Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Entry Summary Declaration (ENS): Everything You Need to Know

-

Freya Jane

- Director of Customer's Success

Are new safety and security declaration requirements impeding your progress as a carrier? The UK government made it compulsory to submit an Entry Summary Declaration (ENS) before the goods arrive to ensure they comply with the safety and security standards. Following January 31, 2025, no shipment will be able to proceed without an ENS.

Filing an ENS manually can be time-consuming and error-prone, which may lead to delays and penalties. This piece of content is intended to provide you with a thorough understanding of ENS and its submission process.

Understanding Entry Summary Declaration (ENS)

An ENS is a safety and security declaration that must be submitted by the carrier before the goods are dispatched.

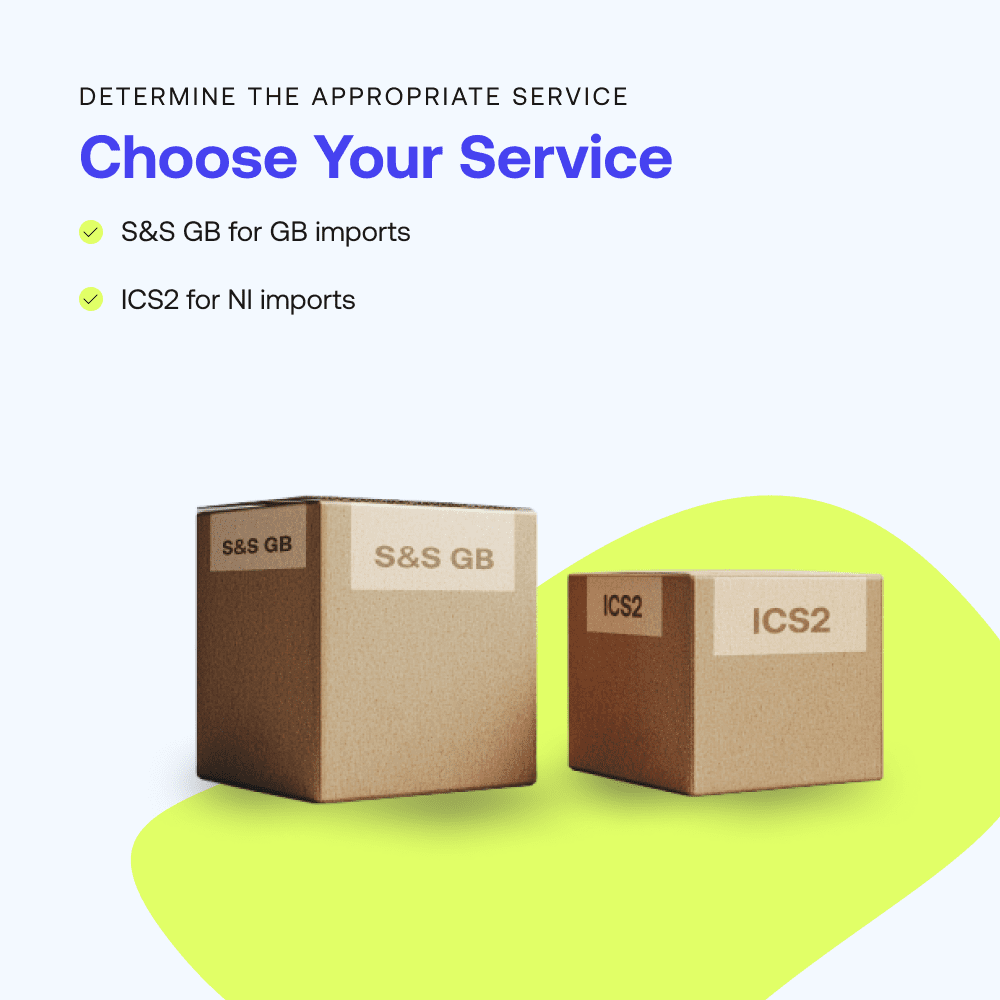

Both Great Britain and the European Union have separate ENSs.

