Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Free Trade Agreement Compliance Strategies: A Must Read for UK Businesses

-

Freya Jane

- Director of Customer's Success

International trade is controlled by a variety of laws, regulations, and trade agreements, and meeting these standards is critical for enterprises involved in global trade. A free trade agreement (FTA) is no exception, and firms in the UK that want to benefit from these accords must comprehend how they affect trade compliance.

It aims to promote international commerce by eliminating or lowering trade restrictions such as tariffs and quotas.

By giving goods and services exchanged between FTA partner nations preferential treatment, they provide UK businesses the chance to enter new markets and become more competitive.

To fully reap the advantages, firms must comply with the precise compliance requirements of free trade agreements.

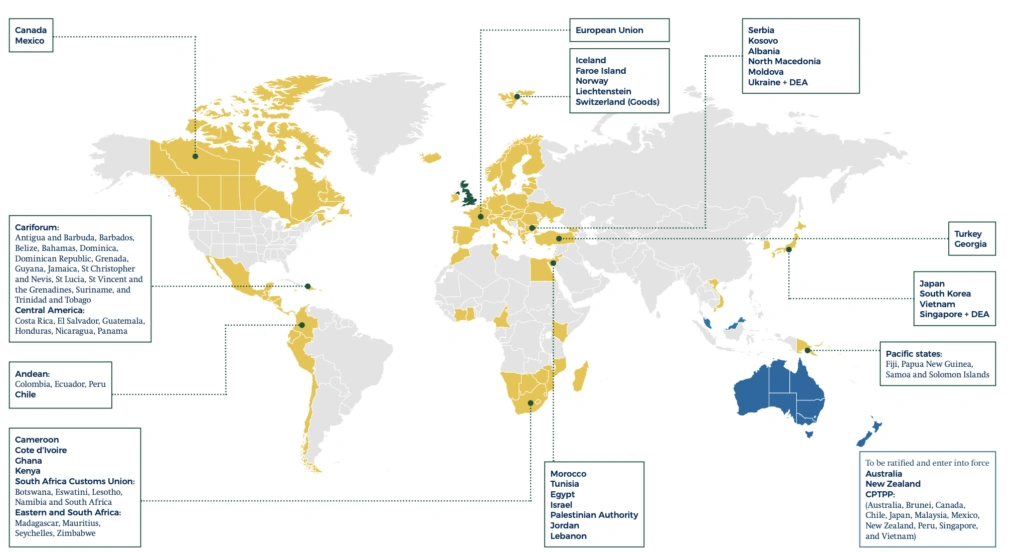

UK FTAs in force as at April 2023

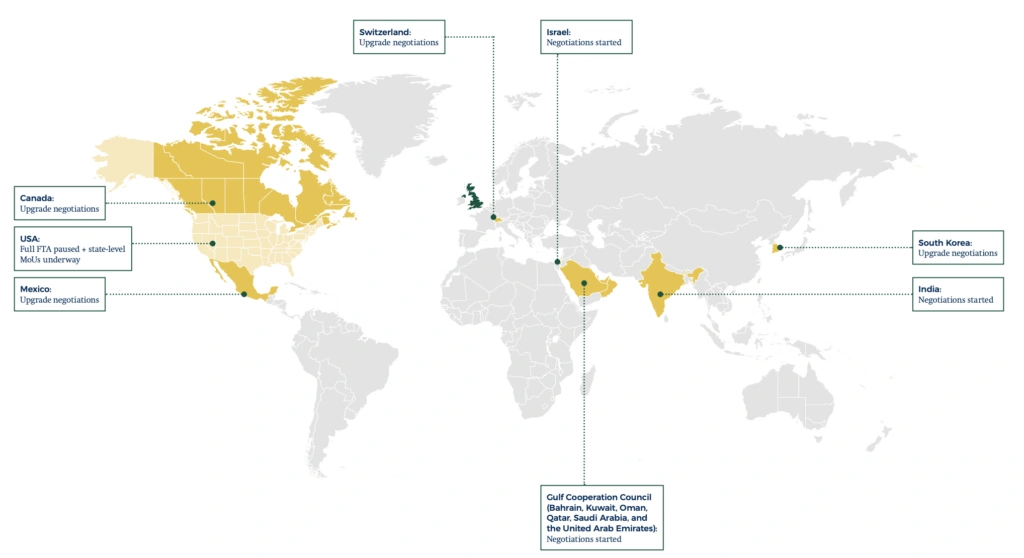

UK FTAs under negotiation as at April 2023

Let’s examine how FTAs affect trade compliance for firms in the UK in more detail.

Rules of Origin

The rules of origin are a crucial component of compliance requirements in free trade agreements. The rules of origin decide whether items are eligible for preferential treatment under an FTA.

Goods must meet the origin requirements outlined in this agreement in order to be eligible for reduced or zero tariffs. These requirements may include using materials sourced from FTA partner countries, meeting product-specific requirements, or meeting other requirements like value-added or regional content requirements.

For UK businesses, adhering to regulations of origin may be difficult.

It necessitates meticulous monitoring and verification of the origin of commodities across the supply chain and an in-depth understanding of the specific regulations of each free trade agreement.

