Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Features of compliance management system for customs broker

-

Freya Jane

- Director of Customer's Success

The foundation of smooth international trade is made up of compliance management systems and customs declarations. It is imperative that professionals and enterprises operating in the global market comprehend their features, complexities, and critical role in enabling seamless cross-border transactions.

For customs brokers, compliance is critical. It can be difficult to navigate the complexities and ensure adherence in a world where international trade regulations are constantly changing.

According to a study conducted by Navex,

“83% of risk and compliance professionals believe that maintaining an organisation’s compliance is vitally important.”

This demonstrates how important it is to have a strong compliance management system (CMS) in order to minimise risks and streamline customs procedures for brokers and their clients.

In this blog, we examine the essential elements and importance of compliance management systems designed specifically for customs brokers.

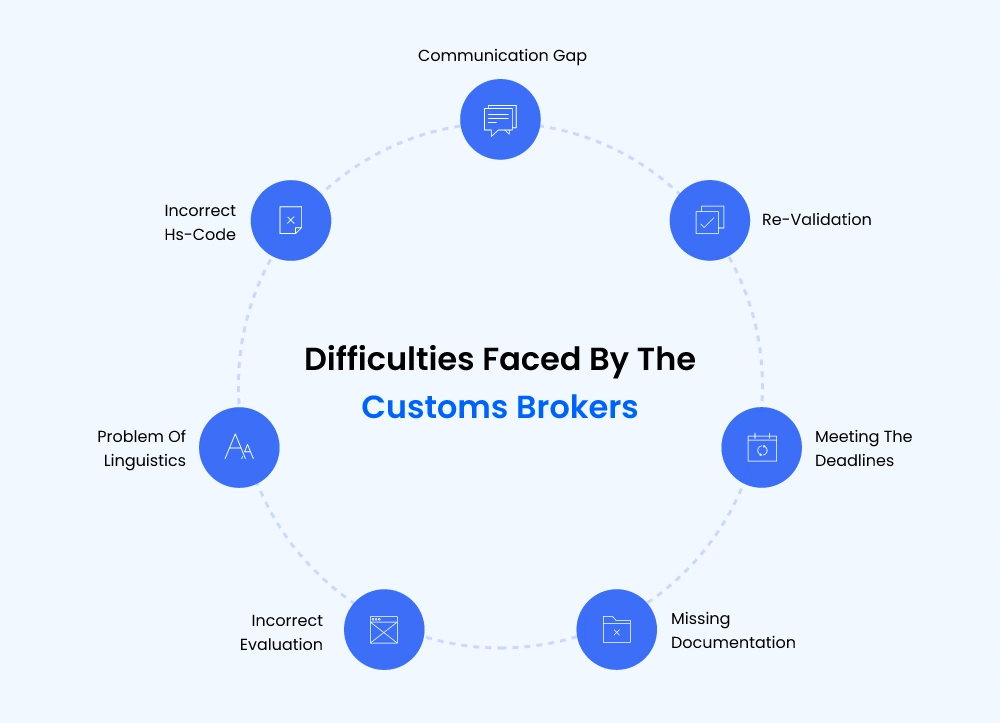

What difficulties did the customs broker encounter while using CDS?

Here are a few challenges that customs brokers used to face earlier while customs document declarations:

Top features of compliance management system for customs broker

Handle regulatory changes With ease

Regulatory intelligence in real-time will help you stay ahead. With the help of this software, firms may stay up to date on the most recent changes to international trade legislation, allowing them to adjust and maintain compliance promptly.

Simplified document management

Reduce the complexity of creating and managing documents. Automated procedures cut down on human labour and ensure accuracy in important documents such as certificates of origin and invoices.

Accuracy in tariff classification

Say goodbye to errors in duty calculations. Automated tariff classification enables accurate product classification, which aligns with customs declarations and reduces compliance concerns.

Transparent compliance monitoring

A strong audit trail function keeps detailed records of all transactions and compliance actions. This transparency facilitates audits and verifies compliance with rules.

Real-Time compliance verification

In order to avoid fines, penalties, and delays, the system performs real-time compliance checks to make sure shipments comply with regulatory standards.