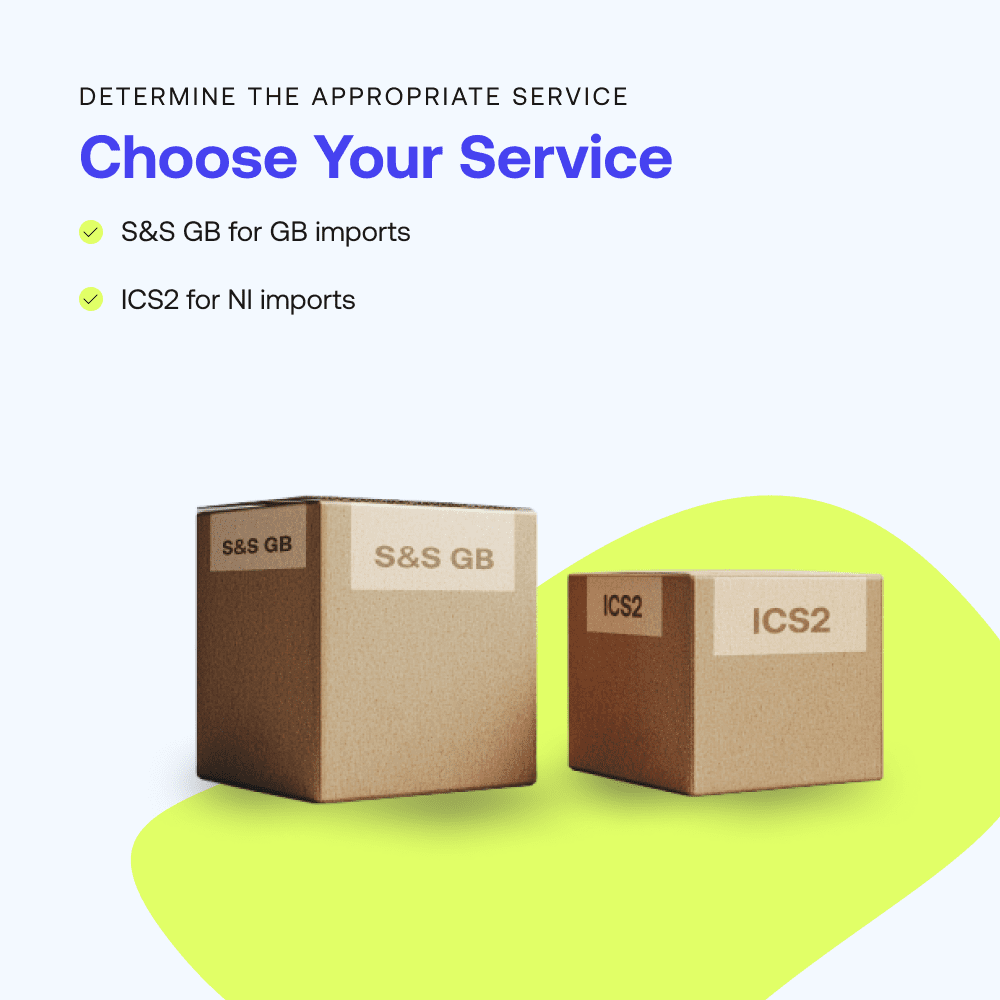

ENS GB is known as Safety & Security GB (S&S GB). Carriers will be required to submit S&S GB for all the goods entering the GB from 31st January 2025.

Submit ENS GB when:

- Importing goods into GB from EU & RoW

ENS EU or ICS is required when goods enter the European Union and Northern Ireland.

Submit ENS EU when:

- Importing goods into NI and EU from GB & RoW

This declaration helps customs authorities conduct a thorough security and safety assessment of cargo entering a territory. Moreover, it provides the shipper with information in case additional certificates of documents are needed.

Want to learn more about Safety & Security Declarations? Read Out!

What information do you need to submit an Entry Summary Declaration (ENS)?

You’ll need the following information to submit an ENS:

Where do I submit the Entry Summary Declaration?

To submit ENS, you must be registered for the following:

- Import Control System (ICS2): For bringing goods into Northern Ireland and the EU

- Safety & Security Great Britain (S&S GB): For bringing goods into GB

When Entry Summary Declaration is not required?

An ENS is not required in the following cases:

- When receiving goods into Northern Ireland (NI) from an EU country

- Moving NI qualifying goods from NI to GB

- Moving goods from EU to GB

Some goods are also free of submitting an ENS, including:

- Goods entering by pipeline

- Items of correspondence

- Electrical energy

- Products of sea fishing

- Goods in the personal bags of travellers

When do I need to submit an ENS?

There are different time limits to submit an Entry Summary Declaration based on the shipping or transport mode you use.

Who should submit an ENS?

The ENS submission is a legal requirement of the carrier, who is the operator of the transport by which the goods are being carried.

Goods moving by rail

The carrier is a rail freight operator that transports goods by rail and will be responsible for submitting an Entry Summary Declaration (ENS).

Goods moving by air

The airline must submit an ENS if goods are transported by air.

Goods moving by sea

Submitting and ENS is the responsibility of the shipping company for the goods transported by sea.

Goods moving by roll-on roll-off (RoRo)

There are usually two carriers when the goods are transported by RoRo:

The haulage company: For the accompanied goods declaration

The ferry operator: For the unaccompanied goods declaration

Goods moving by combined transport

For combined transport (for instance, a truck carried on a ferry), the operator of the active transport on arrival in the UK is responsible for filing an ENS.

If the ferry carries the driver-accompanied truck and will drive off when it arrives in the UK, the ENS submission will be the obligation of the trucking company.

