Fast & Accurate ENS GB & EU ICS2 Solutions Built for You.

Windsor Framework impact on Customs: The devil is in the details

-

Freya Jane

- Director of Customer's Success

Understanding Windsor Framework and its History

The Windsor Framework, which is a set of new arrangements proposed by the UK government to replace the Northern Ireland Protocol, has significant implications for customs in Northern Ireland. The Protocol, which was agreed as part of the UK’s withdrawal agreement from the EU, introduced customs checks and controls on goods moving between Great Britain and Northern Ireland, effectively creating a customs border in the Irish Sea.

On February 27, 2023, the United Kingdom and European Union agreed to the Windsor Framework. It presents a new set of policies intended to address critical areas:

Restoring Trade Flow: The framework’s main goal is to bring back trade’s seamless flow within the UK’s internal market, eliminating the barriers that have hampered trade operations between the UK’s east and west.

Maintaining Northern Ireland’s Place in the Union: Another crucial element of this framework was maintaining Northern Ireland’s place in the Union.

Resolving the Democratic Deficit: In order to provide a more impartial approach, the Windsor Framework aims to resolve the democratic deficit that existed in the original Northern Ireland Protocol.

On March 24, 2023, these arrangements were formally adopted at the meeting of the Withdrawal Agreement Joint Committee.

Learn more about the key schemes of the Windsor Framework with our detailed guide.

Impact of Windsor Framework on the Customs Industry

Under the Windsor Framework, the UK government aims to restore Northern Ireland’s trading place in the UK internal market and remove the burden of customs checks on goods moving between Northern Ireland and Great Britain.

This will be achieved by disapplying over 1,700 pages of EU law, along with the accompanying European Court of Justice jurisdiction, which will be replaced by core UK internal market rules.

This means that goods moving between Northern Ireland and Great Britain will not be subject to customs checks or tariffs, unless there is a specific risk or intelligence basis to do so.

What research says about the impact of the Windsor Framework on customs:

The Windsor Framework put a set of new arrangements for internal trade, which is named “Green Lane”. This means that products that are sold in Northern Ireland will not be required to undergo unnecessary checks, documentation, and duties.

How “Green Lane’’ is beneficial:

“The ‘green lane’ with reduced checks is a game-changer for businesses. It will streamline trade within the UK and reduce unnecessary costs and delays.” (Business representative)

This saves time and costs and streamlines customs procedures, making trading a breeze for traders.

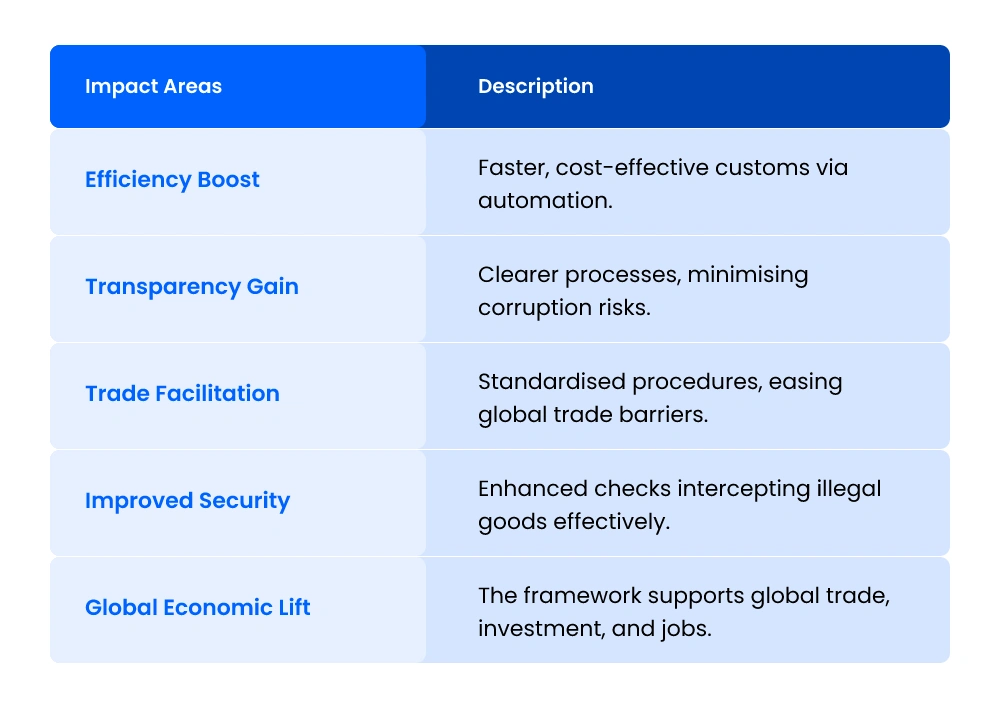

How Windsor Framework Impacts Custom Operations?

1. Speed and Efficiency

The Windsor Framework’s adoption transformed customs procedures, increasing their speed and efficiency. Automated procedures shortened customs clearance times, allowing goods to cross borders faster, saving businesses money and boosting the economy.

2. Increased Transparency

The implementation of more transparent customs procedures substantially diminishes the likelihood of corruption and bribery. Clear regulations and established procedures increased predictability and reliability in global trade operations.

3. A Decrease in Trade Limitations

The Windsor Framework lowered trade obstacles by standardising documentation requirements and customs procedures. This made trade movements easier, which helped big companies and smaller startups that wanted to grow internationally.

4. Enhanced Security and Compliance

The switch to risk-based techniques improved customs’ ability to assure regulatory compliance while focusing on security issues. Customs agents enhanced their ability to intercept illegal products by targeting high-risk shipments, bolstering national security.

5. Impact on the Global Economy

The influence of the Windsor Framework extended beyond national boundaries since it promoted a more favourable environment for international trade. It supported cross-border investment, job development, and the trade of products and services.

Devil is in the Details

The products transported from Northern Ireland to the EU must still be declared following customs rules and subject to all checks and restrictions under European Union law.

This implies that companies in Northern Ireland that export to the EU still need to abide by EU customs laws and deal with more administrative barriers.

In order to monitor and manage risks, the Windsor Framework also incorporates a new data-sharing system. If internal UK traders have supplied enough commercial information, this technology will enable them to transfer goods without the need for physical checks.

This will help to reduce the burden of customs checks and ensure a smoother flow of trade between Great Britain and Northern Ireland.

iCustoms transformational customs technology will assist the industry, regulators, and traders in reducing the administrative burden. Its simplified process, intelligent document processing, HS lookup service, and customs integrations with HMRC will make the administrative requirements and new compliance super easy.

Contact us at info@icustoms.ai to learn how iCustoms will assist traders, governments, and the industry in fulfilling the new administrative requirements.