Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Intelligent Document Processing Solutions in Trade Compliance

-

Freya Jane

- Director of Customer's Success

Trade compliance is an essential element in guaranteeing ethical and lawful behaviour in business operations; it entails the strict observance of both national and international regulations. Trade compliance is an important component of global business since organisations must follow multiple laws, accurately document their transactions, and fulfil specific standards while doing international trade, which can be made easy with intelligent document processing solutions.

It can be difficult to navigate this landscape because of the many rules controlling international trade, the complicated network of regulations, and the substantial documentation requirements. It requires meticulous attention to detail, continuous regulatory updates, and the capacity to find one’s way through an intricate web of documentation.

Here enter smart, intelligent document solutions. This technological innovation marks a substantial progression in the management of trade compliance documentation. It processes and manages trade compliance paperwork through automation, artificial intelligence, and complex algorithms.

Challenges of trade compliance documentation

The trade compliance documentation requirements are complex and present major obstacles for businesses that trade internationally. These challenges include a number of crucial elements:

Regulatory Complexity

International trading necessitates compliance with an array of regulations and legislation from several countries. Every country has its own laws controlling product standards, tariffs, quotas, imports, and exports. It can be quite difficult to navigate this web of requirements and ensure compliance.

Huge amounts of paperwork

Managing and processing a substantial amount of documentation is necessary for trade compliance. It includes different documents such as origin certificates, invoices, bills of lading, and customs declarations, among others, which require careful handling.

Various document formats

In international trade, documents frequently have different formats, languages, and structural elements. Managing this variability makes it more difficult to extract and interpret crucial information correctly.

Regulatory requirements

Trade regulations and legislation are updated on a regular basis, requiring businesses to adjust their compliance practices to meet the current standards constantly. This continual evolution necessitates vigilance to maintain compliance with the most recent regulations.

Deadline pressure

Due to the time-sensitive nature of these procedures, meeting deadlines for import and export document submissions is critical. Any delays or mistakes in these documents can result in noncompliance penalties and supply chain disruptions.

Streamlining trade compliance with intelligent document processing solutions

Intelligent Document Processing Software automates crucial procedures, drastically transforming the trade compliance environment:

- Effective Document Management: IDP reduces manual handling and inefficient storage by digitising and organising documents.

- Accelerated Data Extraction: Automation increases accuracy and efficiency by extracting important information from documents more quickly.

- Accuracy and Compliance: IDP validates data against predetermined guidelines and regulations to guarantee accuracy and compliance.

- Risk Mitigation: Automated data analysis reveals potential compliance concerns ahead of time, allowing for proactive risk-reducing actions.

- Workflow Optimisation: AI document processing optimises workflows, which increases working efficiency and reduces the need for manual work.

How to implement iCustoms’s Intelligent Document Processing Solutions in trade compliance

Integrating iCustoms Intelligent Document Processing (IDP) technology into trade compliance involves numerous methodical steps, all of which serve to streamline the compliance process:

Uploading and scanning documents

The first step is to scan and upload trade-related papers into the IDP system. These documents may include origin certificates, bills of lading, customs declarations, invoices, etc. These documents are effectively digitised and saved by the IDP system.

Document Preparation

The IDP solution arranges and gets the documents ready for processing after they are uploaded. This phase entails ensuring that the papers are in a format appropriate for further analysis. To make extraction and validation simpler, it could entail standardising formats, organising data, or classifying documents.

Automatic extraction of data

The IDP solution automatically extracts data by using sophisticated machine-learning algorithms. It locates and extracts crucial data from the documents, including product specifications, amounts, costs, and relevant dates. This automatic extraction considerably minimises the time-consuming manual work necessary for data collecting.

Verification and Validation of Data

The IDP system performs thorough validation and verification procedures after data extraction. It verifies that the extracted data complies with established guidelines, formats, and standards of compliance. By taking this step, the information taken from the papers is guaranteed to be accurate and compliant.

Automated Data Analysis

The IDP system conducts automated data analysis after validation. It delves further into the retrieved data using analytical tools and algorithms to spot trends, patterns, and possible compliance issues. This analysis offers insightful information to support decision-making and compliance strategy optimisation.

