Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Stay Compliant: A Breakdown of Customs Regulations for Dual Use Goods

-

Freya Jane

- Director of Customer's Success

The global trade world is full of complexities, which become even more challenging when importing or exporting dual trade goods. These goods, with both military and civilian uses, can make it problematic for businesses to comply with governing rules and regulations.

“The European Union denied around 0.6% of the dual-use export applications in 2021 owing to security concerns.”

To save your dual-use goods from denial, you must equip yourself with all the knowledge regarding compliance rules.

“Regarding EU dual-use trade, data collected from Member States show that exports of dual-use items accounted for approximately 2.5% of total EU27 exports (intra- and extra-EU), with a staggering value of 147 billion euros.”

This equates to a significant volume of goods with both civilian and military applications passing through the European Union. While this trade promotes innovation and economic growth, it also necessitates stringent regulations to avoid abuse.

This blog post will walk you through key regulations for trading dual use goods.

Understanding dual use goods

Goods that are used by both the government and civilians are referred to as dual-use goods; different countries have different rules and regulations governing such products. There are many widely used items that were previously used by the government but have now found their way into civilian life. Keeping up with the constantly evolving dual-use restrictions presents a problem for trade-based businesses as more and more commodities make the move to everyday use.

Export control on dual-use goods for EU & UK

Within its member states, the European Union (EU) controls the trade of dual-use goods or those with both military and civilian uses.

EU laws

- Council Decision 2009/428: The basis for EU dual-use export control is this rule.

- Article III: This article specifically requires permission from the government before transferring military equipment.

- Specific policies of each member state: Some European Union countries, like Spain, may require additional controls, while others, like France, may not.

Balancing trade & security

The EU recognises that trade with dual uses fosters technical exchange and boosts the economy.

A dedicated commission keeps an eye on export laws to make sure they adhere to economic requirements.

Nonetheless, in order to uphold non-proliferation agreements, the EU retains export controls, and it has recently held public consultations to evaluate and update rules.

UK export authorisation

- The UK government grants export authorisations for dual-use goods in a manner similar to that of US BIS licencing.

- The United Kingdom maintains a detailed list of controlled goods, including items that Western nations frequently forbid, such as nuclear materials, avionics, computers, and marine technologies.

How are dual use goods categorised?

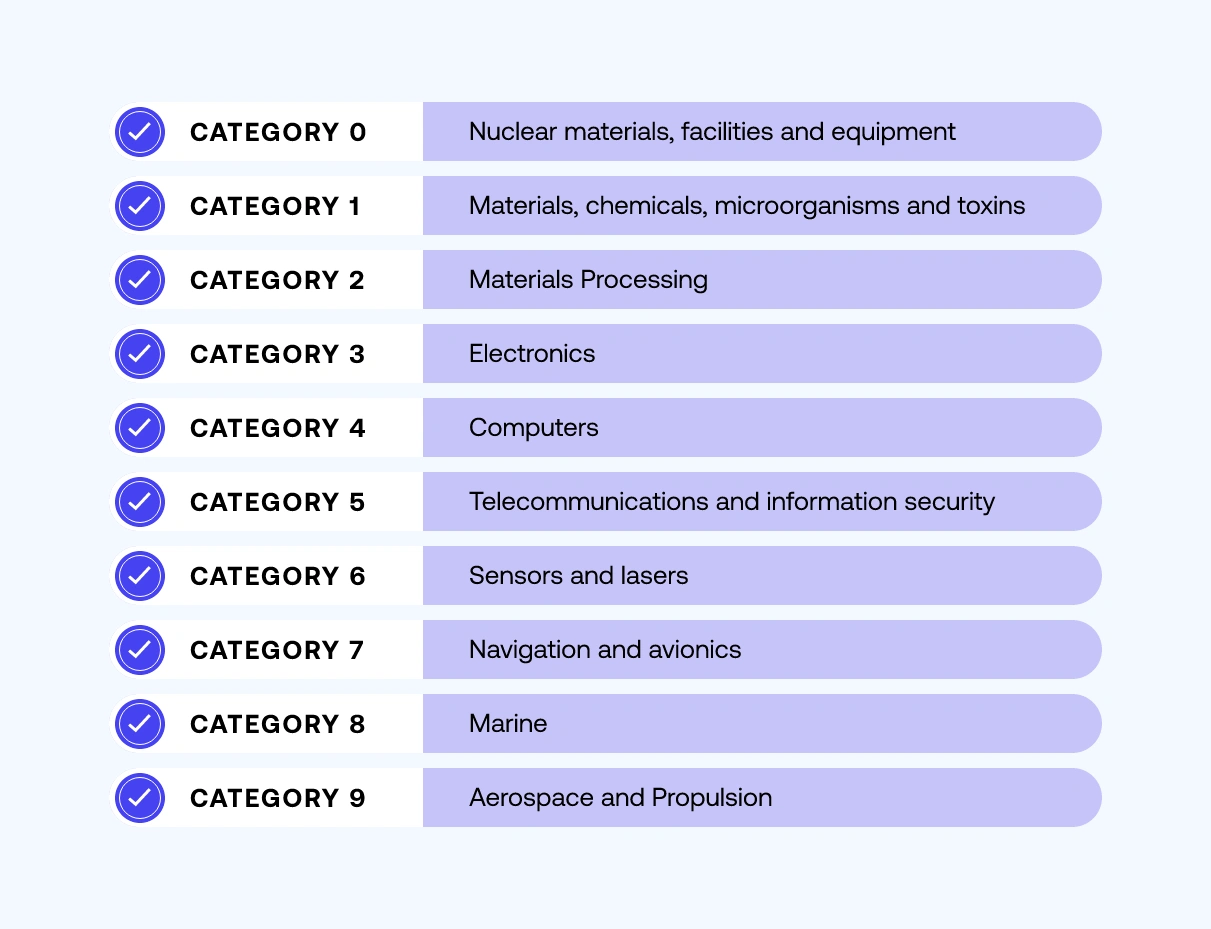

Dual use goods are divided into 10 categories recognised internationally, which are further split into 5 groups.

