Benefits of Intelligent Document Solutions in Customs Declaration

-

Freya Jane

- Director of Customer's Success

In the context of global trade, smooth cross-border transactions are greatly dependent on customs declaration procedures. However, this complicated environment frequently faces problems with manual labour, a variety of document formats, and strict regulatory compliance.

In this domain, the implementation of Intelligent Document Solutions bring about a significant transformation, presenting a range of benefits that redefine the effectiveness and precision of Customs Declaration procedures.

This blog post will take you through the benefits you can get from intelligent document processing solutions.

Customs Declaration Process: Overview

The customs declaration procedure is the first step in the process of bringing goods into or out of the country. It entails the careful submission of documentation outlining the kind, amount, and cost of items that are imported or exported. This procedure is essential for guaranteeing adherence to rules, figuring out relevant tariffs and taxes, and promoting the efficient operation of global trade.

The Importance of Accurate Documentation in International Trade

The foundation of international trade is accurate documentation. It makes regulatory compliance easier, guarantees transparency, and speeds up cross-border trade. The importance of accuracy in customs declaration procedures is made clear by the fact that any mistakes or inconsistencies in documentation may result in delays, penalties, or even the rejection of goods.

Customs Declaration: Moving to Intelligent Document Solutions

A revolutionary change has occurred with the transition from manual processing to Intelligent Document Management Solutions. These solutions use cutting-edge technologies to automate and expedite document processing, providing numerous advantages for customs declaration operations. These technologies include Artificial Intelligence (AI), Machine Learning (ML), and Optical Character Recognition (OCR).

Comprehending Intelligent Document Solutions

Intelligent document solutions have a number of technologies intended to handle, retrieve, validate, and analyse data from various document formats automatically. This contains certifications, packing lists, invoices, and other important paperwork used in customs declarations.

Intelligent Document Processing Solution: Definition and Components

An intelligent document processing (IDP) solution is made up of a number of fundamental parts, each of which is essential to the efficient operation of customs declaration procedures:

OCR (Optical Character Recognition): This technology produces machine-readable text from scanned documents.

Natural Language Processing (NLP): Enables data extraction and interpretation of language.

Machine Learning Algorithms: Increase efficiency and accuracy by learning from data patterns.

How Does Intelligent Document Solution Automate Documents?

Intelligent document processing (IDP) solutions significantly reduce the time and labour-intensive manual work needed for document processing because of their automation capabilities. Through quick extraction, verification, and classification of data from various document sources, IDP guarantees accuracy and uniformity in customs declarations.

Challenges in Customs Declaration

Advanced Documentation Management

It can be difficult to keep track of so many documents, such as invoices, certificates, and other forms. The sheer amount and variety of documents necessitate careful management and organisation.

Inconsistent Languages and Formats for Data

Interpreting and extracting information from documents becomes more difficult when dealing with different formats (PDF files, scans, handwritten documents, etc.) and languages. It takes a lot of effort and is prone to error to translate, standardise, and process data from many sources.

Strong Adherence to Regulations

Compliance with strict and dynamic regulations necessitates ongoing awareness and adjustment. It takes constant observation and adjustment to ensure trade compliance with various international regulations and norms.

Laborious Manual Procedures

Using manual document processing procedures, such as data entry and verification, results in delayed and labour-intensive workflows. The implementation of manual handling in customs declaration procedures results in shipment delays and a reduction in operational efficiency.

Inaccurate Manual Work

When processing documents, the human factor increases the possibility of mistakes, inconsistencies, and errors. Inaccuracies in data entry, classification, or verification can impact trade operations by causing delays, fines, or even rejected shipments.

Absence of Traceability and Visibility

It is difficult to track and trace papers in the system due to limited insight into the state and evolution of document processing. The flow of papers may be difficult to manage and monitor as a result of this lack of transparency.

Ineffective Resource Utilisation and Workflow

Workflow management and resource allocation inefficiencies lead to underutilisation of available resources. The incorrect allocation of human resources and ineffective processes may impede good performance in customs declaration operations.

