Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Understanding Harmonized System (HS) Codes

-

Freya Jane

- Director of Customer's Success

The Harmonized System (HS) is an internationally recognised classification system for categorising and identifying traded products. The World Customs Organization (WCO) developed and maintains it. The HS assigns unique codes to products based on their composition, characteristics, and intended use. These codes, known as tariff codes or HS codes, are standardised across countries and facilitate the smooth flow of goods in global trade.

The primary purpose of the Harmonised Tariff System is to provide a common language for customs authorities, traders, and statisticians to classify products uniformly. It enables countries to classify goods consistently for customs procedures, tariff calculations, trade data collection, and analysis. Having a harmonised classification system promotes transparency, simplifies customs processes, and ensures fair trade practices.

Importance of HS codes in global trade

The importance of HS codes in international trade cannot be denied. A study conducted by Geopard shows its importance,

“Almost $19 trillion of products are being traded worldwide every year.”

This figure illustrates how widely used HS codes are in international trade. It stresses how crucial it is for any business engaged in international trade to comprehend and appropriately use HS codes. Products without the appropriate HS codes may be subject to delays at customs, unanticipated fees or charges, and disruptions in the flow of international commerce as a whole.

Harmonized System Structure HS Code

The hierarchical harmonised commodity description classifies items uniformly across nations. Customs officials, businessmen, and statisticians can precisely categorise items using the codes provided at each level of the system. The Harmonised System’s structure differs in detail.

Some chapters have broad categories, while others contain precise subheadings and tariff codes. International trade and product nature determine specificity. Classifying items, calculating tariffs, customs processes, and analysing trade data require knowledge of the Harmonised commodity and coding System. It helps nations communicate, harmonise trade data, and execute trade policy.

Learn more about HS codes for importers & exporters. Read here!

The Function and Goal of HS Codes

Explaining Why HS Codes Matter in International Trade

A standardised classification system known as HS codes is used to identify and classify goods that are traded globally. They are essential in facilitating consistency and clarity in product classification across international boundaries, promoting efficient product movement across nations. This consistency is required for proper customs clearance, taxation, and trade statistics.

Participation in Paperwork and Customs Clearance

In customs procedures, HS codes play a crucial role by helping customs officials determine which tariffs, charges, and regulations apply to imported and exported products. They are an essential part of trade documentation, assuring compliance with regulations and assisting customs inspectors in accurately determining the nature of the items being carried.

How HS Codes Standardise the Classification of Goods Globally

HS codes establish a uniform method for the consistent categorisation of products around the world. HS codes facilitate a common language for trade by giving each product an identifiable code, regardless of where it comes from. This makes it simpler for companies, governments, and international agencies to categorise and monitor goods across international borders.

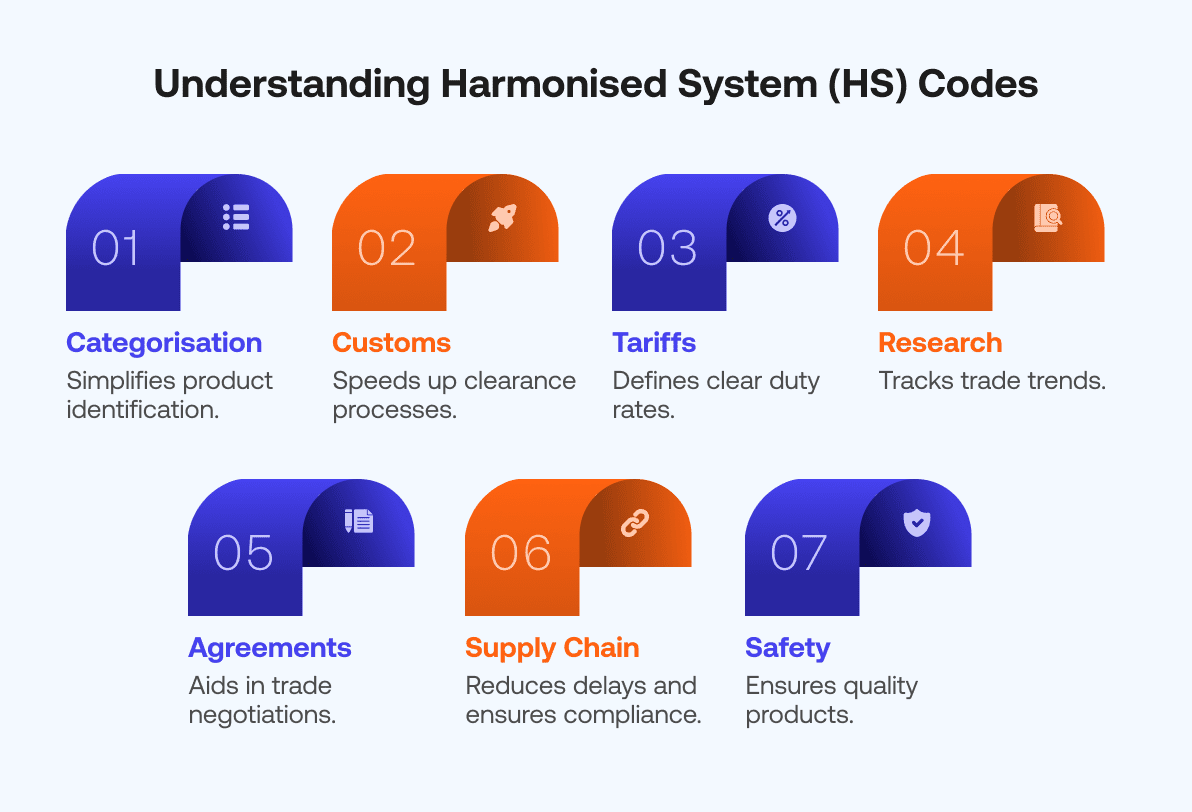

Importance of the Harmonized System in Global Trading

Global trading is immensely important for the better flow of the world economy and the survival of all countries. The harmonised system code plays a crucial role in international commerce by providing a standard framework for the identification and classification of products. Its significance derives from the following factors:

