Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

CHIEF To CDS: Advancements in Customs Declaration Services

-

Freya Jane

- Director of Customer's Success

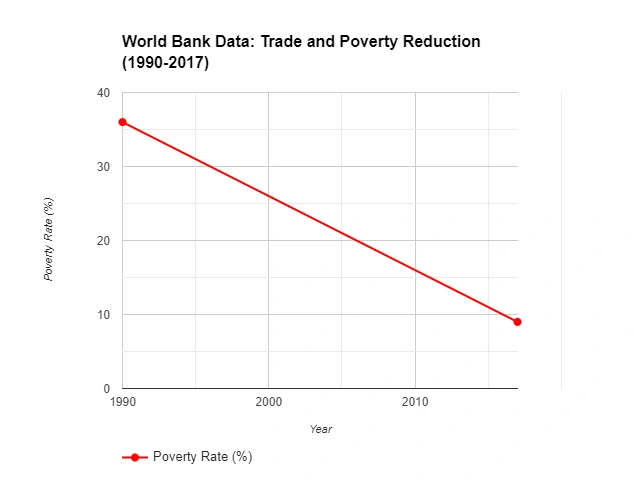

The impact of trade on economic growth:

As said earlier, global trade significantly impacts a country’s economic growth; here’s what research says about it.

“There is a strong correlation between the rise in developing countries’ share of global exports from 16% to 30% between 1990 and 2017 and the decline in global poverty rates from 36% to 9% during that same time frame.”

Trade opens up new markets for domestic companies, which drives economic growth. Increased production to meet foreign demand promotes specialisation, efficiency gains, and job creation. Furthermore, trade promotes technology transfer, increasing productivity and national income.

This blog will highlight multiple strands related to CHIEF and CDS, how CDS has become effective quickly, and what strings are attached to it.

Switching from CHIEF to CDS

CHIEF (Customs Handling of Import and Export Freight) to the CDS system is a major change in customs processing. CHIEF, meaning a long-standing UK electronic system for import and export declarations. With international trade changing and customs procedures becoming more complicated, a more advanced and efficient solution was needed. A Customs Declaration Service improves several things:

Enhanced efficiency

The Customs Declaration Service improves efficiency. Unlike CHIEF, the CDS streamlines customs processes through automation, AI, and data integration. The CDS customs speeds up customs declarations by automating data entry, verification, and processing. This improves trade facilitation, clearing times, and company administrative burdens.

Seamless connectivity

Advanced data integration is another CDS advancement. It connects customs authorities, trade participants, and other parties. APIs enable real-time data sharing, improving supply chain visibility and collaboration. Data integration improves risk assessment, decision-making, and resource allocation.

Risk assessment facilities

The CDS has enhanced risk assessment capabilities. It can analyse massive amounts of data using artificial intelligence and machine learning algorithms to find patterns or anomalies that may reveal trade irregularities or hazards. This lets customs authorities focus on high-risk cargo, boosting security and compliance.

Increased accuracy and compliance

Customs Declaration Service increases accuracy and compliance. The customs declaration service reduces manual data entry and customs declaration errors. Rule-based validation tests ensure customs compliance and reduce penalties. This increases trade integrity and customs data accuracy.

AI technology infrastructure

A modernised and resilient technology infrastructure is the CDS. Cloud computing provides safe storage, processing, and collaboration. Advanced analytics, data visualisation, and dashboards let stakeholders acquire meaningful insights from data. Modernised infrastructure helps customs operations handle rising trade volumes and respond to changing legislation and industry standards.