Insufficient Ability to Adjust to Changes

Operational agility suffers when it becomes more difficult to adjust to changing laws, trade agreements, or technology developments quickly. Operational disruptions and compliance problems may result from a slow response to changes.

High Costs and Intensity of Resources

Using manual processing techniques and being inefficient all add to increased operating expenses. Time-consuming procedures and heavy human resource usage can put a burden on finances and reduce cost-effectiveness.

Restricted Analysis and Accessibility of Data

Accessing and analysing data collected from papers is difficult, preventing thorough insights and strategic planning. Informed decision-making and customs declaration process optimisation are hindered by limited data accessibility.

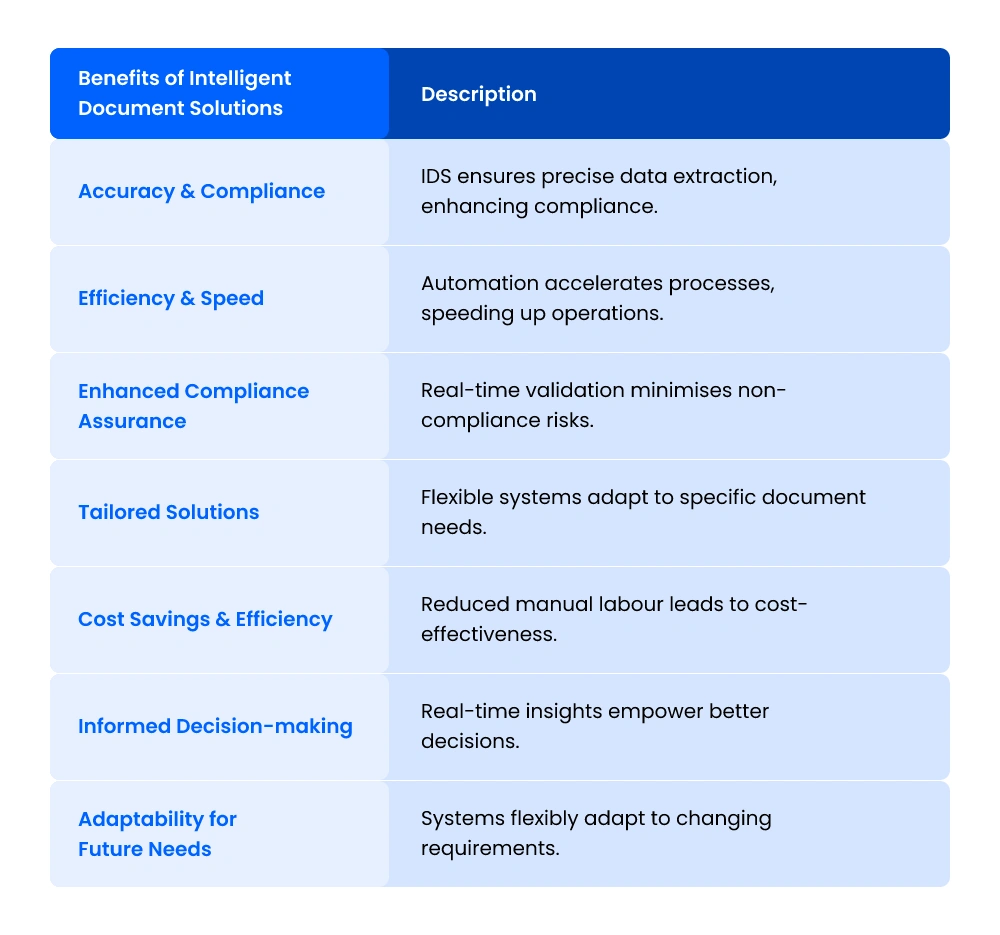

Benefits of Intelligent Document Processing in Customs Declaration

Intelligent document processing software comes with the following benefits:

Improved Precision and Adherence:

IDPS methodically extracts, verifies, and manages data from a variety of documents by utilising cutting-edge technologies like AI and machine learning, transforming accuracy. This precision guarantees that the data included in Customs Declarations is accurate and trustworthy, which improves adherence to customs legal requirements.

