Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

HS Code: A Comprehensive Guide for Importers and Exporters

-

Freya Jane

- Director of Customer's Success

According to a report by Gepard,

“HS codes create a consistent framework worldwide, which resulted in the selling of goods worth $19 trillion each year.”

What is the Harmonized System of Coding (HS Code)?

An internationally recognised system of names and numbers used to categorise traded products is called the Harmonised System of Coding (HS Code), also referred to as the Harmonised Commodity Description and Coding System.

This commodities code system was introduced in 1988 by the WCO (World Customs Organization). Customs officials, statistics organisations, and other government regulatory organisations use it to track and manage the import and export of commodities.

The HS Code's Key Features

Universal: More than 200 economies and countries utilise the Harmonised System Code globally.

Standardised: The hierarchical structure of the commodity code guarantees uniform classification of commodities among nations.

Extensive: With a distinct six-digit number for each commodity group, the HS number covers around 98% of commodity categories.

Dynamic: The HS Code is changed frequently to take into account new items and modifications to international trade trends.

Benefits of the HS Code

Facilitates Trade: Importing and exporting items is made faster and less expensive by the HS Code, which also streamlines customs procedures.

Improves Trade Data: The HS Code makes it possible to gather precise and comparable trade data, which is crucial for businesses and governments to make well-informed decisions.

Encourages Fair Competition: The HS Code makes sure that all traders, regardless of where they are from, are subject to the same customs laws and fees.

Want to know more about Harmonised System Code? Read out!

Why is Hs Code Required?

There are indefinite reasons why these HTS codes are required. Some of the reasons include:

- Customs declaration: Clearance of customs is required when goods cross an international boundary. The right tariffs, taxes, and levies should be applied to the products, according to customs officials with the use of HS codes. This is crucial to prevent the importation of restricted or forbidden goods and to make sure that the government receives the appropriate amount of tax money.

- Trade statistics: HS codes make it easier to follow the movement of commodities between nations, which is critical for gauging global trade and economic expansion. Governments, corporations, and international organisations use trade statistics to help them make well-informed policy choices.

- Regulation of products: HS code can be used to regulate the products that pose threats to consumer health, safety, or the environment. For instance, the usage of HS codes helps to correctly identify and ensure the regulation of products like chemicals, pharmaceuticals, and food.

- Access to markets: In order to enhance market access, HS codes are frequently utilised in international trade discussions. Countries can guarantee that their products are correctly categorised and that they have fair and equal access to each other’s markets by agreeing on HS codes.

Although these Hs-codes are used worldwide, here, our main focus is on Hs code UK. Gov.UK has created a platform for its users to detect and get accurate Hs codes for UK with respect to their goods. This platform will help you get the customs Hs code. The HMRC HS codes is a huge platform specially designed for importers and exporters of the UK. In this regard, iCustoms gives you an opportunity to make your customs work easy for both importers and exporters. Templates, easy format and simple steps enable you to save time and money.

How to Use an HS Code Finder to Identify HS Codes for Your Goods?

A program or piece of software called a “harmonised code finder or HS code lookup tool” enables customers to look up the correct HS code for their particular goods.

A list of potential UK Hs codes that fit the product description is often generated once a description of the item is entered. Businesses that export or import products may find this tool valuable as it can help ensure the proper HS code. Further, it will be used to calculate taxes and tariffs correctly.

The terms Hs code finder and Hs code checker are the same. But, it varies upon the state as every country’s government has now developed its own platform. What we need to understand most is how it works. There are five simple steps:

- Product description: The first step is to give a thorough description of the product you want to categorise. This could include its construction material, intended use, size, and any other pertinent information.

- Choose a harmonised code finder: Several standardised code finder tools, including those offered by customs officials and private businesses, are accessible online. Pick one that applies to your nation and industry.

- Input the description: Enter the product’s description into the harmonised code finder tool. Be sure to be as thorough and precise as you can.

- Review the results: A list of potential HS codes that fit your product description will be generated by the programme. Examine each code to see which is best for your goods.

- Check the code: Once you’ve determined the exact code, confirm its accuracy with your customs department or a customs broker.

Get accurate HS codes in seconds with iCustoms’ iClassification. Start Now!

Example

In order to find the HS code for the product name “Frank Body Cherry Lip Scrub 15ml”. The first step you take is to go to the trade tariff website. You need to keep in mind that you get the exact product description in the tariff with 98% accuracy, as codes are basic and general.