Dual use goods list is:

The five product group categories are:

Struggling to find the right HS code for dual-use goods?

Experience hassle-free HS code identification and reduce the risk of penalties with iClassification!

Rules for dual use goods

Trade in dual-use goods (having both military and civilian uses) is subject to a complicated regulatory framework that aims to stop the spread of harmful technologies and weapons.

Below is a summary of the main guidelines and things to think about:

1. Identifying dual use goods

Control lists: The initial step is to understand what goods are referred to as dual-use. Every country keeps a control list that lists particular goods that are subject to export restrictions. Usually, the categories are defined based on type (materials, electronics, software) and required level of control. For instance:

- Materials: Composites, chemicals, and some metals with possible military applications.

- Technology: Modernised computers, communications and navigational aids, and encryption software.

- Products: Unmanned aerial vehicles (UAVs), drones, and other technology having both military and commercial uses.

“Catch-All” Provisions: A lot of regulations have “catch-all” provisions in addition to the specific lists. These provide authorities power over things that aren’t specifically listed but might be used for military purposes. This means that if you export anything that could cause concern, you need to be aware of how regulations are changing and get advice from the appropriate authorities.

2. Requirements and exceptions for licences

Getting a licence: Exporting dual-use items typically necessitates a licence from the export control agency of your country. By doing this, you can be sure that the products are used responsibly and reach their intended users.

Exceptions: The licence requirement may not always apply, but these are usually limited. For example, consider the following:

Destination country: Goods that your government deems low-risk may be excluded from this requirement.

Minimal military use potential: Products may be exempt if they have a considerably low potential for military application.

Threshold quantities: Tiny amounts that fall below a particular value threshold that the authorities have established may be exempt.

3. Obtaining an export licence

Application process: Each country has its own licencing procedure, but in general, you have to send a thorough application to the appropriate export control agency. Usually, the application will ask for details regarding:

Specific items: Detailed information about exporting goods, together with their possible applications and technical details.

- End-use and end-user: Details regarding the products’ intended use and end-user, which helps assess and reduce the misuse of goods.

Transaction details: The transaction’s value and any applicable payment information.

Supporting documents: Depending on the particular goods, technical datasheets, user manuals, and other paperwork could be needed.

Government review: Your application will be examined by the export control agency based on a number of criteria, such as:

International obligations: Adherence to international agreements, such as non-proliferation treaties.

National security risks: Determining whether the export poses harm to the security of your country.

Risk of diversion: The possibility that the materials will be used for unapproved military purposes.

End-user reliability: Ensuring responsible use by confirming the recipient’s reputation and reliability.

4. Non-compliance consequences

Penalties: There may be serious consequences for breaking export control laws. Penalties differ from nation to nation but may include:

Licence denial: Your application for an export licence can be rejected.

Seizure of goods: The authorities seize the goods.

Fines: The export control agencies can impose hefty fines.

For more details about dual use goods regulations, visit this Council Regulation (EC) No 428/2009

Additional points to remember

To successfully trade dual goods, keep the following points in mind:

Record-keeping

Businesses that trade dual use goods are frequently required to keep a thorough record of all the transactions for a specific period of time. These documents usually contain information about goods, their intended use, and the receiver. Keeping records manually can be a hassle and has a risk of getting lost; thus, it is advised to use an automated system for this purpose. Keep your worries about keeping records at bay with iCustoms; our AI-driven software responsibly keeps your data safe for a desired period of time.

Customs brokers

When dealing with dual-use items, businesses should seek assistance from customs brokers, who have expertise in seamlessly trading such goods. iCustoms offers advanced automated Customs Declaration Software for customs agents and brokers Customs Declaration Software for customs agents and brokers to help them handle declarations with ease, eliminating the risks of errors and saving time.

Get accurate HS codes in seconds with iCustoms!

Simplify customs clearance and ensure compliance.

FAQs

How do I know if the goods are dual-use?

You need to match the technical features and attributes of the goods you want to trade with the predetermined list of dual-use goods established by the government. If the attributes match the parameters defined in the list, the goods fall under the dual-use category.

What are the sanctions on dual-use goods?

The dual-use goods sanctions typically involve:

- Licencing requirements

- Export controls

- Trade embargoes

How do you classify dual use goods?

Dual-use goods classification can be performed using the iCustoms HS code lookup tool, iClassification. It ensures the accurate classification of your goods and determines the HS code precisely, saving you from errors and unnecessary delays.

You may also like

Streamline Product Classification

Uncover iClassification for precise Global Trade, Delivering Time-Saving Accuracy.

Subscribe to our Newsletter

About iCustoms

Streamline Product Classification

Uncover iClassification for precise Global Trade, Delivering Time-Saving Accuracy.