The Power of Artificial Intelligence: Impact on Customs Operations

-

Freya Jane

- Director of Customer's Success

We live on the verge of the 21st century, an era of adventure, exposure, technology, innovation, and advancement. Artificial intelligence has covered the world, regardless of the field; it tries to bring comfort to people. All fields use AI to enhance their research and compete in a growing world.

A study shows,

“With a compound annual growth rate (CAGR) of 28.46%, the worldwide artificial intelligence (AI) market is expected to reach an astounding $1.81 trillion by 2030.”

This remarkable rise is indicative of AI’s ability to completely revolutionise a wide range of industries, including customs processes.

Integrating AI into customs processes can significantly shorten shipment clearance times. This results in decreased expenses, quicker product transportation, and an improved environment for international trade.

Customs operations enable international trade and provide security and compliance in a globalised society. AI has transformed customs processes, improving efficiency, accuracy, and security. This post will examine AI’s impact on customs operations and its prospective uses in this vital sector.

Increasing accuracy and efficiency

Systems powered by AI technology have significantly increased operational efficiency. AI-enabled procedures show up to a 40% reduction in the time required to clear shipments, according to statistical data that indicates a considerable reduction in processing times. Furthermore, It is anticipated that supply chain management, transportation, and warehousing expenses will drop by 25 to 40% and 5 to 10%, respectively.

What is included in customs operations in international shipments?

You should keep in mind the following aspects when it comes to dealing with customs operations:

- Classification of goods

- Origin of goods (preferential and non-preferential)

- Value of goods

- Customs planning (import/export certificates)

- Incoterms

- Customs monitoring and control

- Verification of documents

Artificial Intelligence in Customs

Similar to all businesses, customs trade has also made its branches stronger and wider by using the best artificial intelligence softwares. The customs trade has spread by leaps and bounds across the world. Customs trade uses the smart setup that different businesses are developing to support the traders and help them effectively trade.

Automated intelligence specifies methods to expand and broaden its ways of providing facilities to traders. It drives expertise in every customs declaration process so that trade becomes easy and convenient.

Experience how artificial intelligence is shaping the future of customs. Try Now!

Artificial Intelligence Customs Software

The artificial intelligence trading software regulates the goods’ flow and processing by following these basic steps to establish a good declaration experience for the trader.

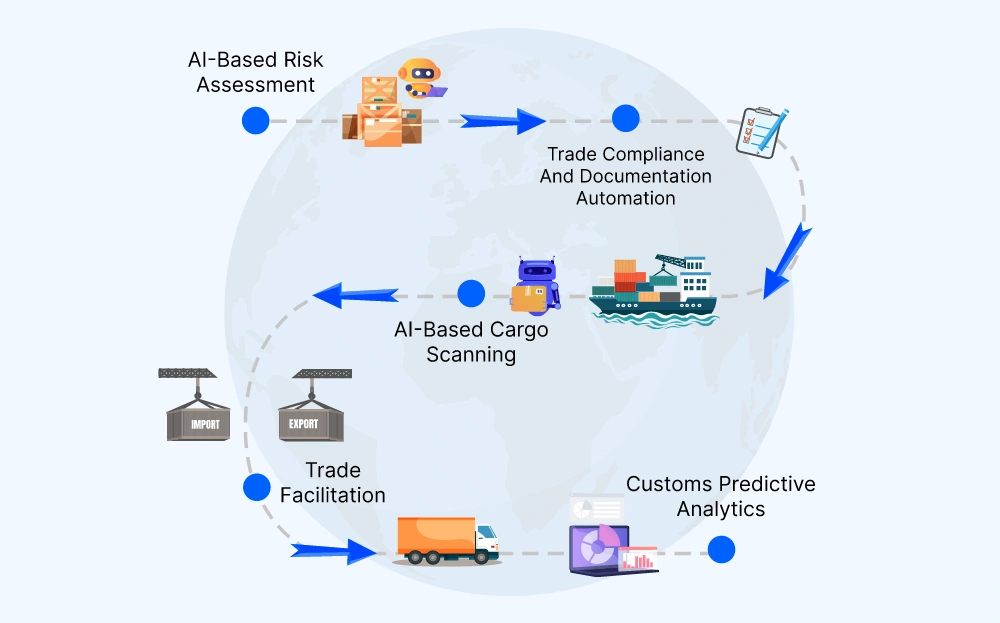

AI-based risk assessment

AI business improves customs risk evaluations. Using machine learning algorithms, customs officials may analyse trade data, identify risk indicators, and spot irregularities. They can prioritise inspections on high-risk cargoes, enhancing operating efficiency and lowering delays for low-risk consignments. AI-powered risk assessment and profiling boost trade facilitation and security.

Trade compliance and documentation automation

AI-based cargo scanning

AI-powered cargo inspection and scanning improve customs security. AI-trained computer vision algorithms can accurately identify contraband and dangers in X-ray and scanning images. AI technology automates cargo screening, increasing security and efficiency.

Trade facilitation

AI-enabled trade facilitation technologies streamline customs. Virtual assistants, chatbots, and AI-driven customer care systems can help traders with questions, customs procedures, and communication with authorities in real-time. Intelligent solutions and customs brokerage services improve the customer experience, eliminate manual involvement, and streamline trade procedures to improve international trade.

