t seen much technological advancement due to data scarcity, high costs, and technical barriers.

The sheer volume of paperwork, combined with the intricacies of international regulations, makes trade compliance a daunting task. Businesses face huge penalties for non-compliance, delays in shipments, and disruptions that can affect global supply chains.

The cost of these challenges is not only financial. Trade compliance often requires significant time and human resources to manage, with errors leading to costly operational setbacks. Misclassified goods, for instance, can lead to fines, delays, or even the seizure of merchandise. Manual processes are prone to human error, and managing the wealth of information needed for each transaction is a herculean task.

However, the winds of change are blowing, and AI is at the helm of this transformation. Let’s explore how artificial intelligence is reshaping trade compliance, solving long-standing challenges, and paving the way for a smarter, more efficient future.

AI’s Key Contributions to Trade Compliance

No More Paper Cuts with AI

Paperwork has long been one of the most time-consuming and error-prone aspects of cross-border trade. But with AI stepping in, the game has significantly changed.

By automating document processing, AI can swiftly classify, extract, and verify trade documents such as invoices, certificates of origin, and packing lists. This not only reduces the workload on compliance teams but also ensures that documents are filed accurately, helping businesses stay compliant with regulations.

The result? Trade operations that are faster, more efficient, and less dependent on manual checks.

According to the International Chamber of Commerce (ICC), digitalising trade documents could slash processing times by up to 75%. For businesses that thrive on speed and accuracy, this isn’t just an upgrade—it’s a game-changer.

By streamlining operations and reducing paperwork bottlenecks, AI is helping companies stay competitive in an increasingly fast-paced global market.

A £25 Billion Opportunity for Economic Growth

The transformative power of AI in trade compliance isn’t just an idea—it’s backed by compelling data. According to the International Chamber of Commerce (ICC), digitalising trade documents has the potential to unlock £25 billion in new economic growth. This incredible boost would help businesses save time, cut costs, and increase their bottom lines, all while meeting the demands of a fast-paced, interconnected global economy.

The numbers tell a compelling story:

- £25 billion in new economic growth through digitalised trade documents.

- Efficiency savings of £224 billion globally, thanks to reduced paperwork and faster processing times.

The digital transformation of trade compliance isn’t just about efficiency—it’s about opportunity, inclusivity, and unlocking potential for businesses worldwide.

End of HS Code & Tariff Woes

Accurate product classification is crucial for customs compliance. Misclassifying goods can result in hefty fines, shipment delays, or even seizure of goods. AI’s impact here is significant.

