Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Delayed Shipments Due to Export Customs Declaration? Solutions for Manufacturers

-

Freya Jane

- Director of Customer's Success

Have you ever considered how a minor export documentation mistake could result in expensive delays? The first line of security is an accurate and timely export customs declaration. Mistakes such as missing information or errors in paperwork can bring your operations to a halt, resulting in financial losses and disrupting production plans.

Many companies don’t pay attention to efficient documentation processes, which may lead to costly mistakes, particularly in the import/export industry.

This highlights that only 3% of the companies have minimal document management procedures in place, while others lack any at all. Such businesses struggle to excel in the competitive market and fall behind their competitors.

Don’t allow your business to stumble over these unexpected obstacles! In this blog post, we’ll examine the most common reasons for shipment delays and offer solutions to make your exporting journey more smooth.

Understanding export customs declaration

The export customs declaration is responsible for the free flow of goods across borders; thus, it must be accurate and submitted on time. Any inconsistency in documents, such as mistakes or missing information, may lead to delays. As a consequence of these delays, manufacturers may suffer monetary losses, production schedule disruptions, and harm to customer relationships.

Causes of delayed shipments

Manufacturers, you know how much a delayed shipment can mess with your schedule for production and customer satisfaction. You can prevent needless headaches and guarantee efficient operations by being aware of the common pitfalls.

Documents errors

- Incomplete or incorrect information: Errors in the description, value, quantity, and documents lead to customs inspection.

- Missing documents: Some customs documents are often overlooked, such as commercial invoices, certificates of origin, and packing lists.

- Incorrect harmonised system codes: Leads to misclassification of products, which in turn causes erroneous taxes and duties.

Customs inspections

Customs inspections: Authorities may randomly check shipments at borders, which can take a lot of time.

Risk-based targeting: Some shipments are considered high-risk due to factors like import history, origin, and product type; these may face delays at customs.

Non-compliance problems: Delays or penalties can also be caused by violations of export regulations and trade restrictions.

Problems with classification and valuation

- Product classification challenges: Finding the right HS code may take a lot of time, leading to delays.

- Valuation issues: Problems could arise when customs officials and experts have different opinions on the value of the goods.

Curious to learn about HS codes for different industries? Read more!