Alertness via denied party screening

Make sure business activities are moral. The integrated denied party screening technology checks trade partners against government watchlists, prohibiting them from engaging in banned transactions.

EDI-enabled seamless data exchange

Encourage effective communication. EDI capabilities provide for easy data interchange between trading partners and government authorities, reducing errors and delays.

Improving insights using reports and analytics

Acquire useful knowledge about trade activity. Robust analytics and reporting tools provide insightful data-driven decision-making skills that optimise workflows.

Real-time visibility into the supply chain

Keep an accurate eye on and track. Take advantage of supply chain visibility in real-time, which enables companies to follow the flow of goods, keep an eye on milestones, and improve transparency overall.

Coherent integration for increased effectiveness

Integrate systems seamlessly for a cohesive strategy. The ability to integrate with other enterprise systems guarantees a coherent approach to managing international trade, enhancing productivity by optimising data transfer.

Learn more about the benefits of the Customs Management System. Read here!

What things define a good customs compliance management system?

A compliance management solution is defined as a complete hub where multiple services are given to its customers related to customs. It is basically software that provides importing, exporting, and other relevant services that are essential for customs compliance.

A good complaint system holds great power, and it aids in giving a captivating customs declaration experience to both the trader and the customs broker. Let’s learn about what makes a reliable customs management system.

Product classification

The most major component of quality compliance systems is its technique for product classification. For integration purposes, the foremost requirement is the correct identification of the product, including its description, to analyse the appropriate commodity code.

Document automation

As per the AI-integrated environment, everything depends on smart technology and innovation. The best compliance software must use AI-based power automation processes to make work smarter and reduce paperwork.

Customs classification

Selecting the relevant commodity code with respect to the product description is essential for compliance management. A customs software program must be capable of extracting the correct commodity code when the product file is uploaded to a certain platform.

Automatic re-validation

Compliance management is all about ease and comfort for the customs brokers so that they can manage the flow smoothly. The management system should have the ability for automatic re-evaluation to cross-check the documentation prior to submission.

Time-saving

A very important factor that defines good compliance management software is how efficient it is in terms of time-saving. If the system can manage bulk amounts of customs data in a limited time, then it will help the customs brokers.

Manage customs procedures more efficiently and precisely with our innovative platform. Start Now!

Does iCustoms fit into the category of a good customs compliance management system?

Above is a detailed disclaimer regarding what customs brokers should look into while searching for better customs compliance management solutions. If we specifically talk about iCustoms, it holds all the properties that make it a good fit for this category. It is an AI-driven customs platform that improves and simplifies customs procedures for brokers, businesses and traders.

One unique feature that separates it from other customs software is its document automation feature, IDP Customs. Although iCustoms provides CDS services for both importers and exporters through its customs classification tool. Along with that, it gives brokers and customs traders the ability to make bulk uploads of documents.

And it will fill out the regulatory form for customs clearance. Moreover, it will extract and transform all the required information that is needed in the declaration. Hence, it covers all the points that define a good customs clearance platform.

Conclusion

In a time when innovation has become the norm, iCustoms shines as a model of change for customs brokers. iCustoms is a cutting-edge solution that reinvents customs compliance with its extensive range of features, user-friendly automation, and efficient networking.

See how iCustoms can help you achieve faster customs clearance and ensure compliance with confidence.

FAQ's

What is a compliance management system?

A compliance management system is an organised strategy or framework that organisations use to ensure they follow the applicable laws, regulations, and internal policies. It entails methods, technologies, and policies for efficiently managing, monitoring, and enforcing compliance.

What are the four pillars of a compliance management system?

A compliance management system is built on these four pillars:

- Policies and Procedures

- Risk Assessment

- Monitoring and Reporting

- Training and Communication

What are the four steps in maintaining compliance?

The four steps in ensuring compliance are the following:

- Identification

- Assessment

- Implementation

- Monitoring and Review

What makes compliance management important for businesses?

Businesses need compliance management because it reduces legal risks, fosters a culture of accountability, protects reputation, and assures conformity to industry standards.