Regular Categorisation

Global harmonisation code systems across the world have uniqueness and balance, which makes it easy to trade. The classification system helps customs traders and inspection authorities easily verify the goods through unique and similar six-digit codes.

Aiding with Customs Clearance

A smooth customs experience gives the customs officers an advantage in checking the goods code along with the duty taxes for a deduction. This saves time, provides maximum efficiency, and also fulfils the requirements based on the HS code of products.

Setting Tariffs

The Harmonised Commodity Description and Coding System underpins customs taxes and trade regulations. HS codes let governments set import duties and VAT in a clear and predictable manner. Based on HS codes and tariff rates, businesses may determine import/export costs and make market entry and pricing choices.

Market Research

The HS collects and analyses worldwide trade information. HS-coded trade data helps companies track trade flows, gauge economic performance, analyse market trends, and formulate trade policy. The uniform categorisation system facilitates global, regional, and national trade data comparisons and analysis.

Trade Agreement Harmonisation

Trade deal discussions use the HS. The unified product categorisation helps nations harmonise their trade commitments and responsibilities. Harmonisation commodity description of HS codes aids trade cooperation, regional integration, and free trade agreements.

Management of the Supply Chain

HS streamlines worldwide supply networks for businesses. HTS code categorisation guarantees customs compliance, reduces delays and fines, and streamlines cross-border shipping. It manages inventory, logistics, and product tracking throughout the supply chain.

Safety for Shoppers

The HS Nomenclature helps consumers by identifying and tracking items. HS-coded labelling, packaging, and product descriptions help consumers choose safe, high-quality products.

Guarantee accurate HS code classification with iCustoms’ iClassification tool. Start Now!

How Do You Stay Compliant with Harmonized System Updates and Revisions?

To stay compliant with Harmonised system tariff updates and revisions, it is essential to adopt a proactive approach and stay informed about any changes in the classification system. Regularly monitor official sources such as the World Customs Organization (WCO) website, national customs authorities, and trade publications for updates and revisions. Review the modifications carefully to understand their impact on your business.

Assess how changes affect your product classifications and ensure that your internal systems and documentation are updated accordingly. Seek expert advice from customs experts or trade consultants to clarify any uncertainties and ensure accurate product classification. Train and educate your staff on the updates and revisions, and collaborate with customs authorities to stay updated on regulations and receive guidance when needed. Conduct regular internal audits to identify and rectify any non-compliance issues.

Engage in industry networks and forums to exchange experiences and insights with peers. By staying proactive, educated, and engaged, businesses can comply with HS code 2023 updates and revisions, ensuring accurate classification and international trade regulations.

iCustoms Role in Harmonized System Code

iCustoms is a customs clearance platform that provides multiple services to its customers. It is an HMRC-recognised enterprise that provides customs declaration services, including product classification and HS code lookup. The iCustoms harmonised system code provides the HS lookup tool, which promptly gives the accurate UK commodity code with respect to the product description. It has divided the process into code lookup, mapping, bulk upload, and validation steps. Its harmonised system code UK gives it the advantage of getting codes for both importing and exporting.

iCustoms is a leading customs declaration service platform that ensures a smooth customs experience. The features it provides follow EU customs rules and regulations and are purely authentic. The classification service allows users to classify their goods for both import and export. It includes different fragments, which ensure that goods and documentation contain all the relevant information to avoid rejections from HMRC.

Conclusion

The Harmonized System HS code is fundamental to international commerce because it promotes streamlined customs clearance processes, precise data analysis, and effective management of global supply chains. Knowledge and use of HS provide companies with the tools they need to successfully negotiate the nuances of international commerce, streamline internal processes, and expand into new markets throughout the world.

These commodity codes HMRC offer a consistent categorisation framework, simplifying product identification, easing customs operations, and ensuring conformity with trade rules. By accurately assigning HS codes, firms may traverse the difficulties of global trade more successfully, boost customs compliance, and gain a competitive advantage in the worldwide market.

Prepared to use HS codes to simplify international trade? Expand your market reach easily, maintain compliance, and handle global commerce easily with iCustoms.

Discover how to transform your customs processes with iCustoms' iClassification software.

FAQs

What is the Harmonised System code UK?

Using product-specific codes, the HS code classifies products for customs and trade purposes in the United Kingdom.

How does the Harmonised System Code work globally?

The HS code is used to classify things globally in a uniform manner, which facilitates trade and customs procedures.

How does the Harmonised System of Classification benefit international trade?

The HSC improves trade statistics accuracy internationally, streamlines customs, and assists in determining tariffs.

How are the Harmonized System Codes for particular items determined?

Harmonised System Codes are assigned to products based on their qualities, materials utilised, and intended function.