Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

The End of Duty-Free Imports? Trump’s Bold Move to Reinstate the De Minimis Rule

- Freya Jane

- Director of Customer's Success

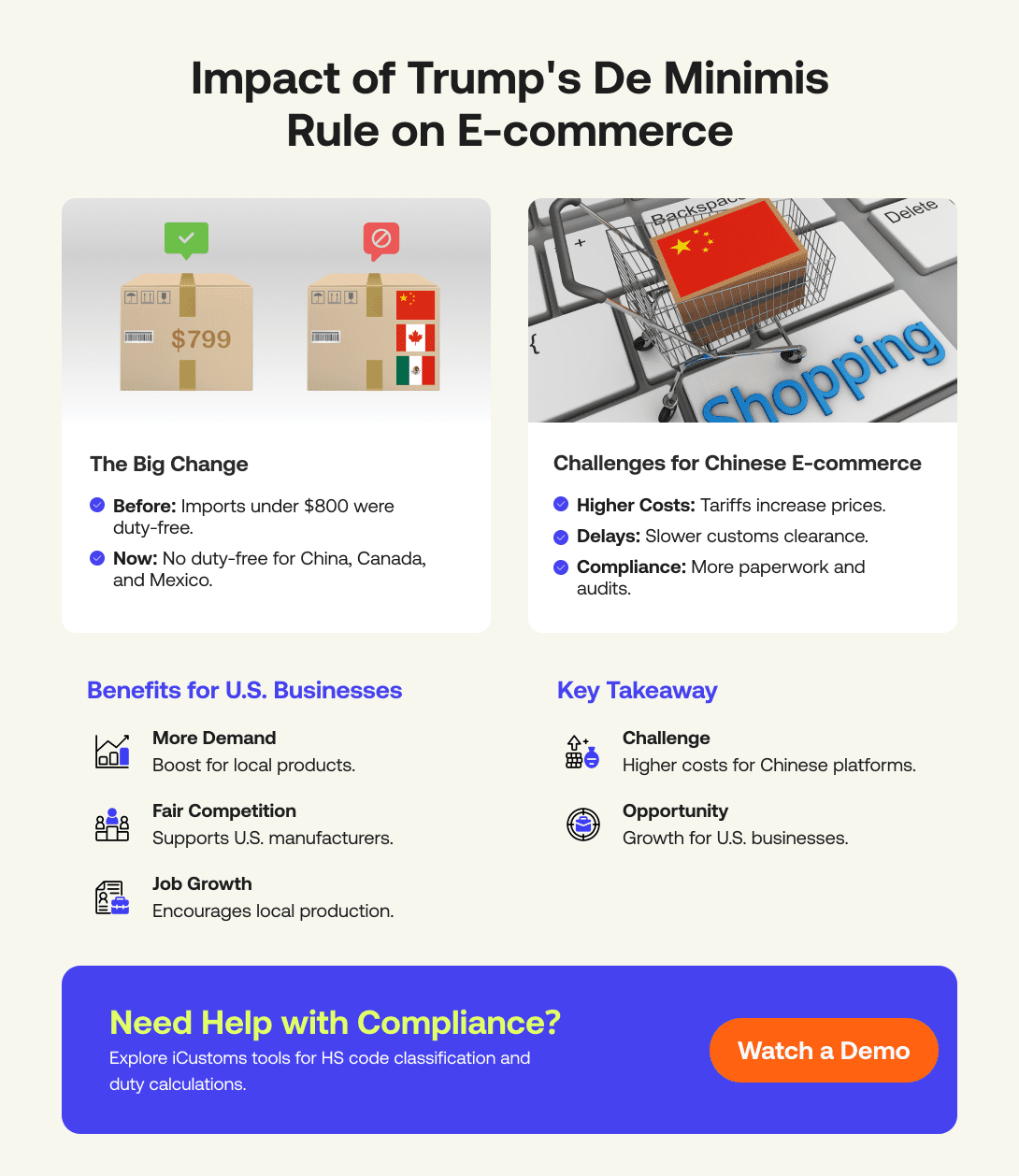

The Trump administration recently proposed significant changes to the de minimis rule to change the dynamics of international trade. This law has long been a pillar of cross-border trade, especially for small enterprises and e-commerce platforms, as it permits imports worth less than $800 to enter the US duty-free.

However, this exemption for imports from China, Canada, and Mexico was revoked by an executive order signed by President Donald Trump on February 1, 2025. With a special focus on reducing the power of Chinese e-commerce giants like Shein and Temu, the move was presented as a calculated attempt to tackle tariff evasion and protect domestic industry.