If the ferry carries an unaccompanied container or trailer, the active means of transport is the ferry, and it will be responsible for an ENS submission.

Tired of struggling with manual ENS declarations?

Let iCustoms automate data extraction and ENS filing for you.

Step-by-step Entry Summary Declaration (ENS) submission

Entry Summary Declaration is required to be submitted prior to importing goods into the GB and NI to ensure the safety and security of the goods and facilitate smooth entry.

Here are the key steps involved in submitting an ENS:

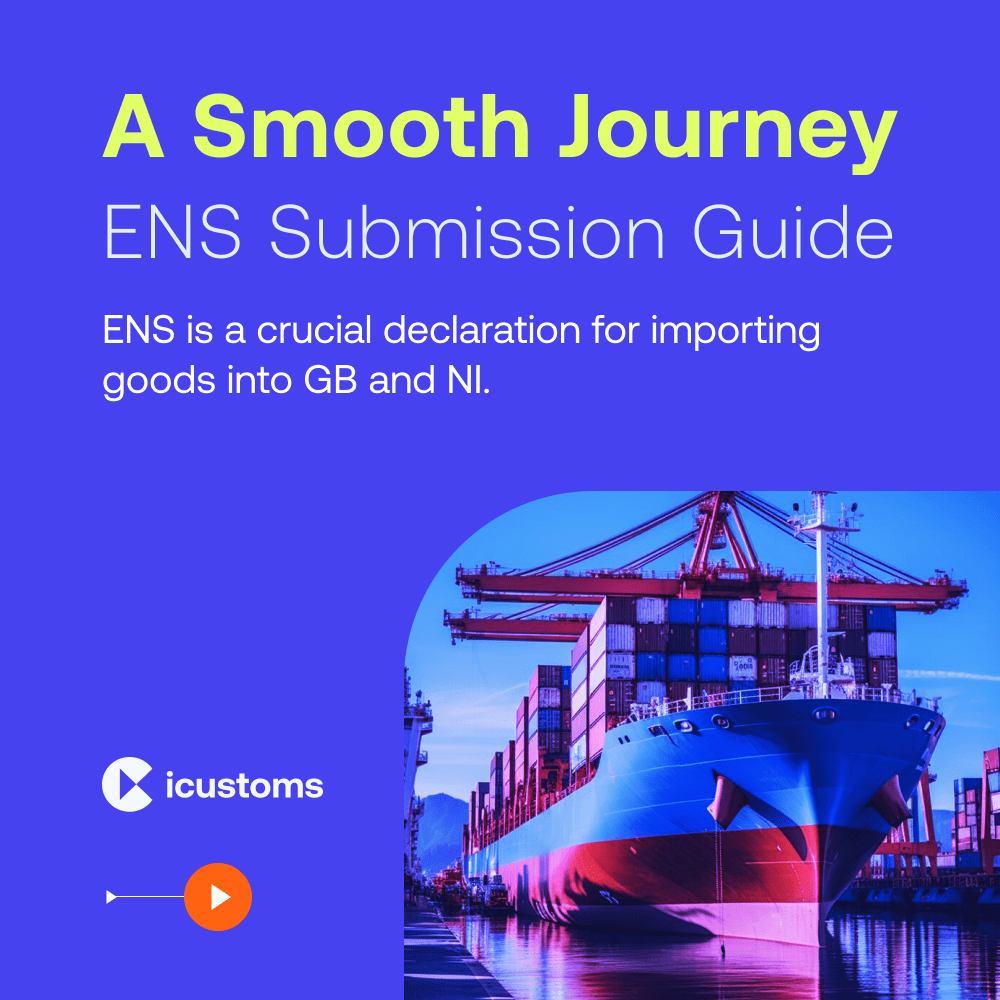

1. Determine the appropriate service

2. Gather the required information and documents

You will need the following information about the goods:

- Commodity code or goods description

- Consignee and consignor

- Types and number of goods

- Packaging of the goods

- Mode of transport

You may also need some additional documents or licenses, such as:

- Import license

- Certificate of origin

- Health certificate

3. Submit your declaration

When importing in the GB, you will need to know the Safety and Security location code for the entry port to submit an ENS. Once your declaration is accepted, you will receive a movement reference number.

In the case of moving goods through a port without an inventory-linked system, you will need to use the Goods Vehicle Movement Service (GVMS) to generate a reference number.

4. Await assessment and possible course of action

Your Entry Summary Declaration will go under the safety and security assessment, and the Border Force will identify the shipments they want to either hold or proceed.

If your goods are identified as high-risk, you’ll get a “Do Not Load” message from the Border Force, and they will instruct you on what to do next.

5. Making amendments

You must be sure about the accuracy and completion of the ENS declaration before submission. However, you can make an amendment even after submission. You can make changes to the declaration until it reaches the point of arrival.