The lower mistake margin lowers the possibility of fines, hold-ups, or non-compliance problems resulting from inaccurate documentation.

Optimised Process and Effectiveness

By automating tedious and time-consuming processes, IDP optimises the entire AI document processing process. This automation greatly accelerates processing times, speeding up data extraction, validation, and categorisation.

IDP improves overall operational efficiency and speeds up Customs Declaration operations by optimising workflows. This allows organisations to process larger volumes of declarations without sacrificing quality or accuracy.

Enhanced Assurance of Compliance

Real-time identification of anomalies or non-compliance concerns is ensured by IDP platforms through continual validation against current legislation and standards.

By addressing possible compliance issues early on, this proactive strategy helps to reduce the risks associated with regulatory non-conformity. Consequently, this guarantees more efficiency and conformity with Customs Declaration procedures.

Personalisation to Meet Particular Needs

IDP systems are versatile and flexible enough to meet the demands of different Customs Declaration specifications. These systems can be set up and tailored to support various languages, document formats, and regulatory regimes.

This customisation feature guarantees accurate handling of particular documentation requirements, enabling organisations to satisfy particular operational and regulatory requirements successfully.

Savings on expenses and efficiency in operations

IDP lessens reliance on manual labour by automating labour-intensive document processing operations, making it the best business document solution. The optimisation of resource utilisation results in notable cost savings from this reduction.

IDP reduces the need for a great deal of human engagement, which benefits organisations by allowing for more economical Customs Declaration procedures and efficient resource allocation.

Improved Decision-Making and Transparency

IDP platforms use extracted document data to provide in-depth, real-time insights, empowering decision-makers with insights into trends, patterns, and possible risks in customs declaration procedures, thanks to this access to precise and useful information.

The enhanced transparency facilitates informed decision-making for better trade strategies and compliance by providing stakeholders with unambiguous visibility into the status and evolution of document processing.

Flexibility and Expandability for Future Requirements

IDP systems are designed to be flexible and scalable so they may adapt to changing business needs and regulatory environments. It is simple to expand, upgrade, or modify these systems to take advantage of new trade agreements, legislation, or technology developments.

This flexibility guarantees that customs declaration procedures remain pertinent and efficient, putting companies in a position to handle upcoming demands and obstacles successfully.

The Bottom Line

Customs declarations are crucial in the world of international trade. Making the switch to Intelligent Document Processing Solutions offers a revolutionary change in Customs Declaration procedures by providing accuracy and efficiency.

IDPS expedites the extraction of data, improves compliance, lessens the need for human labour, and fosters improved decision-making. Because of its flexibility, Customs Declaration procedures have advanced significantly and are prepared for changing trade dynamics.

FAQ's

What is the difference between RPA and IDP?

Intelligent Document Processing (IDP) focuses exclusively on processing and managing data from documents using AI and machine learning, whereas robotic process automation (RPA) automates repetitive operations across applications.

What is intelligent document recognition?

The capacity of systems to automatically recognise, categorise, and extract data from different document types utilising AI and OCR technologies is known as intelligent document recognition or IDR.

What is the benefit of intelligent document processing?

IDP guarantees accuracy, expedites document processing, improves compliance, lessens the need for manual labour, and offers insightful information to help with decision-making.

What are the capabilities of IDP?

The features of IDP include adaptive learning, document sorting, data validation, automated data extraction, document categorisation, document sorting, and integration with current systems for efficient document management.

You may also like:

Struggling to Extract, Catagorise & Validate Your Documents?

Capture & Upload Data in Seconds with AI & Machine Learning

Subscribe to our Newsletter

About iCustoms

Struggling to Extract, Catagorise & Validate Your Documents?

Capture & Upload Data in Seconds with AI & Machine Learning