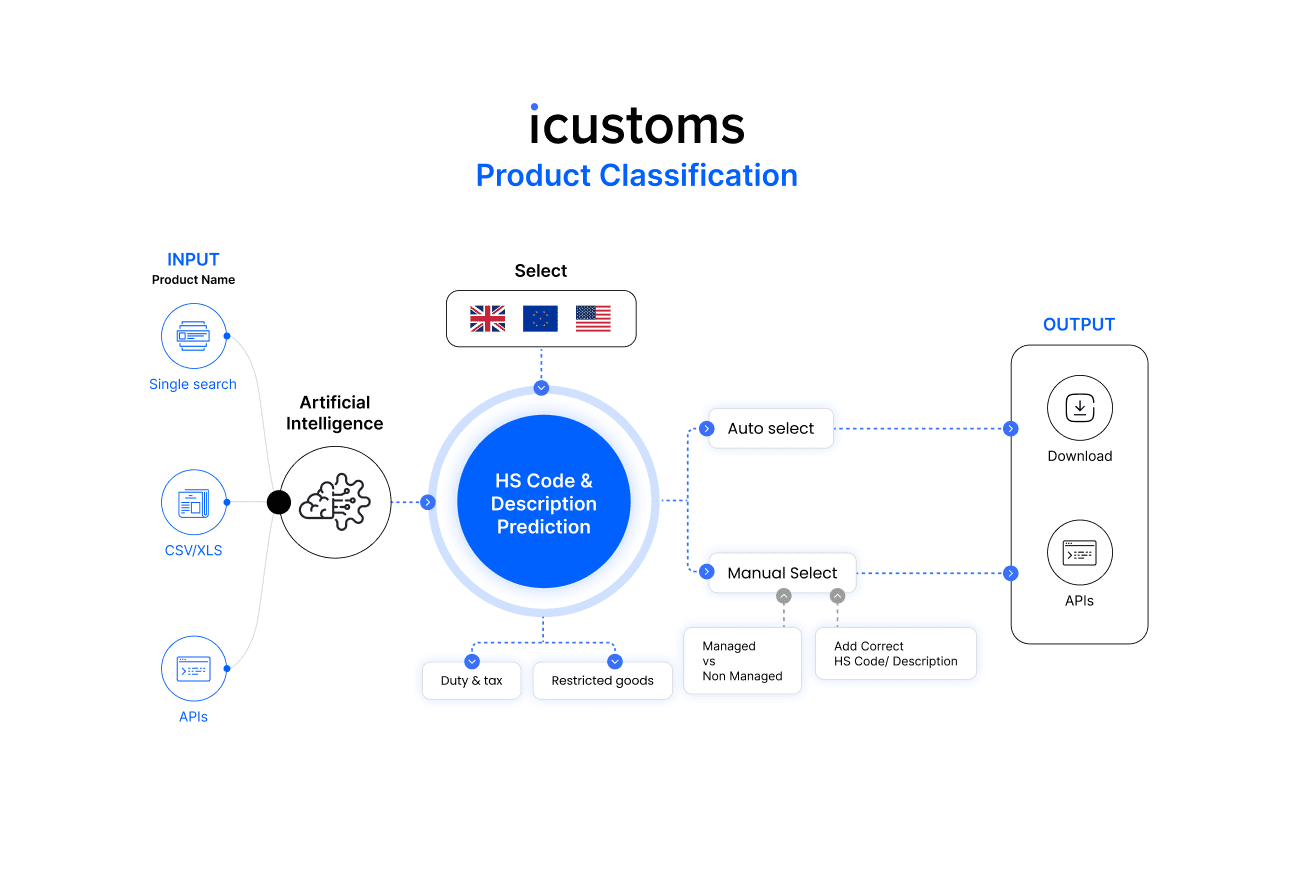

Michael, a UK-based exporter of artisan products, struggled with correctly assigning Harmonised System (HS) codes, resulting in shipment delays and costly fines. AI eliminated the guesswork in tasks like HS code classification, ensuring that goods are accurately categorised and fully compliant with regulatory requirements.

By using iClassification, Michael automatically assigns the correct HS codes and tariff classifications, ensuring smooth customs clearance. His operations became more efficient, and he was able to grow his business internationally without the stress..

For small businesses like him, AI isn’t just a tool—it’s a game-changer, enabling them to stay ahead in the fast-moving and ever-evolving world of global trade.

Customer Service: Instant Support, Anytime, Anywhere

Staying on top of the ever-evolving regulatory landscape requires constant vigilance, as keeping up with shifting regulations is crucial for success. Thankfully, AI-driven chatbots and virtual assistants are stepping in to provide businesses with 24/7 support, simplifying this complex task.

AI-powered chatbots and virtual assistants offer round-the-clock assistance, quickly answering questions and guiding users through intricate compliance processes.

Take, for example, a logistics company in Germany that exports machinery to Asia. With AI chatbots on hand, their customer service team can instantly respond to regulatory inquiries, track shipments in real time, and provide up-to-date compliance details. Whether it’s explaining new import/export laws, verifying documentation, or calculating tariffs, these tools offer personalised, fast support.

Beyond improving operational efficiency, AI virtual assistants also enhance the customer experience. They deliver accurate, real-time information on everything from troubleshooting customs issues to keeping track of shipments or staying informed about regulatory changes. Businesses can rely on these tools for seamless operations, quicker decision-making, and enhanced customer satisfaction—no matter the time of day.

Empowering SME’s to Thrive

Since Brexit, overcomplicated regulations and a maze of paperwork have left many SMEs struggling to keep up. Customs processes, once already a complex challenge, have only grown more difficult, causing delays and costly mistakes.

AI technology can overcome these challenges. Moreover, AI is also tackling one of the biggest hurdles in global trade: the trade finance gap.

Small and medium-sized businesses often struggle to access the capital needed to engage in international trade. According to the International Chamber of Commerce (ICC), Digitalising trade documents could bridge this gap, potentially generating £1 billion to support smaller businesses, enabling them to grow and thrive in global markets.

This shift is creating a more inclusive trading environment. By simplifying processes and reducing barriers, AI is leveling the playing field, making it easier for businesses of all sizes to participate in international trade.

Automated Speed, Accuracy, and Compliance

Trade documentation used to be a massive headache for many businesses, especially customs brokers who were buried in paperwork and constantly chasing up with ever-evolving regulations.

But recently, AI-powered Intelligent Document Processing (IDP) solutions started to turn this frustration into efficiency. These advanced tools can scan and extract key information from trade documents—like invoices, bills of lading, and customs declarations—at remarkable speed and accuracy, eliminating the need for manual data entry and significantly reducing processing times.

Furthermore, AI can transform data into actionable insights, enabling businesses to achieve greater accuracy, stronger compliance, and a significant competitive edge in the global trade landscape.