By deliberately following these steps, you can ensure a smooth import process for goods into the UK.

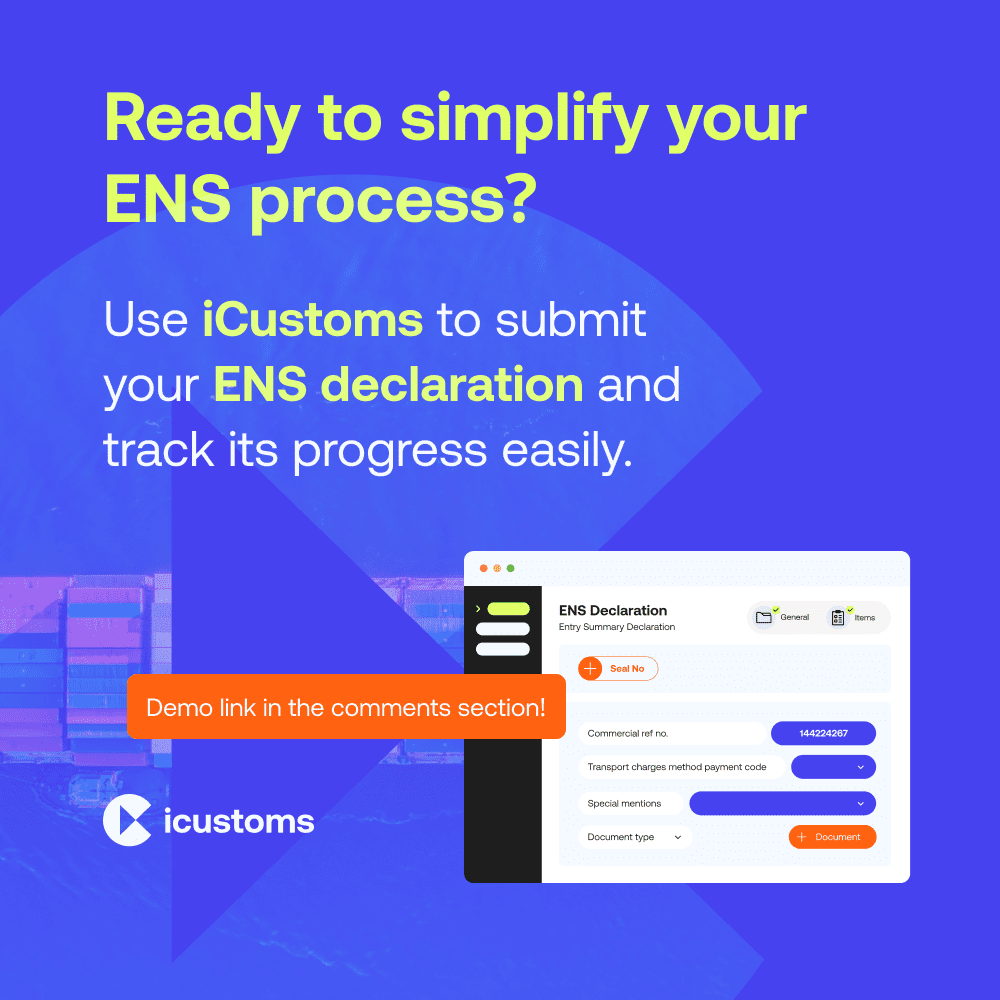

Streamline your ENS declarations with iCustoms

iCustoms eliminates the need for tedious tasks involved in manual ENS declarations, providing you with a seamless ENS experience.

Here’s how iCustoms can be beneficial for you:

- Automated Data Extraction: Using Intelligent Document Processing (IDP), iCustoms automatically extracts data from bill of lading and fills the ENS, saving valuable time.

- Mirroring: With a convenient mirroring feature, iCustoms automatically fills the Entry Summary Declaration fields based on the data from your Customs Declaration form or vice versa.

- All-in-one platform: Whether you run a small import/export business or have a large company, iCustoms offers all the solutions to make your trading experience smooth and seamless.

- Integration with existing ERPs: By seamlessly integrating with your current ERPs, iCustoms streamlines your overall business operations.

The bottom line

Submitting the Entry Summary Declaration (ENS) is going to be an essential requirement for all imports from January 31, 2025. This ensures the safety and security of the goods before they reach the destination country. Manual submission of an ENS can be time-consuming and error-prone, leading to fines and delayed shipments.

Let iCustoms simplify the ENS filing for you, streamlining everything from automated data extraction to submission to customs authorities. Experience the efficiency of iCustoms today!

You may also like:

Simplify Your ENS Submissions with iCustoms

Automate data entry, reduce errors and ensure compliance

Subscribe to our Newsletter

About iCustoms

Simplify Your ENS Submissions with iCustoms

Automate data entry, reduce errors and ensure compliance