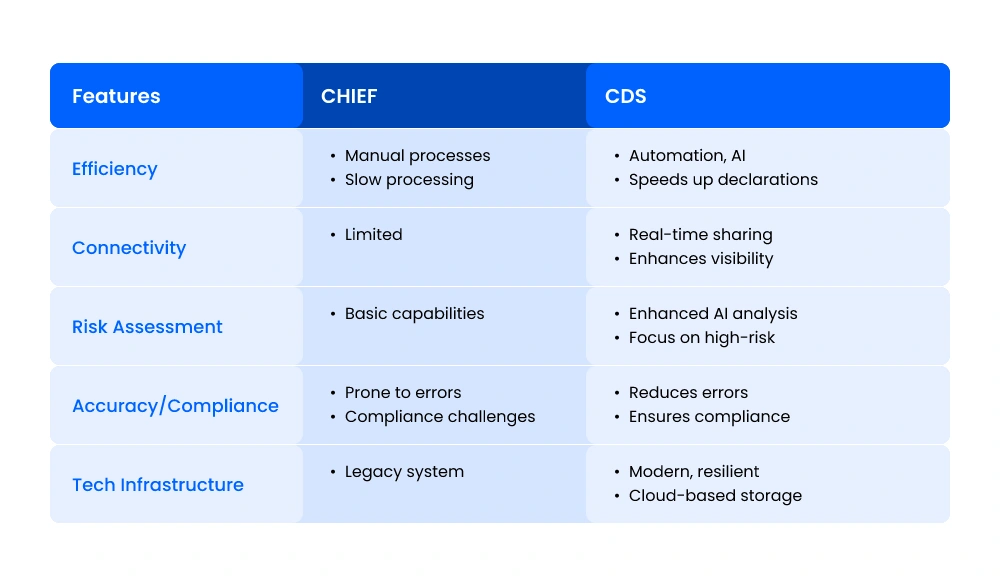

Difference between CHIEF and CDS

Customs Declaration Service (CDS)

All export trade via CHIEF was closed on March 31, 2023, and moved to CDS on October 1, 2023. It was running from 2018, but the pace was slow. Now, HMRC has taken an official step and replaced all the customs trade with the declaration service. Many firms, such as iCustoms, are handling customs declarations. It provides trade compliance with effective and emerging AI-based technology to make trade faster.

Customs Declaration Service Software

The Customs Declaration Service (CDS) program is an online technology streamlining customs declaration filing and processing procedures. Importers, exporters, customs brokers, and other authorised users can all benefit from the system’s ability to expedite and automate customs processes. They provide different logistics services to traders and play a vital role in their declaration. The most important things they provide include:

- Classification

- Customs declaration

- HS-code lookup

- Customs management

- Document automation

- Document submission

- OCR feature

HMRC And CHIEF To CDS system

At first, HMRC provided the CHIEF customs system services for customs trading, but now CDS registration at HMRC is common. Cds.gov.uk is the official website, and you need to register on it. CDS login HMRC uses the government gateway credentials for declaration purposes. For the CDS login, a lot of firms are providing these services with a bunch of extra-touch features that make it easy for traders to submit customs declarations.

Conclusion

Customs declaration services have changed international trade. Customs authorities and trade players can improve efficiency, compliance, and operations by using AI, blockchain, and IoT. These advances improve risk management, trade facilitation, cost, and teamwork. Switching from CHIEF to a new Customs Declaration Service is a strategic decision to use sophisticated technologies and streamline customs processes.

It makes international trade more efficient, transparent, and secure, facilitating trade, compliance, and economic progress. Changing from CHIEF to a Customs Declaration Service improves customs processes. The CDS CPC codes improve efficiency, data integration, risk assessment, accuracy, compliance, and technology infrastructure. This move leverages new technologies to expedite customs processes, improve international trade, and boost economic growth.

FAQs

Why is CHIEF being replaced with CDS?

CDS is replacing CHIEF in customs processing to boost efficiency, automation, and interaction. In order to improve trade facilitation and streamline declarations, CDS utilises cutting-edge technology.

What does CDS stand for in customs?

Customs Declaration Service is referred to as CDS. It is a new system that replaces CHIEF for handling export and import declarations, using innovative technologies for increased efficiency and compliance.

What's the difference between CHIEF and CDS?

CHIEF was dependent on manual procedures, whereas CDS utilises automation, artificial intelligence, and real-time data sharing. Compared to CHIEF, CDS seeks to expedite declarations, enhance risk assessment, and guarantee more accuracy and compliance.

Do all importers need to register for CDS?

Yes, all importers involved in customs declarations must register for CDS in order to assure compliance with the new system and benefit from its evolved features and trade processing efficiency.