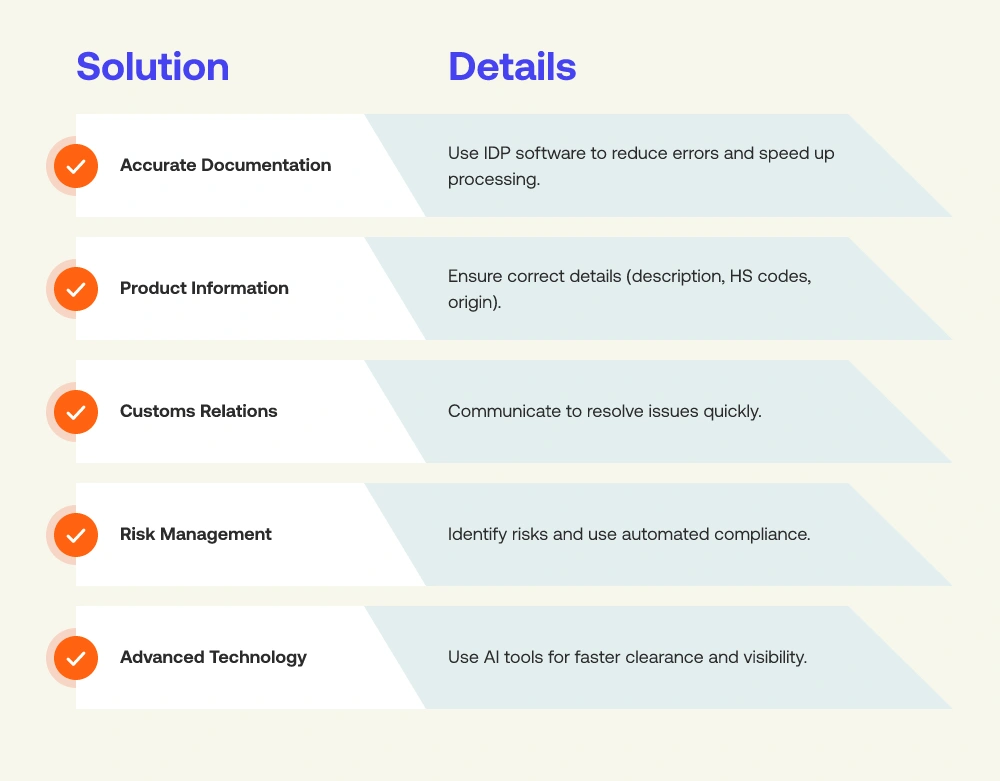

Solutions for manufacturers

Manufacturers should follow these solutions to ensure smooth export customs declaration:

Accurate documentation

Efficient customs clearance requires thorough and precise documentation. Manufacturers can benefit from a well-organised and easily-tracked documentation process by implementing a powerful document management system. You may automate some operations and cut down on mistakes by using intelligent document processing software. IDP software can effectively reduce shipment delays by ensuring the following:

Reduced errors

Faster document

processing

Enhanced communication

Improved compliance

Better visibility

Streamlined workflow

Drowning in customs paperwork?

Automate documentation with AI-powered IDP, reducing errors and saving you 70% of your time!

Accurate documentation

Accurate and comprehensive product information is required for successful customs clearance. It includes:

Product description

HS codes

Country of origin

Inaccurate goods details may cause customs delays, inspections, and additional costs.

Establishing reliable relations with customs officials

The key to quickly resolving issues is maintaining open communication with customs authorities. Proactively communicating with customs authorities can assist producers in comprehending their unique needs and establishing confidence. Advice on customs clearance might shed light on possible problems and their solutions.

Assessment and reduction of risks

It is critical to identify any risks in the export process in order to avoid delays. The best way for manufacturers to be ready for everything is to have a backup plan. To reduce the possibility of customs problems, export controls and compliance processes should be put in place, which can be made possible with automated system.

Adopting advanced technology

Utilising AI-driven technology is crucial for improving customs procedures. Automated customs clearance technologies can speed up the process of submitting and clearing documents. Data analytics can improve customs compliance and spot problems. Supply chain visibility technologies can provide real-time shipment status information to proactively handle delays.

How iCustoms can help you reduce shipment delays

Manufacturers may simplify their supply chain processes using iCustoms’ AI solutions, which simplify customs clearance. Advantages that stand out include:

- Automated data entry: The automated entry of data saves time and reduces the likelihood of human error, greatly enhancing the precision and effectiveness of customs declarations.

- Compliance assurance: The system ensures compliance with the most recent customs laws and provides real-time guidance, assisting firms in remaining compliant and avoiding penalties.

- Document management: iCustoms’ CDS simplifies access and retrieval of customs documents, making both the auditing and customs inspection processes more efficient.

- Quicker clearance: By utilising CDS to process accurate and comprehensive customs declarations, iCustoms accelerates clearance procedures, leading to fewer shipment delays and better on-time delivery results.

- Data analytics: Customs Data Analytics from CDS can help businesses spot patterns, problems, and opportunities for growth. Improving customs procedures and shortening clearance times are both possible outcomes of this data-driven strategy.

Reduce the risk of penalties and ensure seamless clearance with iCustoms! Start Now

Bottom line

Manufacturers face substantial difficulties due to delays in export customs declarations. This blog aims to improve supply chain efficiency, decrease the likelihood of delays, and streamline export processes. Building solid relationships with customs authorities and taking a proactive approach to customs compliance is key. Manufacturers can reduce the effect of delays in export customs declarations and keep customers happy by following these methods.

Get Your Free Demo Today! Discover the power of iCustoms AI and simplify your export journey.

You may also like:

Simplify Customs with our Powerful Customs Management Software

Automate declarations, track shipments, & ensure compliance.

Subscribe to our Newsletter

About iCustoms

Simplify Customs with our Powerful Customs Management Software

Automate declarations, track shipments, & ensure compliance.