Take Olivia, a logistics manager in the UK who handles shipments for small businesses. Before adopting iCustom’s AI-driven iDP, Olivia spent countless hours manually processing documents, trying to meet tight deadlines. With the introduction of her AI tool, those hours vanished. Not only did she streamline her processes, but she also had more time to focus on building stronger client relationships and supporting business growth. For Olivia, it wasn’t just about speed; it was about staying ahead of the competition and staying compliant, all while delivering better service.

Thanks to AI, trade documentation is no longer a bottleneck—it’s a source of competitive advantage.

The Ultimate Risk Detector

AI has transformed risk assessment in trade compliance by flagging discrepancies, such as missing data or incorrect tariff codes, in real-time.

Machine learning helps customs authorities focus on high-risk shipments, while AI identifies patterns of compliance issues like fraud or sanctions violations, predicting risks at border crossings for proactive measures.

By analysing vast datasets, AI can also detect patterns that indicate potential compliance issues, such as sanctions violations or fraudulent activity. It can even predict risks at border crossings, allowing businesses to take preventive measures.

Max, a senior officer at a busy UK shipping hub, once had to sift through mountains of paperwork to catch discrepancies. With AI, his team prioritised high-risk cargo more effectively, identifying 25% more non-compliant goods. AI complemented Max’s expertise, allowing him to focus on cases requiring his deep knowledge and judgment.

Bridging Borders for Seamless Global Trade

In the fast-paced world of global trade, smooth communication between customs authorities is critical to ensuring goods flow efficiently.

AI-enabled platforms like iCustoms have transformed this process, allowing customs agencies to share data in real-time and significantly reducing border delays. This was particularly vital for perishable goods, such as fresh produce or pharmaceuticals, ensuring they reached their destinations on time without risk of spoilage.

Customs Management Platform enables easy submission of declarations and helps meet customs requirements in one place, the process becomes even smoother. By enhancing coordination and optimising trade routes, AI didn’t just speed up operations—it connected global markets, making international trade more seamless, efficient, and responsive than ever before.

Stay One Step Ahead

The global trade landscape is full of uncertainties. Weather events, geopolitical tensions, and supply chain disruptions can disrupt even the most carefully crafted plans. However, with the power of AI, businesses can foresee potential obstacles and adjust their strategies ahead of time.

By analysing historical data, AI systems can predict when and where disruptions are likely to occur, empowering companies to minimise risks, reroute shipments, and keep operations running smoothly. From optimising routes to reducing fuel consumption, businesses are leveraging AI to boost efficiency while staying agile in an unpredictable global landscape.

By empowering businesses to make data-driven decisions, AI is turning challenges into opportunities, helping companies stay resilient and competitive in the fast-paced world of international trade.

Master Compliance and Audits

One of AI’s most powerful advantages is its ability to enhance accuracy through real-time data analysis. By processing vast volumes of information, AI can pinpoint discrepancies, errors, and potential compliance risks that might otherwise go unnoticed.

With AI solutions like iClassification, businesses can effortlessly stay compliant as the system adapts to evolving regulations. Additionally, AI plays a pivotal role in retrospective audits by uncovering overlooked errors or missed opportunities. This process has the potential to inject millions of pounds back into the economy, particularly in the UK. Not only does this fuel economic growth, but it also enhances confidence in global trade operations, ensuring smoother, more efficient business practices.

Step Into the Future As AI is Here to Stay

Looking ahead, the future of trade compliance will be shaped by intelligent systems that make global trade simpler, safer, and more efficient. With breakthroughs in document automation, predictive risk analysis, and real-time support, AI is transforming an industry once mired in complexity into one driven by innovation and agility.

AI is ushering in a transformative era, enabling businesses to expand into new markets, reduce costs, and maintain compliance with constantly changing regulations.

iCustoms is at the forefront of innovation with its multi-award-winning AI platform, empowering businesses to confidently navigate complexities, streamline operations, and ensure compliance in today’s ever-evolving global landscape.

Though challenges remain—such as ensuring responsible AI use, tackling cybersecurity risks, and promoting sustainability—the potential of AI to streamline operations and foster growth is undeniable. The trade compliance industry is on the brink of a golden era, where businesses thrive and trade flows more smoothly than ever.

As AI continues to evolve, its ability to reshape trade compliance grows exponentially. The future lies in the seamless integration of AI technologies, creating a smarter, faster, and more efficient global trade ecosystem. Businesses that embrace AI-driven solutions will gain a competitive edge, improving operational efficiency and staying ahead in an ever-evolving global marketplace.

The future of trade compliance is AI-driven—and it’s more promising than ever.

Discover the future of trade compliance with iCustoms’ innovative AI

You may also like:

Tired of compliance issues, delays, and fines? Streamline your operations with iCustoms.

Reduce costs, minimise risks, and improve efficiency

Subscribe to our Newsletter

About iCustoms

Tired of compliance issues, delays, and fines? Streamline your operations with iCustoms.

Reduce costs, minimise risks, and improve efficiency