Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Supply Chain Innovation: A Deep Dive Into iCustoms AI Solutions

-

Freya Jane

- Director of Customer's Success

The global trading market values operational speed and precision in today’s digital age. Businesses that participate in complicated supply chain management face substantial obstacles in customs-related activities. Manual customs processes frequently slow down the complex supply chain. Thus, there is a growing need for both highly intelligent and very efficient solutions.

As per McKinsey’s report,

“The average supply chain is 43% digital, and the businesses that digitalise their supply chain can see a 3.2% increase in earnings before taxes and interest and 2.3% in annual revenue.”

This is where iCustoms steps in. By means of its artificial intelligence-driven customs software, iCustoms not only tackles obstacles but also advances the industry, setting new standards for accuracy and efficiency in the ever-changing realm of international trade.

This article examines the challenges that custom businesses confront in the rapidly evolving supply chain innovation environment. It provides useful insights and highlights the vital role that iCustoms plays in advancing the industry.

What is supply chain management (SCM)?

To understand the core purpose of supply chain management, first, let’s understand the concept of the supply chain:

A network for an organisation to carry out the processing activities of goods or services from raw materials to manufactured form and then from their source to the final destination. It runs through the channel from the supplier to the customers.

- Procurement

- Product lifecycle management

- Supply chain planning

- Fleet management

- Order management

Innovations in supply chain management have improved customs processes. Artificial intelligence-based programmes have improved customs documentation. While innovations in supply chain management have improved customs processes, challenges persist. Common hurdles include unpredictable delays, accuracy issues, cost inefficiencies, freight forwarding hassles, and the need to keep up with rapid technological advancements.

Domains of supply chain management

In supply chain management, various management software applications are employed, each with a distinct purpose. These softwares strengthen different company’s departments, which together determine success. It includes ERP, TMS, WMS, Customs Brokerage, E-Commerce and Freight Forwarding.

Integration of Legacy Systems

ERP software helps companies manage and connect fundamental business operations and functions across departments and divisions. ERP solutions centralise and automate many corporate processes, such as finance, human resources, CRM (customer relationship management), production, marketing, and reporting.

Transportation Management System (TMS):

Businesses that need to move goods or products can benefit the most from Transportation management system software. Examples include traders, distributors, and retailers. It helps firms reduce transportation costs, have quicker delivery times, manage risks, and track shipments.

Warehouse Management System (WMS):

WMS software helps businesses consolidate their warehouse operations, ensure their inventory is correct, handle orders better, and make their warehouses more productive overall. Warehouse management system systems benefit companies with massive warehouses or distribution centres, such as stores, e-commerce, and transportation companies.

Customs brokerage:

Customs brokerage is a highly specialised service offered by customs brokers. It is also known as customs brokerage services or customs clearing. Their assistance in navigating government agencies’ complex and ever-changing customs procedures speeds up commodity import and export.

Freight forwarding:

Freight forwarding also refers to transporting goods and services by any means. It resembles TMS, as it’s crucial for cross-border trade. The businesses involved in customs clearing use freight forwarding services to simplify import and export.

E-commerce:

The worldwide nature of e-commerce presents regulatory issues and opportunities for customs operations. To facilitate smooth and safe cross-border trade, customs agencies have changed their processes to account for the specifics of e-business.

Challenges in Customs and SCM

Even though we have discussed what SCM is for and its importance in the customs market. However, businesses need help when using supply chain software. Some common issues that firms face include

iCustoms Innovation in the Supply Chain Industry

Customs and supply chains are intricately linked, yet few solutions immaculately integrate with both. iCustoms bridges this gap, providing end-to-end customs declaration management for imports and exports. Services like iClassification, iDP, iDM, and iCalculator, driven by AI and smart algorithms, ensure timely and accurate customs declarations. Modernising customs procedures, iCustoms connects various supply chain domains, enhancing efficiency, fostering trade opportunities, and ensuring reliability.

iCustoms is an end-to-end solution for managing the customs declaration for both import and export. It served as an efficient tool for businesses to manage their customs operations. Artificial intelligence and smart algorithms in iCustoms save time and provide accurate results and successful declarations in one go.