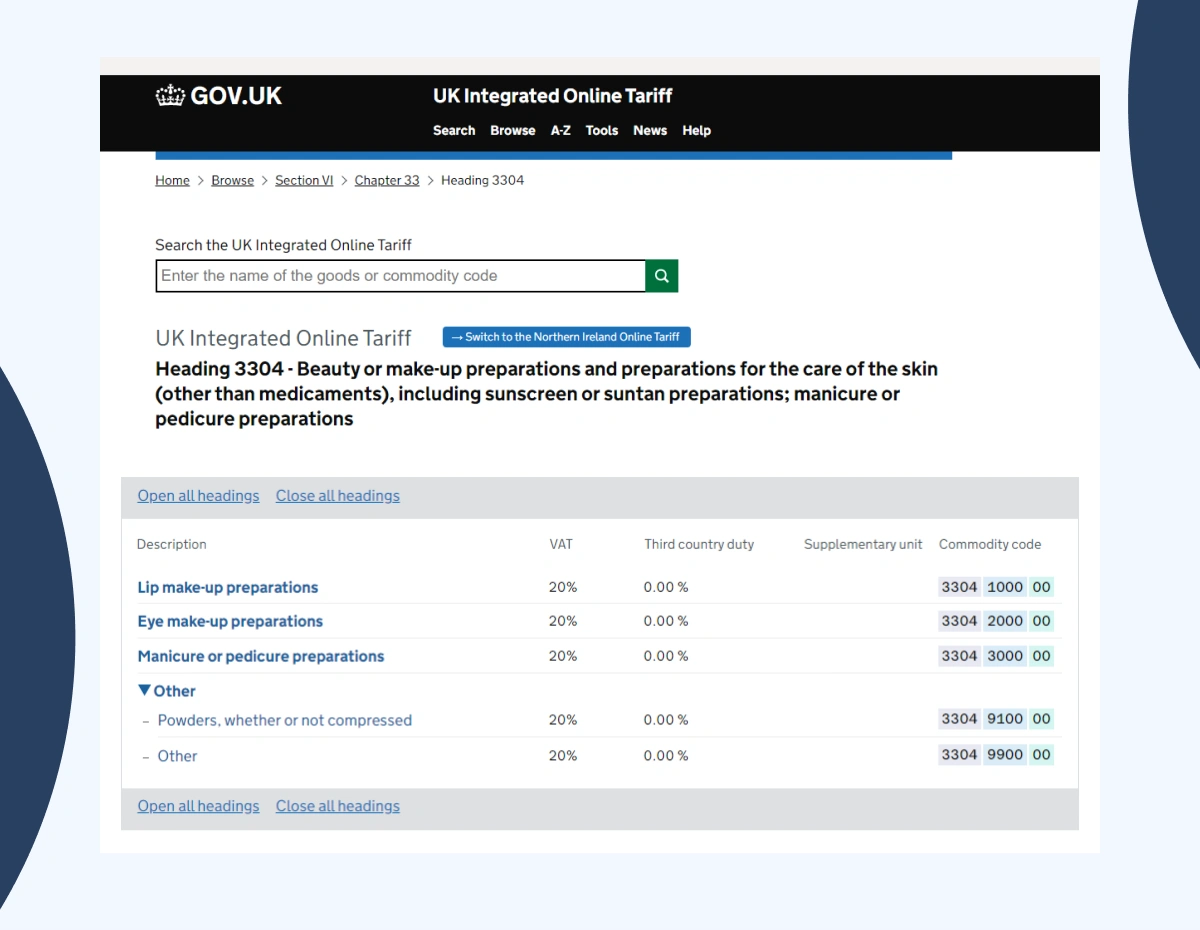

Moving Forward, you can search for your product prior to getting the code and then type the major keyword from the product name. From the demo, we get the basic idea that it is a cosmetic product used for lips. You can choose cosmetics, beauty, or lip balm, to be more specific. You have to type the word in the box as per image section 1.

On clicking enter, it will take you according to your keyword direction. Following the code structure will lead you to the correct UK Hs code of the item as per section 2 in the image.

HS Code Finder

UK Integrated Online Tariff

Best match Products Name or products description , you can select any of them to check and calculate duty rate, VAT rate and total landed cost.

- Searching...

This tariff information is for the UK only

Classification of Harmonised System Code (HS2, HS4 and HS6)

The ten-digit Harmonised System (HS) code is divided into three different levels: HS2, HS4, and HS6.

HS2

The first two digits of the HS code, or “HS2,” provide a wide range of product classifications. For example, HS code 62 is for clothing and accessories, and HS code 70 is for jewellery.

HS4

Going on to HS4, this level of classification offers a more precise identification and includes the first four digits of the HS code. For example, women’s suits, ensembles, jackets, blazers, dresses, skirts, divided skirts, trousers, bibs and brace, breeches and shorts (other than swimming clothes)’ are classified under HS code 6204, while fake jewellery is classified under HS code 7117.

HS6

HS6, denoted by the first six digits of the HS code, provides the most detailed classification level. For example, cufflinks and studs are classified under HS code 7117 11, while suits for women or girls made of wool or fine animal hair are classified under HS code 6204 11.

Harmonised System Code in International Trade

The various HS categorisation levels have diverse applications. HS4 and HS6 codes provide precise information which is beneficial for enterprises involved in international trade, customs officials, and policymakers. HS2 codes are useful for gaining a broad overview of international trade in many product categories.

The first six digits are globally recognised, and the same, but the last four digits vary from country to country. It is because each nation has the freedom to alter the code to suit its unique requirements and internal laws. The first six numbers, however, are constant throughout all nations that employ the HS system. iCustoms provides you with the ease of getting the UK-specified codes for both imports and exports.

Conclusion

The HS codes are vital in customs declarations because one has to specify the products which are exported or imported for inspection and validation. The harmonised code gives you the advantage of switching to different names of the same product to specify the same product with different descriptions in one code. These are easy to validate and remember and are worldwide known, which makes it easy to import and export.

Experience hassle-free HS code identification and reduce the risk of penalties with iClassification!

Frequently Asked Questions

What are HS codes?

HS codes are internationally recognised codes that are used to categorise goods for trade. They are necessary for clearing customs and making sure the appropriate taxes and fees are paid.

What is the HS code in the shipping?

When shipping, the HS code is used to identify and categorise items for customs purposes. It is used in bills of lading, commercial invoices, and other shipping documents.

Are HS codes different for each country?

Globally, HS codes are the same; however, some countries may add digits to the code number to further distinguish things for their own customs and tax needs.

How do I find the HS code for my product?

To determine the HS code of a product, one may seek guidance from customs authorities or utilise classification databases available online.

You may also like

Streamline Product Classification

Uncover iClassification for precise Global Trade, Delivering Time-Saving Accuracy.

Subscribe to our Newsletter

About iCustoms

Streamline Product Classification

Uncover iClassification for precise Global Trade, Delivering Time-Saving Accuracy.