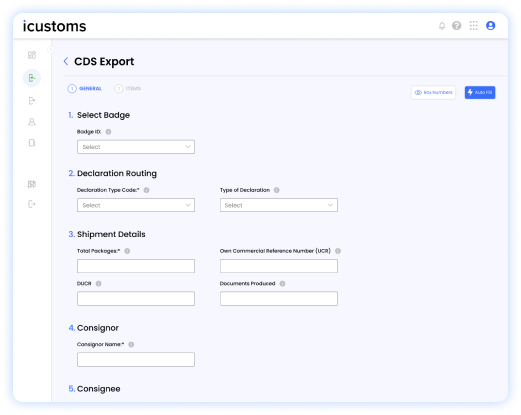

iCustoms’ platform is designed to handle CDS export in UK efficiently while keeping you customs compliant. The easy solution helps businesses cut through the complexity of the clearance process, avoid unnecessary delays and disruptions at the border.

Send your declarations directly to the new Customs Declaration System (CDS) of HRMC or the CHIEF

Submit declared for the New Computerised Transit System (NCTS) and move your goods easily between EU and UK.

Streamline your trading process with intelligent document processing – efficiency at your fingertips!

Monitor and track the status of your export declaration journey via an intuitive dashboard.

Our advanced machine-learning tool allows you to classify up to 100% faster and easier than searching manual through the codes and regulations.

Automatically create all supporting paperwork, documentation, and electronic reporting at one place.

The software eliminate human and data entry errors and reduce potential delays, unnecessary costs, penalties, and risks.

It accurately combines multiple steps in compliance requirements process into one seamless workflow even with fewer resources.

Creating export documents means entering your trade information over and over again. With iCustoms electronic form filing, you’ll save a lot of time.

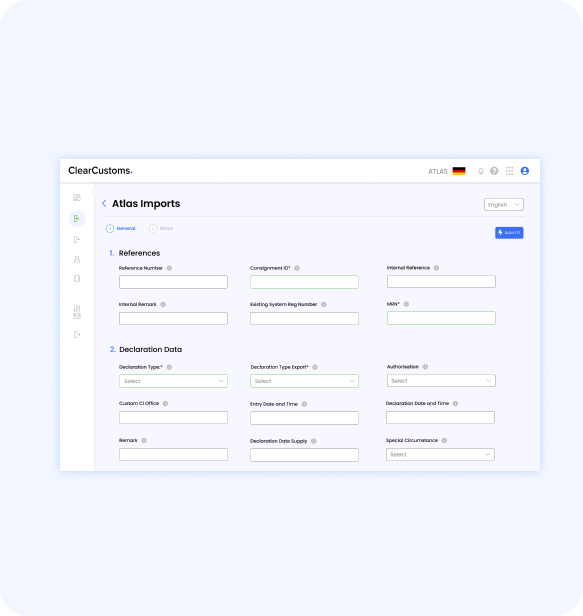

Enter the required information at once and it automatically formats improving the accuracy of your paperwork by reducing typos and mistakes that slow down the shipment process.

The software eliminate human and data entry errors and reduce potential delays, unnecessary costs, penalties, and risks.

It accurately combines multiple steps in compliance requirements process into one seamless workflow enen with fewer resources.

Direct connectivity to the UK customs – gives you the confidence and efficiency.

Capture data from your trade documents within seconds and route the information to your declaration forms.

iRule’s engine validates and verify the input data against thousand of customs rules and explain in simple English.

The software helps you quickly validate the accuracy of all data before submitting a declaration.

CDS stands for Customs Declaration Service, a digital system used for handling export declarations in the UK.

CDS was introduced in the UK in August 2020 to replace the previous system, CHIEF (Customs Handling of Import and Export Freight). Learn more

There could be several penalties for voilations such as:

Does all UK exporters use the Customs Declaration Service?

You can declare any sort of goods to and from the UK. But before submitting any declaration to UK, you need to declare if you have the following goods:

1. foriegn goods

2. commercial goods

3. cash amount over £10,000

4. commercial and industrial goods

5. medicines