It has modernised customs procedures by automating documentation and simplifying shipment tracking. Its suite of products independently integrates with all aspects of supply chain management, transforming complex customs declarations into a reliable structure and innovative process. It connects various supply chain domains; iCustoms enhances business efficiency, fosters trade opportunities, and upholds reliability.

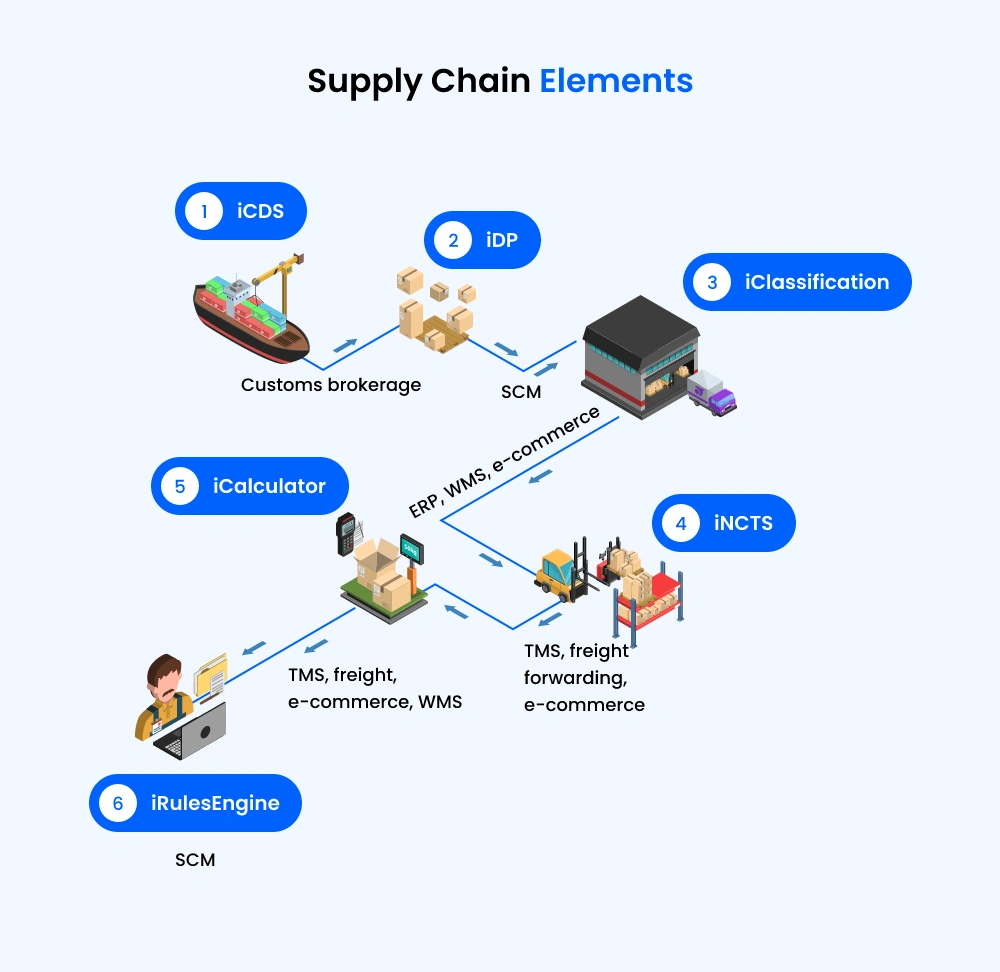

Reliable iCustoms Integration with Supply Chain Industry

It’s essential to grasp how iCustoms intelligently integrates with various SCM software. iCustoms achieves this through APIs, making it a versatile platform. Explore iCDS, iDP, iClassification, iNCTS, iCalculator, and iRulesEngine-each tailored to optimise specific customs processes and effortlessly integrate with your supply chain software.

iCDS:

The fundamental service of iCustoms is providing customs clearance services to firms or individual traders. iCDS tool uses smart automation to make declarations easier and quicker. iCDS is correlated with supply chain automation because enterprises must deliver goods to maintain stability.

Moreover, iCDS is also linked with customs brokerage as it upholds the major direction towards a seamless customs declaration.

iDP:

iCustoms offers sophisticated customs document processing. The Customs Declaration Service (CDS) effortlessly integrates all essential documents into the iDP service. After traders or businesses upload documents, this automated solution quickly manages formalities.