Businesses may face severe financial and operational implications if they violate the rules of origin, which can include fines, increased tariffs, and losing preferential status.

Record-Keeping and Documentation

Another important component of trade compliance that is impacted by free trade agreements is record-keeping and documents.

It often requires firms to keep accurate and full records of all transactions involving the covered products or services.

Businesses in the UK must demonstrate compliance with the rules of origin and other FTA standards by adhering to record-keeping and documents requirements.

It entails keeping thorough and well-organised records, making sure they are easily available for audit or verification needs, and keeping them around for as long as each FTA requires.

The trade compliance and reputation of a firm may suffer from penalties or fines, resulting from noncompliance with record-keeping and documentation standards.

Verifications and audits

FTAs may also require enterprises to conduct audits or verifications to guarantee compliance with the rules of origin and other FTA provisions.

Customs officials or other approved agencies from FTA partner countries may conduct audits or verifications, such as on-site inspections, sample testing, and other verification processes.

It can take a lot of time, effort, and resources to conduct audits and verifications, and businesses must provide comprehensive information, supporting documents, and proof of origin to support their claims.

To guarantee compliance with FTA regulations, UK enterprises need to have strong internal controls, keep correct records, and be ready for audits or verifications.

Fines and remedies

UK businesses may face substantial financial and operational repercussions if they fail to adhere to free trade agreement obligations.

Depending on how serious the violation was, there may be monetary fines, a revocation or suspension of preferential treatment, and other consequences for non-compliance.

It’s critical that UK businesses take proactive steps to guarantee compliance with FTA regulations and are aware of the fines and punishments linked with non-compliance.

Reducing risks and guaranteeing compliance may include making significant investments in comprehensive compliance programmes, carrying out frequent internal audits, and consulting experts.

How can iCustoms help with UK FTA compliance?

One of the top providers of trade compliance technologies, iCustoms.ai, has creative solutions that may help firms in the UK comply with free trade agreements (FTAs).

iCustoms.ai can help UK firms comply with trade agreements under free trade agreements in the following ways:

Automated rules of origin management

The intricate task of managing rules of origin is made simple by iCustoms’ sophisticated algorithms and machine learning rules engine. In order to ascertain whether items qualify for preferential treatment under free trade agreements (FTAs), the platform can precisely gather, validate, and handle the relevant data, guaranteeing adherence to rules of origin regulations.

Customs management

iCustoms customs management software offers real-time compliance checks with customs rules and regulations, generates correct customs documentation, automates data entry, and streamlines customs operations. To guarantee adherence to FTA regulations, the platform also provides functions including tariff categorisation, value management, and duty optimisation.

Data analytics

Businesses may study trade data and spot patterns and trends by using their business intelligence reports. The technology helps firms proactively manage risks and guarantee compliance with FTA regulations by using AI and machine learning to deliver actionable information.

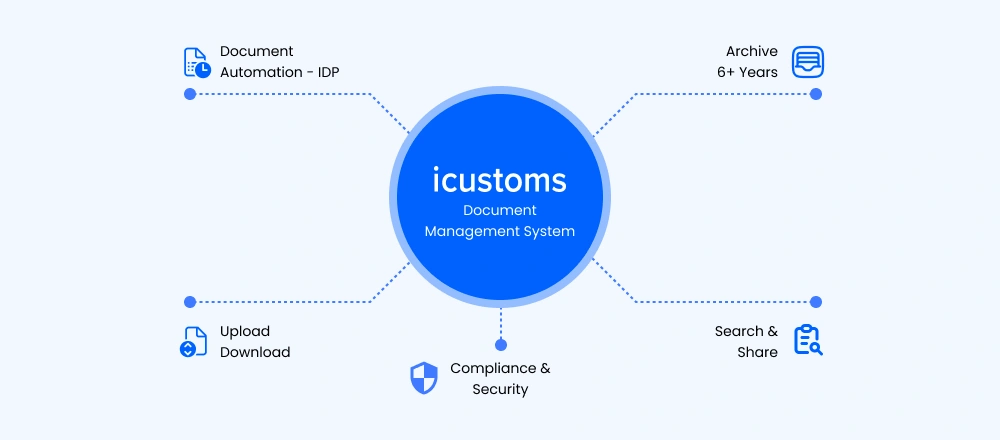

Digital documentation

iCustoms.ai’s digital document management features make the generation, administration, and exchange of trade-related documents easier. By providing features like digital signatures, electronic document production, and document tracking, the platform lowers the possibility of mistakes and delays in documentation while guaranteeing adherence to FTA regulations.

To summarise, iCustoms provides a wide range of trade compliance solutions that can assist firms in the UK in adhering to free trade agreements. Utilising cutting-edge technologies like artificial intelligence (AI), data analytics, and digital documentation, iCustoms helps companies optimise their trade procedures, improve transparency and management of their supply chains, and guarantee adherence to the intricate regulations of free trade agreements (FTAs). This minimises the possibility of non-compliance fines and maximises the advantages and prospects presented by these agreements.

So, get your journey started by scheduling a demo.

And info@icustoms.ai welcomes your inquiries.