Objectives of Trump’s modifications

Among the main goals of these modifications are:

- Eliminating trade loopholes: Stopping importers from dividing big shipments into smaller, duty-free packages in order to avoid paying taxes.

- Enhancing enforcement: Increasing scrutiny of Section 321 entries (shipments under $800) to prevent undervaluation and misclassification.

- Protecting domestic industries: Helping US businesses by levelling the playing field with international competition.

This blog post will go into the details of these regulation changes and look at how they affect different stakeholders, such as customs brokers, U.S.-based manufacturers, and e-commerce companies.

Impacts on the E-commerce Sector

For Chinese e-commerce sites like Shein and Temu, which have thrived on the ability to send low-value goods duty-free into the U.S. market, the latest revisions to the de minimis rule present serious obstacles.

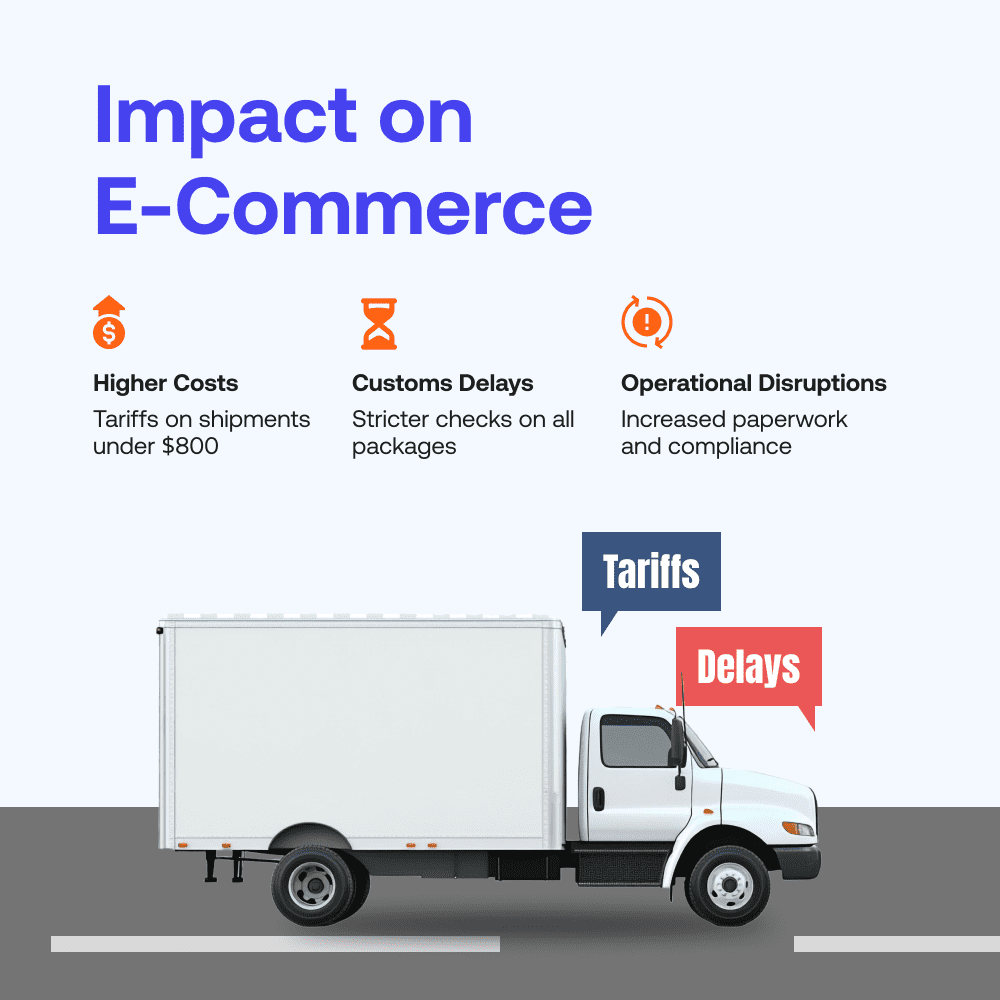

The elimination of the $800 exemption for Chinese imports has resulted in higher customs fees for these businesses, which may reduce their ability to offer competitive prices.

As an example:

- Cost increases: A $799 shipment that was previously duty-free upon entry into the United States could now be subject to tariffs, resulting in significant overhead costs.