It intelligently completes CDS forms and sends HMRC declarations. iDP service is used with all supply chain software as documentation processing is part of every trading phase.

iClassification:

Customs tariff classification is necessary for customs trading. The iClassification service uses the tools of Hs code lookup and Hs mapping to analyse the correct commodity code against the goods with complete descriptions. It also specifies the region-wise tax values to be paid during customs clearance.

For its correlation with the supply chain industry, iClassification corresponds with SCM, WMS, e-commerce and freight forwarding. It is also linked with ERP software because resource planning and order management are phases of this software.

iNCTS:

The service of the New Computerised Transit System provides real-time visibility and monitoring of goods shipments. iNCTS service integrates with the APIs of SCM, freight forwarding, and e-commerce programmes to coordinate with the supply chain industry.

iCalculator:

iCalculator is a service that helps enterprises calculate country-wise duty and VAT charges against goods. This tool provides an accurate amount of charges that helps companies avoid paying extra charges during port entries.

In the supply chain industry, iCalculator integrates with TMS, e-commerce and WMS softwares to help firms achieve efficient supply chain management.

iRulesEngine:

iCustoms provides the iRulesEngine service, a comprehensive resource encompassing customs rules and regulations. This service aids companies in maintaining vigilance and verifying their documentation before declaration submission.

With an extensive library of over 500 RulesEngine sets, it ensures precise and error-free declarations. iRulesEngine intelligently integrates with all supply chain software, enabling companies to experience streamlined and stress-free supply chain management.

Benefits of iCustoms Supply Chain Integration Software

Switching to iCustoms offers customs businesses AI-based solutions for supply chain optimisation. Benefits include connecting with SCM domains, real-time visibility, error reduction, cost efficiency, and compliance assurance. With iCustoms, you can thrive in the competitive supply chain industry while ensuring regulatory adherence.

Connecting SCM’s domain

Connecting and integrating iCustoms’ software into supply chain management (SCM) systems helps businesses comply with technology. This collaboration enables them to foster growth while maintaining regulatory adherence.

Real-time visibility

iCustoms assures adequate monitoring, control, and real-time visibility for the firms in their customs trading.

Error reduction

Trade companies can eliminate the risk of errors associated with manual work by utilising iCustoms’ AI-automated software. This advanced technology ensures high accuracy and reliability in their operations.

Cost efficiency

Organisations can gain a significant advantage in the highly competitive supply chain industry by effectively managing their costs. With iCustoms offering cost-effective compliance services, businesses can increase profitability while ensuring regulatory adherence.

Compliance assurance

Companies can improve compliance and reduce risks by automating customs clearance. Retailers can quickly and accurately submit customs declarations with a few clicks by automating pre-declaration customs data collection, minimising risk, and improving operational efficiency.

Ending Statement

In conclusion, success in today’s dynamic supply chain environment requires customs businesses to pursue innovation actively. When optimising productivity, decreasing overhead, and guaranteeing consistent dependability throughout the supply chain, iCustoms is without peer. It’s time to move forward in the ever-changing world of supply chain management by enhancing your customs operations with iCustoms.

With iCustoms, you can maximise the efficiency of your customs processes. Increase productivity, cut expenses, and guarantee consistency in the ever-changing world of supply chain management. Changing now will provide a better tomorrow.

FAQ's

What is supply chain management?

Supply chain management is the process of managing the complete production and distribution of goods or services, starting from the buying of raw materials and ending with delivery to clients.

What is supply chain sustainability?

The goal of supply chain sustainability is to integrate socially and ecologically conscious practices into the chain while taking the environment, society, and economy into account.

Are logistics and supply chains the same?

No, supply chain management includes logistics as a subset. Logistics pertains to the actual transportation and storage of commodities, whereas supply chain management covers a wider range of activities such as planning, sourcing, production, and distribution.

Is supply chain visibility essential for businesses?

Yes, supply chain visibility is critical for businesses. It offers up-to-date information on the whole supply chain, which facilitates improved decision-making, reduces risks, and boosts overall operational effectiveness.