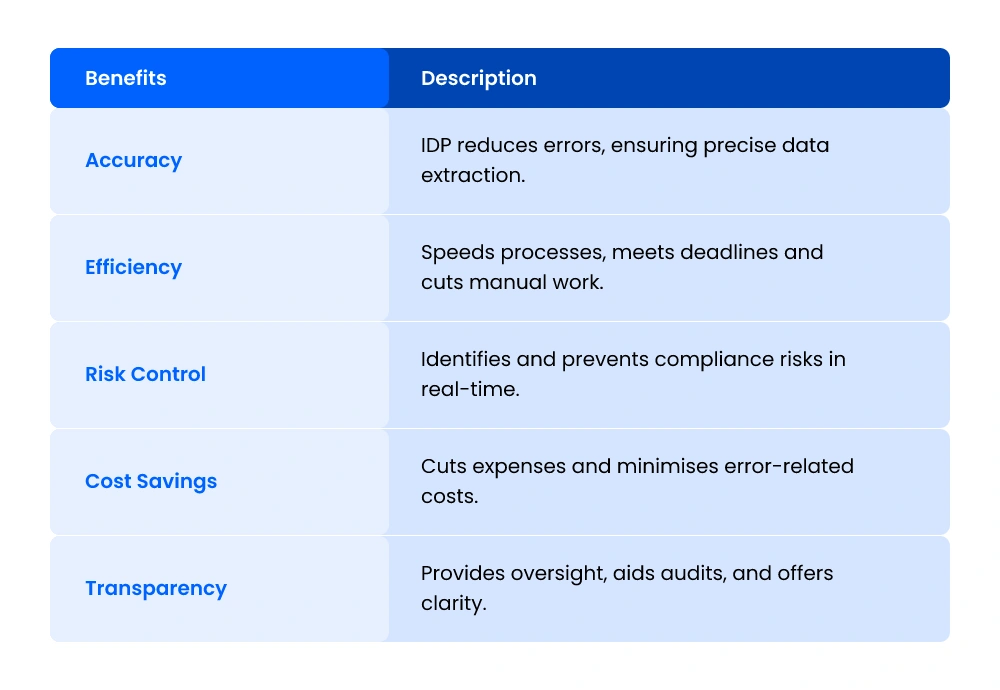

Benefits of IDP for Trade Compliance

The integration of Intelligent Document Processing (IDP) into trade compliance processes offers numerous substantial advantages that facilitate streamlined operations and improve compliance:

Enhanced accuracy

When compared to manual approaches, IDP dramatically increases the accuracy of data extraction and processing. Automation lowers human error in document handling and information extraction. IDP reduces the possibility of errors and non-compliance by guaranteeing higher levels of accuracy in compliance-related data.

Enhanced efficiency

IDP’s automation significantly reduces the time necessary to process trade-related documents. Certain tasks that previously required substantial manual labour, including data input and validation, are presently handled with efficiency and precision by the system. This effectiveness speeds up the compliance process, allowing companies to fulfil deadlines and optimise their processes more successfully.

Improved risk mitigation

The ability of IDP to do automated data analysis is essential for risk reduction. The technology detects and flags risks in real time by continuously analysing data for compliance patterns, inconsistencies, or possible problems. By taking a proactive approach, compliance officers can minimise the chance of compliance violations and related risks by acting promptly to address issues.

Cost reduction

IDP’s efficiency and accuracy translate into cost benefits for organisations. Reduced manual effort and improved processes result in decreased operational expenses connected with compliance duties. Furthermore, the reduced likelihood of errors and related penalties or disruptions contributes to cost savings.

Increased transparency

Intelligent document management, handling, and data processing increase transparency in the compliance process. It provides a thorough overview of the whole compliance process, including data extraction and validation, as well as document uploading. In addition to guaranteeing accountability, this openness makes regulatory inspections and audits easier.

The Bottom Line

Intelligent Document Processing (IDP) revolutionises trade compliance through the seamless integration of automation powered by artificial intelligence. Its accuracy and efficiency provide correctness and compliance with changing rules by streamlining complex documentation processes. IDP is more than simply a tool; it’s a strategic asset that helps businesses succeed in the competitive international marketplace and manage the complexities of compliance.

Ready to revolutionise your trade compliance? Find out how the Intelligent Document Processing solution from iCustoms may improve the effectiveness of your business in international trade. Reach out to us right now to see the difference!

FAQ's

What is intelligent document processing?

IDP improves accuracy and efficiency while managing large amounts of data from various documents by using automation and AI for data extraction and analysis.

What is the difference between OCR and intelligent document processing?

OCR is primarily concerned with turning scanned documents into editable text. In contrast, IDP goes beyond text extraction by combining OCR, AI, and machine learning to read, process, and analyse data within documents intelligently.

How does intelligent document processing work?

Intelligent document processing analyses, extracts, and validates data from documents before integrating it into systems using AI algorithms. It streamlines workflows by automating processes, including gathering information, document submitting, validation, and analysis.

What is the benefit of intelligent document processing?

IDP reduces manual labour and errors while greatly increasing document handling speed, accuracy, and efficiency. It improves compliance, speeds up document processing, reduces costs, and facilitates improved decision-making.

You may also like:

Struggling to Extract, Catagorise & Validate Your Documents?

Capture & Upload Data in Seconds with AI & Machine Learning

Subscribe to our Newsletter

About iCustoms

Struggling to Extract, Catagorise & Validate Your Documents?

Capture & Upload Data in Seconds with AI & Machine Learning