- Disturbances in operations: Consumer prices may increase as a result of supply chain efficiencies being disrupted by greater expenses and slower delivery times.

- Customs clearance requirements: Complete customs clearance is now required for even small shipments, which causes delays and adds additional documentation. The procedures for clearing customs, which include thorough paperwork, examinations, and even audits, are time-consuming by nature, adding more complexity.

Furthermore, European e-commerce platforms that operate in the US market are anticipated to face further difficulties as a result of the recently announced 25% tariffs on EU goods.

Higher EU import prices, particularly in industries such as automotive production and luxury products, may result in price increases for American customers and lost competitiveness for European companies.

Key challenges for E-commerce companies

- Higher operating expenses as a result of compliance fees and tariffs.

- Delays in customs that result in longer delivery timeframes.

- Increased chance of audits or seizures due to increased inspection of shipments.

Smaller businesses with narrow profit margins could find it more difficult to absorb these additional expenses and delays, which could push them to look for other markets or rethink their reliance on international trade.

Advantages for U.S. Businesses

Although international e-commerce platforms face difficulties as a result of the de minimis regulation modifications, US-based businesses stand to gain real advantages.

One of the most immediate benefits is a possible boost in demand for locally based products. The elimination of the $800 exemption gives U.S. manufacturers and retailers a competitive advantage when import prices increase for overseas sellers.

Principal advantages for US businesses:

- Increased demand for local products: Customers may start choosing products made in the United States, opening up new markets for American companies.

- Level playing field: In sectors like textiles and clothing, where regional manufacturers have long claimed that fast-fashion merchants undercut their business, stricter enforcement levels the playing field.

- Job creation: By encouraging local production, the revised de minimis framework helps make the US economy more robust and self-sufficient.

For example, small and medium-sized enterprises (SMEs) that make textiles, electronics, or consumer items could see a boost in orders as buyers favour cost-effective, locally available solutions.

The significance of accurate HS code classification

The Harmonised System (HS) code classification is now more important than ever due to recent modifications to the de minimis rule. Determining the appropriate tax rates for goods that were previously exempt under the $800 level requires accurate HS code classification.

Errors in HS code assignment or misclassification can have serious repercussions, such as:

- Shipment delays: Incorrect classification causes lengthy customs and processing delays.

- Fines and penalties: Failure to comply may result in potential fines.

- Reputational damage: A company’s reputation with partners and customs officials may suffer if mistakes are made repeatedly.

In order to overcome these difficulties, iCustoms provides a powerful iClassification tool that helps find accurate HS codes.

Among the tool’s primary characteristics are:

- Automated HS code identification: Precise classification according to product specifications is guaranteed by sophisticated algorithms.

- Real-time duty assessments: Accurate duty rates customised for individual shipments are provided by current regulatory data.

- Simplified documentation: Businesses have less administrative work to do thanks to pre-filled forms and templates.

Furthermore, iCustoms also has a dedicated iCalculator tool for calculating taxes and duties. The calculator, for instance, can be used by a small business importing electronic components from Canada to calculate the associated duties and make sure that the required paperwork is ready ahead of time, which would expedite the customs clearing procedure.

Challenges and criticism of Trump’s changes

The Trump administration’s changes to the de minimis rule have drawn harsh criticism and presented real-world challenges, despite its goals to strengthen trade enforcement and safeguard domestic industries.

Principal challenges:

- E-commerce delays: Consumers and small businesses have been disproportionately impacted by processing time delays brought on by stricter customs procedures.

- Global pushback: The United States faces criticism from the EU and China for upholding its high $800 de minimis level while putting pressure on other countries to reduce trade restrictions.

- Complexity for SMEs: Smaller importers who are not familiar with customs regulations are burdened by new compliance requirements, such as precise HS code categorisation.

Wrapping up

The de minimis rule changes made by the Trump administration represent a significant change in US trade policy that will affect consumers, regulators, and businesses alike. These changes are intended to eliminate gaps, improve enforcement, and preserve local industries from unfair competition by eliminating the $800 exemption for important trading partners like China, Canada, and Mexico.

Ensure compliance with the new regulation with iCustoms advanced AI tools for HS code classification and tax and duty calculation!

See how iCustoms’ HS code finder and duty calculator can help you comply with the recent de minimis regulation!

You may also like:

Simplify Customs with our Powerful Customs Management Software

Automate declarations, track shipments, & ensure compliance.

About iCustoms

Simplify Customs with our Powerful Customs Management Software

Automate declarations, track shipments, & ensure compliance.