Customs predictive analytics

AI-driven predictive analytics help customs officials plan and allocate resources. AI algorithms analyse past trade data, market trends, and external factors to estimate trade volumes, detect bottleneck locations, and optimise operational resources. Data-driven customs clearance operations are more efficient, faster, and better.

Accelerate your trade and simplify customs with AI-powered solutions.

Uses of Artificial Intelligence for Customs Trader

Artificial intelligence in business provides multiple advantages to its entrepreneurs, which support the business and play a vital role in expanding it. For instance, every businessman avails of the opportunities the growing AI platforms provide. Limiting ourselves to customs provides many advantages to customs traders, such as:

Trade facilitation

AI can automate customs declarations and compliance inspections. AI can extract essential information from trade documents, check data accuracy, and streamline customs processing using Natural Language Processing (NLP).

Tariffs and value

AI algorithms aid tariff classification and valuation. AI can assess product descriptions, photos, and specs to establish the Harmonised System (HS) code and value, ensuring customs compliance and precise duty computations.

Risk and compliance

AI can estimate risk by analysing trade records, financial data, and customs declarations. AI can help customs officials detect high-risk cargo and dealers and enforce trade restrictions by finding patterns and anomalies.

Fraud detection

AI systems can spot smuggling, misdeclaration, and invoice fraud. AI can detect abnormalities in trade data, financial transactions, and historical patterns and alert customs authorities to probable fraud, improving enforcement and preventing illicit trade.

Supply chain monitoring

Automated AI can track things across the supply chain. AI can assure supply chain integrity and visibility by integrating data from IoT devices, GPS tracking, and customs declaration documents, including CN22 and CN23.

Trade analysis

Artificial intelligence can draw insights and patterns from customs databases, market reports, and trade statistics. Customs traders can use this information to make decisions, find market opportunities, and optimise their trading tactics.

See the AI magic. Watch a 2-minute demo of iCustoms automating complex HS code classification.

Is iCustoms Software an AI-solution?

| Artificial Intelligence HS code lookup | To provide accurate HS code with respect to object |

|---|---|

| Customs Declaration | Uses AI-based technology such as IDP for customs document OCR and submission |

| Tax calculator | Calculates the area specimen taxes to be paid via products |

| Rule Engine | iCustoms Rule engine uses AI solutions in maintain ease for its customers |

| iClassification | A major component to use artificial intelligence in classifying goods |

iCustoms is upgrading itself in the growing artificial world to provide better services to its customers. It uses technology like IDP to extract information from the documents and submit the declaration to HMRC for compliance.

How do iCustoms’ AI solutions ensure customs compliance?

Since rules governing international trade are always changing, compliance is a major concern. AI tackles this problem by:

- Real-time updates: To maintain operations compliance, AI systems automatically update databases in response to global regulatory changes.

- Automated audits: AI identifies possible compliance risks by analysing historical data, allowing for proactive mitigation.

- Error reduction: AI reduces inconsistencies and guarantees accurate declarations by comparing trade documents with customs regulations.

For example, AI systems lower the risk of fines and penalties by assisting traders in adhering to frameworks such as:

- US Export Administration Regulations (EAR)

- EU’s Union Customs Code (UCC).

Conclusion

Customs operations and artificial intelligence work together to ensure that trade management is carried out effectively. Customs agencies can improve risk assessment, automate compliance checks, improve cargo inspection, streamline trade operations, and optimise resource allocation using artificial intelligence technologies.

It’s possible that incorporating AI into customs procedures will lead to increased efficiency, accuracy, and security. This, in turn, will lead to more streamlined trade flows and an overall improvement in trade management.

Governments, firms, and other stakeholders in international trade must embrace the collaboration between customs and AI to successfully manage the challenges of international trade in the digital age.

With iCustoms, discover the revolutionary potential of AI in customs management. Streamline trade processes more effectively and raise your management standard. Start now!

Stop Losing Time and Money to Manual Customs.

Get expert guidance from our customs specialist!

FAQs

How can AI help customs automate HS classification?

Artificial intelligence (AI) expedites the process of HS classification by evaluating the features and descriptions of products, utilising past information to spot patterns, and providing precise HS code suggestions.

What is the automated system for customs?

An automated customs system is a technology-driven platform that automates and digitises customs procedures, such as

- Documentation

- Risk assessment

- Declarations

- Clearance

What are the benefits of customs automation?

Automation of customs processes improves efficiency, expedites processing, lowers errors, improves compliance, streamlines documentation, improves risk management and lowers total costs.

You may also like:

Struggling to Extract, Catagorise & Validate Your Documents?

Capture & Upload Data in Seconds with AI & Machine Learning

Subscribe to our Newsletter

About iCustoms

iCustoms is an all-in-one solution helping businesses automate customs processes more efficiently. With AI-powered and machine-learning capabilities, iCustoms is designed to streamline your all customs procedures in a few minutes, cut additional costs and save time.

Struggling to Extract, Catagorise & Validate Your Documents?

Capture & Upload Data in Seconds with AI & Machine Learning